All About UPI || Unboxing Space || AddingValues

Curated from: addingvalues.xyz

Ideas, facts & insights covering these topics:

20 ideas

·594 reads

2

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

UPI stands for Unified Payments Interface.

It is a payment mode developed by the National Payments Corporation of India.

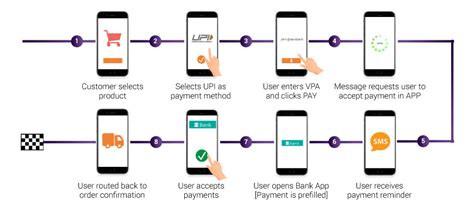

UPI is a payment system that allows you to transfer money between any two parties. As compared to NEFT, RTGS, and IMPS, UPI is far more well-defined and standardized across banks.

This means that you can use UPI to initiate a bank transfer from anywhere in just a few clicks!

The benefit of using UPI is that it allows you to pay directly from your bank account. The hassle or need to type in the card or bank details goes away with UPI.

2

67 reads

Which countries use Bhim UPI?

The Ministry of Finance has said that the Unified Payments Interface (UPI) has gained acceptance in Singapore (March 2020), Bhutan (July 2021), and recently with partners in UAE and Nepal (February 2022). Many other Countries are Planing to be a Part.

2

68 reads

Use Case of UPI

One can use UPI app instead of paying cash on delivery on receipt of product from online shopping websites and can perform miscellaneous expenses like paying utility bills, over the counter payments, barcode (scan and pay) based payments, donations, school fees and other such unique and innovative use cases.

You can use UPI to transfer money to your family, friends, or even between your own bank accounts. The much wider use of UPI comes when you have to pay different merchants.

2

56 reads

mPIN in UPI:

Another benefit of using UPI is that you can do away with the need to wait for an OTP and enter it to complete the money transfer.

The mPIN is a 6-digit passcode that you must enter every time you need to make a transaction.

The mPIN is highly valuable because customers do not have to enter IFSC codes or other information each time they want to send or receive money, which is why the mPIN proves to be a great means to confirm one’s identity.

Without this pin, you cannot make transactions. This ensures that if your phone happens to fall into the wrong hands.

2

41 reads

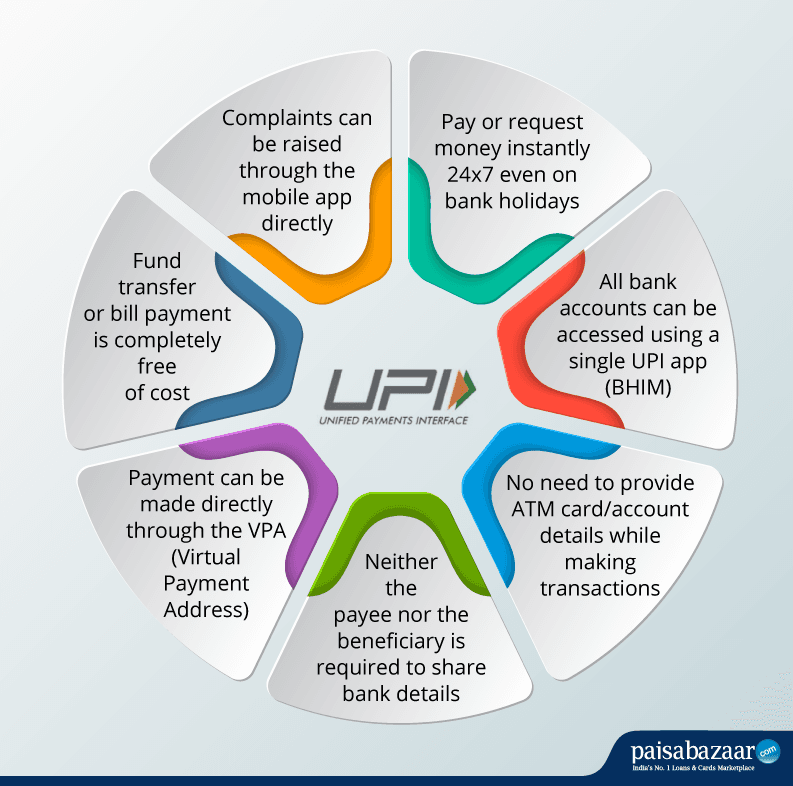

Features of UPI:

UPI is useful because it is easier to use than credit or debit cards. Apart from being easy and convenient, UPI boasts of a host of other features.

2

50 reads

Reliability: Since UPI is launched by NPCI, one of the biggest features associated with it is its reliability. With UPI, customers have far greater control over transferring their funds and do not have to worry about them getting lost along the way

UPI

2

35 reads

Real-time transfers: Another vital feature associated with UPI is the fact that all transfers occur in real-time. Customers press the send button and their beneficiaries receive the payments in a matter of seconds. As a result, basic daily-life activities such as buying groceries, taking an auto or cab home from work, or paying a friend back after borrowing money are simple and convenient

UPI

2

22 reads

Inclusivity: UPI does not always rely on the internet. UPI offers the option to conduct transactions without a smartphone or working internet

UPI

2

30 reads

No minimum transaction limit: UPI does not have a minimum transaction limit. Payments as low as Re 1 can be made while using this payment mode

UPI

2

30 reads

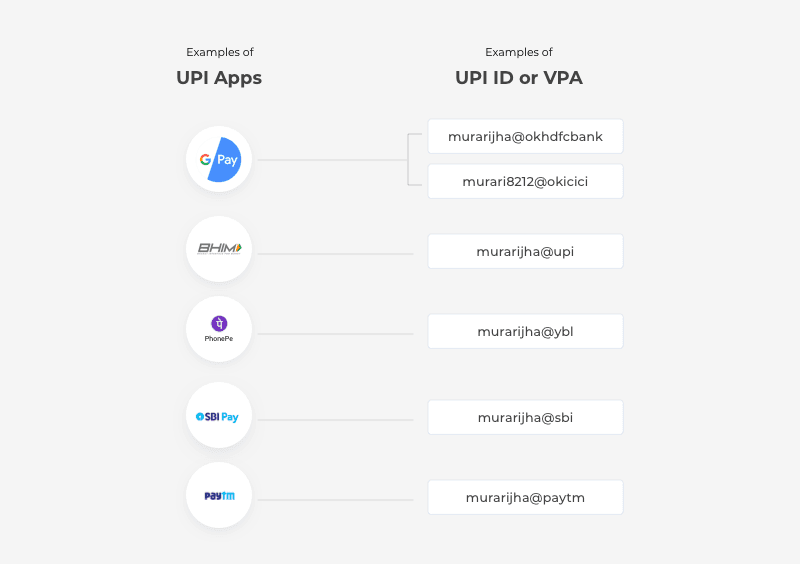

Using a UPI ID:

Your UPI ID functions almost in the same way your name does. It offers a Virtual Payments Address for senders to enter when transferring money to your account. In order to create your own VPA or UPI ID, you must begin by downloading any app of your choice and registering yourself on it.

2

22 reads

Download and Register BHIM:

You need an app to create a UPI ID and begin transacting. One of the apps that you can use is the BHIM app.

BHIM offers rudimentary UPI services ideal for people with very basic needs. BHIM has numerous benefits for both customers as well as merchants:

2

21 reads

Benefits for both customers as well as merchants:

- QR code generation for vendors that enables customers to simply scan and pay them

- QR Code generation for individuals to scan and receive P2P payments

- Fraud prevention features like timeouts following 90 seconds of no activity

- Hindi and English language support

- Transaction histories are available as and when required

- Real-time transfer of money straight into the user’s bank account

- Strong security measures in the form of 2-factor authentication

- Consolidation of all payments (received and sent) within a single platform

- No traditional banking restrictions such as working hours or holidays

2

19 reads

Features of UPI 2.0:

UPI was first launched in 2016. Later on, UPI 2.0 was launched to increase digital adoption in the business sphere as well as to facilitate peer-to-merchant transactions.

The upgraded or revamped version of UPI has the following features:

2

19 reads

Features:

- Use of overdraft accounts: Under UPI 2.0, merchants have the facility to withdraw money even when there is a cash deficit in their account

- Capture and hold facility: Merchants accepting payments through UPI will be able to block certain amounts on their user’s cards and refund the same at a later date

- Support for invoicing: UPI 2.0 supports invoices, which means that businesses can use a single platform for sending invoices and receiving payments

- Easy resolution of refunds: Merchants can now initiate refunds on the same transaction through which they have received money

2

17 reads

Charges on UPI:

UPI seems to be great, but does it come at a cost?

At present, there are no charges for UPI transactions, both P2P and P2M (Person to Merchant). But as the user base saw new heights, some banks started making announcements to their customers about the charges for P2P UPI transactions.

Kotak Mahindra Bank is the first bank to announce charges for P2P transactions made through UPI. They will not charge for the first 30 transactions in a month but there will be a charge beyond the cap.

2

16 reads

UPI Usage in India:

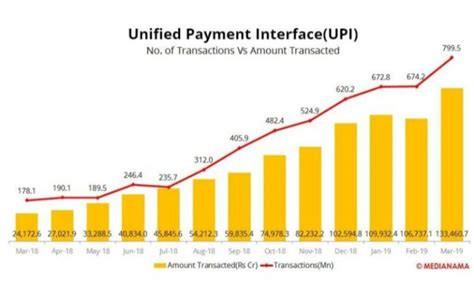

UPI was a game-changer in the Indian payments space in 2018. It became one of the fastest payment modes ever to bring financial inclusion to the masses.

- Between January and December 2018, UPI saw a 7x growth in usage volumes

- Among UPI apps, Google Pay ruled the roost with 62% of all transactions carried out on it

- UPI ate into the share of cards and wallets in a significant manner in 2018

- UPI adoption grew not only in Tier 1 cities but in Tier 2 and Tier 3 as well

2

20 reads

Monthly UPI usage data:

At Razorpay, every month on the usage patterns seen in UPI and the payments space at large.

- In April 2019, UPI saw a 20x growth since April of the previous year.

- UPI transactions fell by 6% in May 2019

2

20 reads

What to do if you pay the wrong UPI ID? (1)

While UPI is the simplest form of making instant payments, it comes with a few constraints. One of the major drawbacks is the issue that occurs if you accidentally paid money to the wrong UPI ID.

Usually, it is difficult to get your money back if you accidentally paid it to the wrong UPI ID. There are low chances that the receiver would be willing to pay the money back..

2

15 reads

What to do if you pay the wrong UPI ID? (2)

However, you can write an application to your bank branch mentioning the details like UPI ID, amount, etc. Your bank branch will send these details to the UPI backend team who will further contact the beneficiary branch for the refund.

Again, no one can guarantee that the amount will be refunded easily.

It is advised to pay a minimum amount of Re. 1 before transferring an amount in bulk. This will help you cross-check and avoid such issues.

2

15 reads

For More Detailed Information visit the site:

Visit AddingValues.xyz Quotes & more Detailed Learnings of the Above mentioned points.

Hope You Enjoyed reading & Got some Impact-full Learnings from this article, If you Did then Hit the like button & put a comment. This helps us to work harder & Smarter Day by Day. & it motivates us to make this kind of content...

Now, this Article is Available in Audio Format as Well, Also we are “AudioBook Media Center” now Available on All Popular Podcast Streaming Platforms Like- Spotify, Apple Podcast, Google Podcast, Anchor, radio public, Pocket Casts & Breaker.

© Copyright 2021-22, All Rights Reserved.

2

11 reads

IDEAS CURATED BY

Hi, Readers we are Unboxing Space here we do all kind of Tech videos, Unboxing, Review, Tips & Tricks, Information & so many interesting things. To watch our videos you can SUBSCRIBE to our channel & Blog so you don’t Miss any informative thing. by IGDM

CURATOR'S NOTE

India retains the top spot with 25.5 bn real-time payments transactions, followed by China with 15.7 bn transactions. We are using these Services in our daily life.

“

Unboxing Space's ideas are part of this journey:

Learn more about crypto with this collection

Understanding the basics of blockchain technology

The benefits and challenges of using blockchain

The future of blockchain technology

Related collections

Similar ideas

10 ideas

How the SWIFT System Works

investopedia.com

6 ideas

Rewards, Debts and Interest: A Complete Guide to Credit Card Management

informationprime.wordpress.com

32 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates