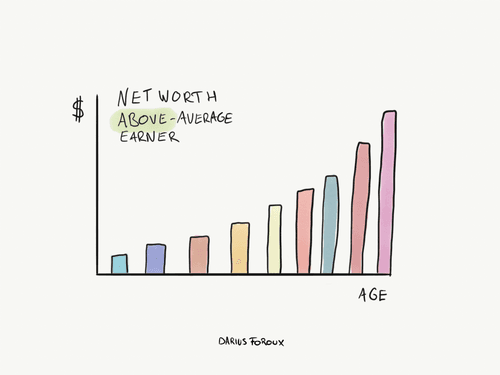

5 Money Rules That Will Increase Your Net Worth - Darius Foroux

Curated from: dariusforoux.com

Ideas, facts & insights covering these topics:

5 ideas

·9.49K reads

64

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Money rules to increase your net worth

- Don't spend all your income at once: the easiest way to grow your bank account is NOT to spend it all.

- Know how the Economy works.

- Avoid debt; personal debt destroys your net worth like nothing else.

- Save as much as you can: find the figures that make you feel comfortable

682

2.86K reads

It takes more time to make money than to spend it

You work thousands of hours to make a certain amount of money. And then, you can drop it all on a new car, luxury vacation, watch, or anything else that you desire.The easiest way to grow your bank account is NOT to spend it all. It’s solid advice. The ancient Stoics knew about this too. True freedom means you desire less.

623

1.79K reads

Know How The Economy Works

Why do economies generally collapse? What’s debt? Who prints money? Why do they print money?You don’t have to be an economist. The point is that basic knowledge about how all this stuff works prevents panic. “Oh shit! The market is down! What now!!” Panicking will not help you.

468

1.61K reads

Personal debt destroys your net worth like nothing else

We must be wise about taking on debt. Like investing, there are rules to it. One thing is sure: Never borrow money to buy a car, electronics, or anything else that goes down in value. But when it comes to more complex things like growing/starting a business, investing in real estate, or even your education, think carefully before you go into debt.

527

1.43K reads

Direct your actions toward generating value

Can you generate value? If the answer is no, then make it your first priority turn that into a yes. Figure out how successful people are rewarded. Read books, study investors, try things out, talk to wealthy people, etc. You want to generate value—either by working for it or investing.

558

1.78K reads

IDEAS CURATED BY

Aniyah J.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to showcase your skills and experience

How to answer common interview questions

How to make a good first impression

Related collections

Similar ideas

8 ideas

5 ideas

5 Destructive Money Habits to Quit Today - Darius Foroux

dariusforoux.com

3 ideas

Ten Moves That Will Skyrocket Your Net Worth

budgetsaresexy.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates