Monte Carlo Options Pricing

Curated from: blog.skz.dev

Ideas, facts & insights covering these topics:

5 ideas

·553 reads

8

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

The options casino

Predicting the movement of stock prices is an alluring challenge with the promise of riches. Unfortunately, predicting future stock prices consistently and reliably is generally considered impossible. However, we can use models to make useful predictions, manage risk, and profit probalistically .

11

194 reads

Normal Distribution

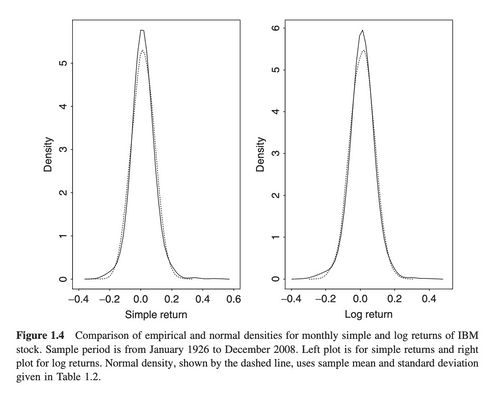

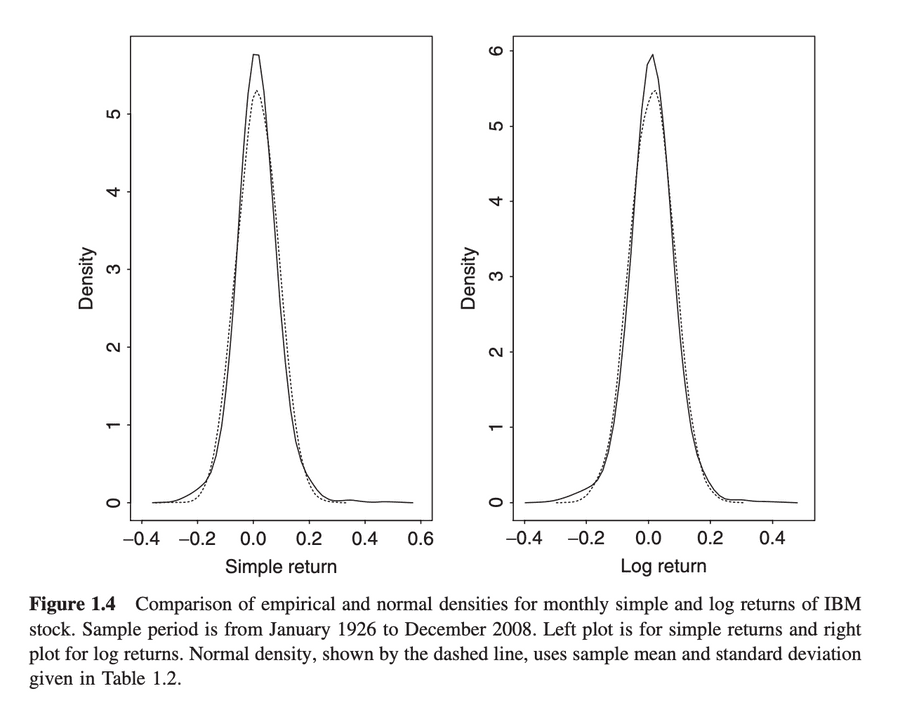

Monthly simple and logarithmic returns of IBM stock with fitted normal distributions. We observe more returns at the extremities of the distributions than the normal distribution would predict. We call these 'fat tails' or 'excess kurtosis'. This image has been taken from 'Analysis of Financial Time Series, 3rd Ed.' by Ruey S. Tsay.

11

121 reads

Brownian motion

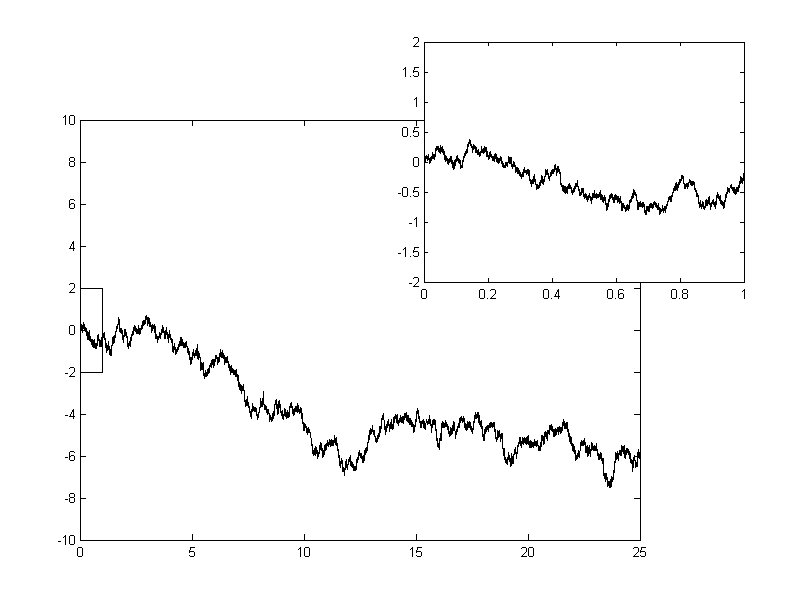

Brownian motion describes the motion of a particle in a fluid or gas. Such a particle bounces around “randomly” within the fluid surrounding it. The path it creates appears quite noisy and random. It can essentially be considered a limiting form of the random walk where both the time between steps and the step length approach zero (with some caveats: namely, if the time step is

, the step length must be

- this produces a process whose variance scales exactly with time). Consider flipping a coin to determine whether to take a step forward or backward. Now let the time between steps approach zero.

12

85 reads

Option Pricing

Monte-Carlo simulation is a statistical technique inspired by the casinos of Monaco. Much like gamblers resigning their fates to probability, we hand over the results of statistical analysis to chance. By running enough trials, we can make conclusions with statistical significance.

Consider evaluating a call option with a strike prices of $105 for this stock. What would be the expected value of the option at expiry, given a geometric Brownian model for the stock’s movement?

12

88 reads

More Advanced Scenarios

Monte-Carlo simulation of terminal values is a relatively simple simulation, and one can probably be completed analytically. The true power of Monte-Carlo simulation is unlocked when analysing scenarios that are more difficult to solve analytically, if not impossible. For example, if we wanted to analyse an American-style option, which can be exercised anytime, we might want to count the probability of a stock price exceeding the strike price at any time during the lifetime of that option. We could do this by counting how many trials cross the strike price boundry.

11

65 reads

IDEAS CURATED BY

Mausam Adhikari's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to use storytelling to connect with others

The psychology behind storytelling

How to craft compelling stories

Related collections

Similar ideas

12 ideas

Options Trading Strategies: A Guide for Beginners

investopedia.com

9 ideas

The 3 Pricing Strategy Options | OpenView Labs

openviewpartners.com

4 ideas

Learn About Compounding

investopedia.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates