Courtney Abbott's Key Ideas from Dealmaking

by Guhan Subramanian

Ideas, facts & insights covering these topics:

19 ideas

·5.46K reads

23

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Dealmaking: Key Takeaways

- Use anchoring and your understanding of the zone of possible agreement (ZOPA) to decide when to make a first offer during a negotiation.

- Auction, when you have a large number of potential buyers, the asset for sale is well specified, or speed and process transparency are important.

- Negotiate when bidders are well known, when the potential for value creation is high, when the working relationship is important, or when the seller has a low-risk tolerance.

- Use setup moves, rearranging moves, and shut-down moves to change the game to your advantage.

74

1.04K reads

Negotiauctions

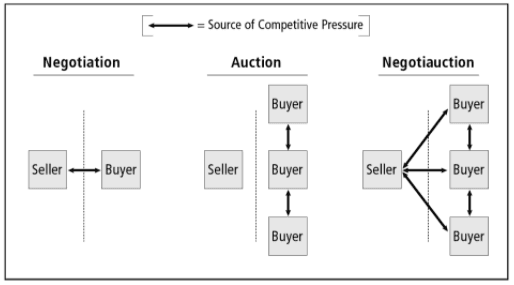

- Negotiauctions is a dealmaking situation in which competitive pressure is coming from both across-the-table competition and same-side-of-the-table competition.

- Negotiauctions are common in complex dealmaking situations.

- The difference between a negotiation, auction, and negotiauction is the source of competitive pressure.

- You need to think multiple steps ahead.

Remember that individuals negotiate deals. It’s critical to understand the incentives of the individuals who are doing the negotiating.

69

713 reads

Common Features of Negotiauctions

- Several (but not too many) potential buyers. Usually between three and ten.

- Asymmetric information. The seller typically knows more about the structure of the situation than the buyers.

- Ambiguity around traditional process setter and process taker roles. The process itself is up for grabs. Roles are highly malleable and control over the deal process can shift over time.

- One or more rounds of bidding and other forms of direct competition among potential buyers in ways that resemble auctions.

66

461 reads

Anchoring

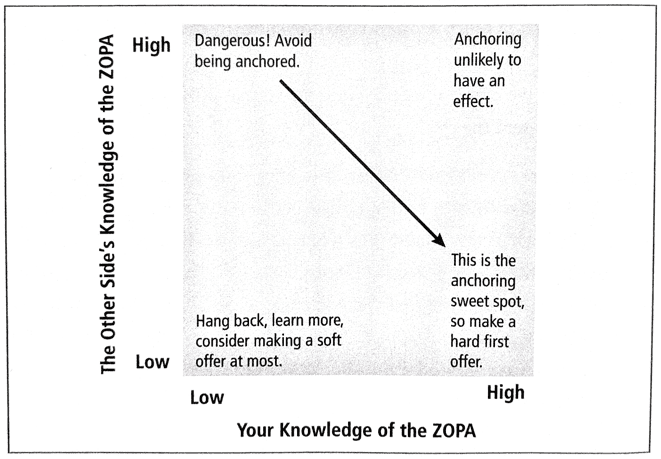

- Anchoring works by influencing your perceptions of where the zone of possible agreement (ZOPA) lies.

- Anchoring is a reason for making the first offer, because you can potentially influence the other party.

- But it only works when the other side is uncertain about where the ZOPA is.

67

423 reads

Risks of Making the First Offer

Anchoring too aggressively. If you make a first offer way outside of the ZOPA, you may have to make large concessions to reach a deal or walk away even though a zone of possible agreement exists.

Anchoring too conservatively. You unknowingly give away a big chunk of the ZOPA on your first move.

Use the midpoint rule to your advantage in the first offer itself. Think about where you want to end up and start with a counteroffer that gets you to that number as a midpoint.

67

356 reads

First Offer Guidelines

- Consider making the first offer when you have a pretty good sense of where the ZOPA is in order to anchor the negotiation in your favour.

- If you don’t know the ZOPA, hang back and let the other side make the first offer, or make a soft anchor, e.g. “We’re thinking about something in the ballpark of $30.”

- When you don’t know the ZOPA, but your opponent does, resist their attempt to anchor you.

- Default to a first offer that is more aggressive than your instincts might lead you to make.

Ask: What is the highest number that I can justify?

66

271 reads

Value-Creating Moves

Differences in expectations about the future often create value in negotiations.

Contingency contracts have three major benefits:

- They align incentives.

- They allow the parties to diagnose the honesty of the other side.

- They enable the parties to share the risk.

65

253 reads

When to Auction, When to Negotiate

An auction is a mechanism in which the seller is a passive participant after the process has been set, and the primary source of competitive pressure arises from competition among buyers.

Negotiation is a mechanism in which the primary source of competitive pressure arises in across-the-table dynamics between buyer and seller.

64

224 reads

Factors To Consider: Profile of Potential Bidders

Consider the following:

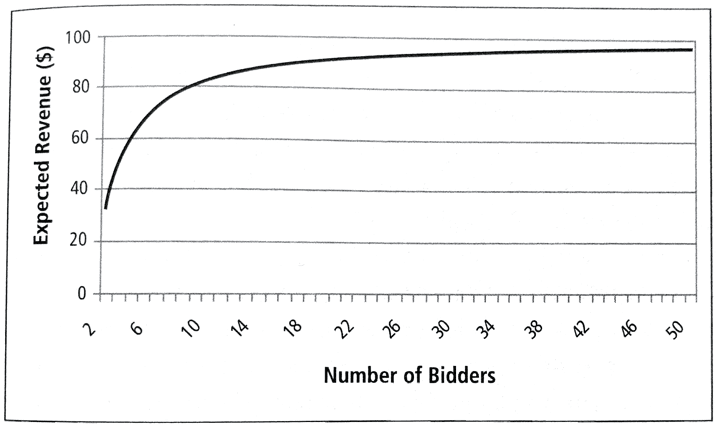

- The number of bidders.

- Certainty about who the bidders are.

- Buyers’ incentives to participate.

- Distribution of valuations.

65

247 reads

Factors To Consider: Asset Characteristics and Specifications

- All else equal, the more you are able to specify what you want, the more likely it is that an auction will be a better option than a negotiation.

- Buying commodities is a good example of an appropriate thing to auction.

- Even clearly defined services can be auctioned like commodities effectively. But you risk losing out on potential win-wins that might have come up during a negotiation.

65

174 reads

Potential for Value Creation

- Auctions boil everything down to price.

- Negotiations open things up for value-creation.

- If there is a possibility for win-win moves, it is better to negotiate with one or more potential counterparties than to hold an auction.

64

194 reads

Importance of Relationship

- Negotiations are best when relationships, service, and/or deal execution are important aspects of what is being bought or sold.

- Negotiations leave room for a more favourable resolution of potential problems down the road.

- Auctions signal that the buyer is indifferent among suppliers, other than the price received.

64

171 reads

Factors To Consider: Seller Profile

- Auctions are a much faster process than negotiations.

- If there is a specific window of opportunity to sell, or the asset is deteriorating as time passes, auctions are preferable.

- Auctions are faster and riskier. They sometimes “bust,” in which nobody shows up; or, even worse, only one bidder shows up.

- Negotiations are safer bets. They allow you to test the water as you make your way to a better outcome.

65

152 reads

Factors To Consider: Contextual Factors

- Broad-based processes like auctions are difficult to keep secret.

- Negotiations are much more private.

- A frequent concern during M&A deals is to broaden the search process in the sale of a company for fear that the employees will find out, start looking for new jobs, and the value of the company drops.

- Transparency: The appearance of a level playing field among bidders.

- Auctions are a more transparent process than private negotiations.

65

138 reads

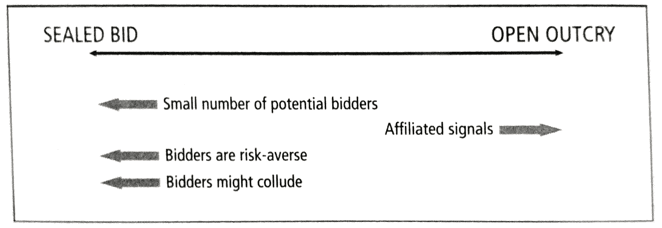

Open Outcry Vs Sealed Bid

Open outcry auction: Bidders know the high bid at all times, and have the option of beating it.

Sealed bid auction: Bidders submit written bids and do not know what others bid, or (often) how many bidders there are before the winner is revealed.

There are four factors to consider here:

- The number of potential bidders.

- The degree to which bidders’ valuations are “affiliated”.

- The degree of bidder risk aversion.

- The need to deter collusion among bidders.

64

131 reads

Number of Potential Bidders

- The minimum number of initial bidders in an open-outcry auction is five or six

- Less than five bidders and better to conduct a sealed auction where a lack of transparency means bidders may bid against themselves.

- A sealed bid auction can create the perception of competition even when there isn’t.

65

121 reads

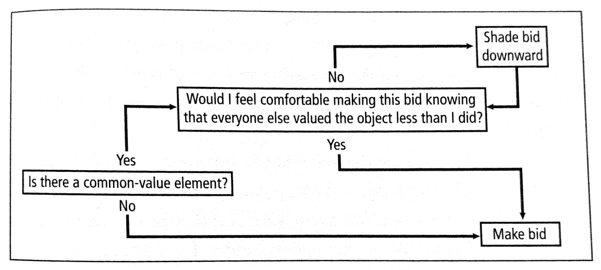

Playing The Game As Process Taker: The Winners Curse

Winner’s curse: The feeling that you overpaid simply because you were the highest bidder.

- Reflect on all the costs and benefits of winning or losing the auction in calculating your reservation value.

- Costs often include much more than price. Could be your reputation, or competitive advantage in the marketplace.

- The only scenario that matters is the one where you win. Think to yourself, “Am I comfortable paying this price, even if it turns out that I over-paid?”

64

131 reads

Bidding in Sealed Bid Situations

- The key is to bid high enough to win, but low enough that you preserve as much profit as possible from the deal.

- Determine how your chances of winning increase with your bid.

- Choose the bid that maximizes your expected profit = Probability x Profit

65

129 reads

Bidding in Open-Outcry Situations

- Continue bidding up to your full reservation value.

- Whenever common value plays a role, bidders should rationally “update” their reservation value during the course of the bidding. E.g. the layman bidder taking cues from an expert with insider knowledge.

Three factors fuel “competitive arousal:” intense rivalry among bidders, time pressure, and the presence of an audience.

Avoid this by:

- Writing down your reservation value

- Ask yourself, “What do I know now that I didn’t know at the beginning of the auction?” If you don’t know anything new, then you should drop out of the auction.

64

125 reads

IDEAS CURATED BY

CURATOR'S NOTE

All about negotiauctiong: The crossover between negotiation and auctioning.

“

Courtney Abbott's ideas are part of this journey:

Learn more about marketingandsales with this collection

Cultivating a growth mindset and embracing challenges

Developing adaptive thinking and problem-solving skills

Effective learning frameworks and approaches

Related collections

Discover Key Ideas from Books on Similar Topics

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates