How to Use Elliott Wave Theory to Spot Crypto Trend - Bybit Learn

Curated from: learn.bybit.com

Ideas, facts & insights covering these topics:

12 ideas

·590 reads

6

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Spotting Crypto Trends

Ralph Nelson Elliott developed Elliott Wave Theory in the 1930s to describe the market’s behavior. Elliott realized the financial markets moved in repeatable and recognizable patterns that can help forecast key turning points and the next trend.

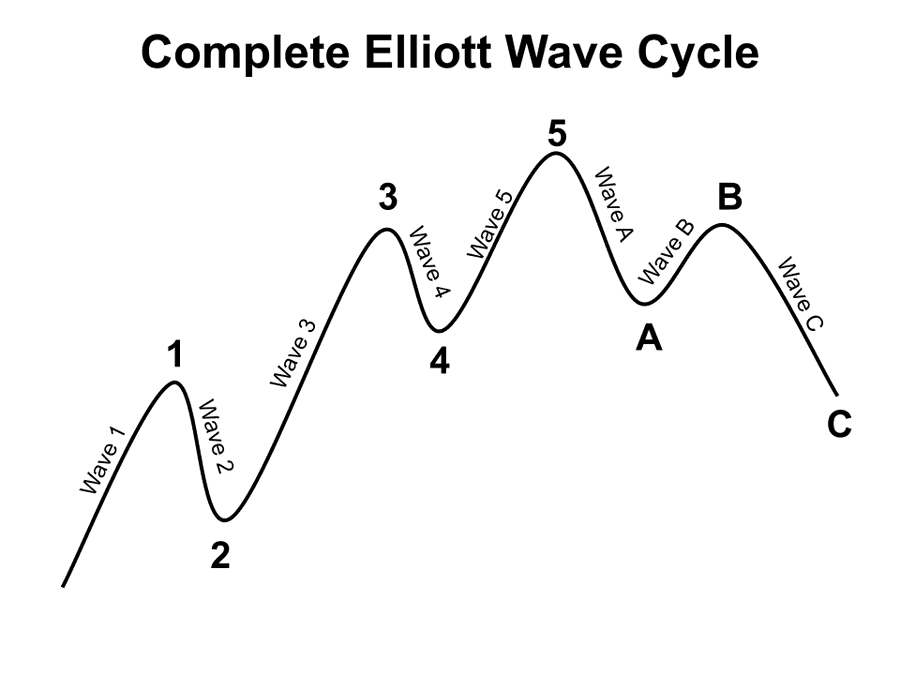

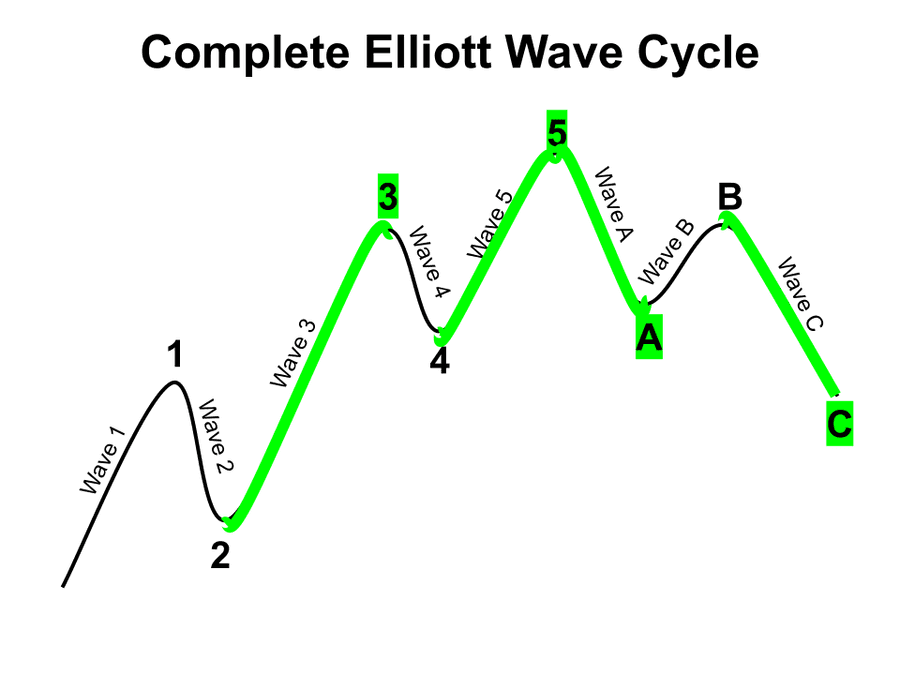

The basis of the complete Elliott Waves cycle is five waves in the direction of the trend, followed by a three-wave countertrend move.

20

113 reads

Eight Wave Cycle

Crypto traders can use the Elliott Wave principle to determine if a rally is part of a corrective phase or a continuation of the old trend.

Depending on the market’s location within the eight-wave cycle, crypto traders can estimate the potential pivot points for the end of the second and fourth waves, helping them time their entries.

20

92 reads

Defining The Elliott Wave Theory

Elliott Wave Theory is used in technical analysis by traders who look for recurring patterns based on market sentiment. They use these patterns to analyze market cycles and forecast future trends.

Elliott Wave Theory combines studying the patterns on a price chart with identifying extremes in investor psychology. When the analysis is performed correctly, the primary value of this theory is that it provides a detailed description of how the market behaves. As a result, traders and analysts can make predictions about future price action and investor behavior.

20

59 reads

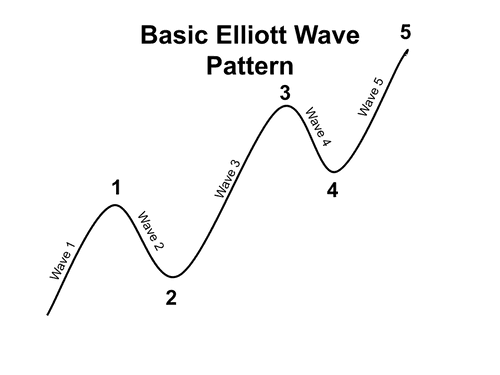

The Basic Elliott Wave Pattern

Elliott went on to describe how these patterns link together to form larger versions of themselves. Essentially, these patterns form the same pattern of the next larger size, producing a structured progression. However, we need to specify which level of the trend we’re referring to when describing the market’s behaviour. These levels of the trend are called wave degrees.

19

60 reads

Elliott Wave Price Cycle

These Elliott Wave price cycles appear in all large financial markets with price histories and are present in crypto markets, too.

The emotional and psychological back-and-forth that we witness in cryptocurrency trading makes it a great candidate for Elliott Wave analysis. A trader can spot developing trends for Bitcoin, Ethereum, and other cryptocurrencies with a basic knowledge of Elliott Wave and its patterns.

19

49 reads

The Impulse And Diagonal Wave

The two main phases of the crypto markets are motive and corrective. With a little training, these phases can be relatively easy to spot on a chart.

Any strong directional moves are likely to be motive waves, as their goal is to make progress. Also, motive waves are thought of as having five subwaves inside of them. There are only two patterns that you will find in the motive phase: the impulse wave and diagonal wave.

The impulse wave is the more commonly spotted pattern. Additionally, within an impulse, Waves 2 and 4 are the corrective waves, having completely different patterns.

20

33 reads

The Three Corrective Patterns

There are three basic corrective patterns: zigzag, flat, and triangle. The goal of the corrective patterns is to consolidate the previous trend. Some common features you will find during the corrective phase include:

- A corrective wave is called “threes,” as they contain three subwaves.

- A corrective wave is a partial retracement of the previous motive wave.

19

38 reads

Harmony In Geometry

One of the fantastic elements of Elliott Wave Theory is that the various waves often display a harmonious geometry. With Elliott’s discovery of the market’s behaviour, there are a few rules and guidelines the market tends to follow. Some of those guidelines centre around the depth of the corrective waves within an impulse.

The two main corrective waves are the second and fourth waves of an impulse. The depth of the correction is different for each of these waves, so it is important to understand this distinction.

19

27 reads

Best Entries and Exits Based on the Waves

When viewing the complete eight-wave cycle in its entirety, there are certain portions of the cycle where trades yield a greater reward relative to the risk. These are the waves that traders will want to focus on to initiate trading opportunities.

Depending on the wave degree, traders can anticipate the end of Wave 5 and the start of Wave A in a correction. For short-term day traders, Wave A won’t be large enough to make it worthwhile. However, Wave A could have a handsome reward if you’re viewing a weekly chart or larger.

20

34 reads

Elliott Wave and Fibonacci Retracement Levels

Elliott Wave analysis and Fibonacci tools work very well together.

The Elliott Wave cycle of eight waves, plus their corresponding five subwaves, are numbers of the Fibonacci number sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, 34 …). Therefore, it is mathematically intuitive that Fibonacci tools are useful in developing an Elliott Wave count and prediction.

19

29 reads

The Elliott Wave Oscillator

Beginning Elliott Wave traders often become frustrated since it can feel subjective as to where the wave labels are placed on the chart. The Elliott Wave Oscillator (EWO) was created to help newer traders determine which wave the market may be in.

The EWO generally appears at the bottom of your chart. The highest and lowest values of the oscillator might indicate Wave 3. If the oscillator pulls back to the zero line, then it’s considered Wave 4.

Lastly, if the market’s price makes a new extreme but the oscillator does not, that may indicate a fifth and final wave of the sequence.

20

25 reads

Elliott Wave Reliability

Elliott Wave analysts who have learned the intricacies of Elliott Wave Theory would suggest it does a good job of describing the context of the market’s behaviour.

However, traders new to Elliott Wave Theory may pass it off as subjective and not useful. Traders interested in learning and implementing Elliott Wave Theory can research its history and application in numerous articles. Different analytical tools work for a variety of traders.

19

31 reads

IDEAS CURATED BY

Daniel M's ideas are part of this journey:

Learn more about crypto with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas

4 ideas

Heikin-Ashi: A Better Candlestick

investopedia.com

5 ideas

What Is REM Sleep? Definition and Benefits

thoughtco.com

4 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates