Praveen kumar's Key Ideas from The Psychology of Money

by Morgan Housel

Ideas, facts & insights covering these topics:

14 ideas

·63.9K reads

213

4

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

1.Luck & Risk

- The difficulty in identifying what is luck, what is skill, and what is risk is one of the biggest problems we face when trying to learn about the best way to manage money.

- Be careful who you praise and admire. Be careful who you look down upon and wish to avoid becoming.

796

9.29K reads

Letter to his son

Some people are born into families that encourage education; others are against it. Some are born into flourishing economies encouraging of entrepreneurship; others are born into war and destitution. I want you to be successful, and I want you to earn it. But realize that not all success is due to hard work, and not all poverty is due to laziness. Keep this in mind when judging people, including yourself.

863

6.57K reads

2.No One's Crazy

- As investor Michael Batnick says, “some lessons have to be experienced before they can be understood.” We are all victims, in different ways, to that truth.

- Every decision people make with money is justified by taking the information they have at the moment and plugging it into their unique mental model of how the world works.

- We all do crazy stuff with money, because we’re all relatively new to this game and what looks crazy to you might make sense to me. But no one is crazy—we all make decisions based on our own unique experiences that seem to make sense to us in a given moment..

779

5.23K reads

3.Never Enough

- If you risk something that is important to you for something that is unimportant to you, it just does not make any sense.

- There is no reason to risk what you have and need for what you don’t have and don’t need.

- If expectations rise with results there is no logic in striving for more because you’ll feel the same after putting in extra effort.

- There are many things never worth risking, no matter the potential gain.

778

4.88K reads

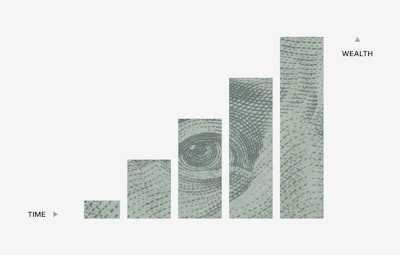

4.Confounding Compounding

- There are books on economic cycles, trading strategies, and sector bets. But the most powerful and important book should be called Shut Up And Wait.It’s just one page with a long-term chart of economic growth.

- Good investing isn’t necessarily about earning the highest returns,because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That’s when compounding runs wild.

793

4.01K reads

5.Getting Wealthy Vs Staying Wealthy

Good investing is not necessarily about making good decisions.It's about consistently not screwing up.

- Getting money is one thing.Keeping it is another.

758

4.7K reads

6.Tails, You win

You can be wrong half the time and still make a fortune

- “It’s not whether you’re right or wrong that’s important,” George Soros once said, “but how much money you make when you’re right and how much you lose when you’re wrong.” You can be wrong half the time and still make a fortune.

765

3.86K reads

7.Freedom

Controlling your time is the highest dividend money pays

- The highest form of wealth is the ability to wake up every morning and say, “I can do whatever I want today.”

848

4K reads

8.Man in the car paradox

No one is impressed with your possessions as much as you are

- It’s a subtle recognition that people generally aspire to be respected and admired by others, and using money to buy fancy things may bring less of it than you imagine. If respect and admiration are your goal, be careful how you seek it. Humility, kindness, and empathy will bring you more respect than horsepower ever will.

805

3.53K reads

9.Wealth is what you don't see

Spending money to show people how much you have is the fastest way to have less money

- Someone driving a $100,000 car might be wealthy. But the only data point you have about their wealth is that they have $100,000 less than they did before they bought the car (or $100,000 more in debt). That’s all you know about them.

- If you spend money on things, you will end up with the things and not the money.

803

3.41K reads

There is no faster way to feel rich than to spend lots of money on really nice things. But the way to be rich is to spend money you have, and to not spend money you don’t have. It’s really that simple.

BILL MANN

775

3.87K reads

10.Save Money

- Wealth has little to do with your income or investment returns, and lots to do with your savings rate.

- Everyone knows the tangible stuff money buys. The intangible stuff is harder to wrap your head around, so it tends to go unnoticed. But the intangible benefits of money can be far more valuable and capable of increasing your happiness than the tangible things that are obvious targets of our savings.

- Every bit of savings is like taking a point in the future that would have been owned by someone else and giving it back to yourself.

757

2.99K reads

When You'll Believe Anything

- Most people, when confronted with something they don't understand, do not realise they don't understand it because they are able to come up with an explanation that makes sense based on their own unique perspective and experiences in the world , however Limited those experience are.

- The one who's confident he knows what's happening based on what he sees but turns out to be completely wrong because he can't know the stories going on inside everyone else's head ?.....He's all of us.

700

3.21K reads

IDEAS CURATED BY

CURATOR'S NOTE

This book gave me some notes that I wanted to keep and share

“

Curious about different takes? Check out our The Psychology of Money Summary book page to explore multiple unique summaries written by Deepstash users.

Praveen kumar's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Understanding the psychological rewards of bad habits

Creating new habits to replace old ones

Developing self-discipline

Related collections

Different Perspectives Curated by Others from The Psychology of Money

Curious about different takes? Check out our book page to explore multiple unique summaries written by Deepstash curators:

15 ideas

Ashish R's Key Ideas from The Psychology of Money

Morgan Housel

1 idea

's Key Ideas from The Psychology of Money

Morgan Housel

2 ideas

Yoma Oniti's Key Ideas from The Psychology of Money

Morgan Housel

Discover Key Ideas from Books on Similar Topics

2 ideas

“I Don’t Want To Be Anything Other Than Me.”

Lewis Howes

18 ideas

Clear Thinking

Shane Parrish

16 ideas

Clear Thinking

Shane Parrish

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates