Max Pamies i del Campo's Key Ideas from Layered Money

by Nik Bhatia

Ideas, facts & insights covering these topics:

26 ideas

·49.3K reads

113

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Money

Prior to the existance of Layered Money there was simply money.

Money is a tool which allows peers the exchange of goods within a consensus value.

286

4.81K reads

Forms of Money

Let's see different forms of money used historicaly:

- Seashells

- Animal Teeth

- Jewelry

- Livestock

- Iron tools

And then...

GOLD & SILVER appeared.

291

3.93K reads

Gold & Silver Coins

Initialy, gold and silver coins were issued as a first-layer form of money. Which means that coins where backed by its own value depending of the purity of gold/silver contained.

First records of coins usage trace back to around 700 BC in Lydia, modern-day Turkey.

Over the years, each region minted their own coins, which varied in gold/silver purity.

282

2.95K reads

Cons of Gold & Silver Coins Usage

Gold & Silver Coins were a huge implementation for humanity growth & evolution. Unfortunately they had some cons:

- Coin Multiplicy: There were too many different currencies, which was an issue to money velocity (how quickly money changes hands).

- Risks of Physical Transfer: sending coins across land and sea was dangerous and a logistical nightmare during the medieval era.

280

2.77K reads

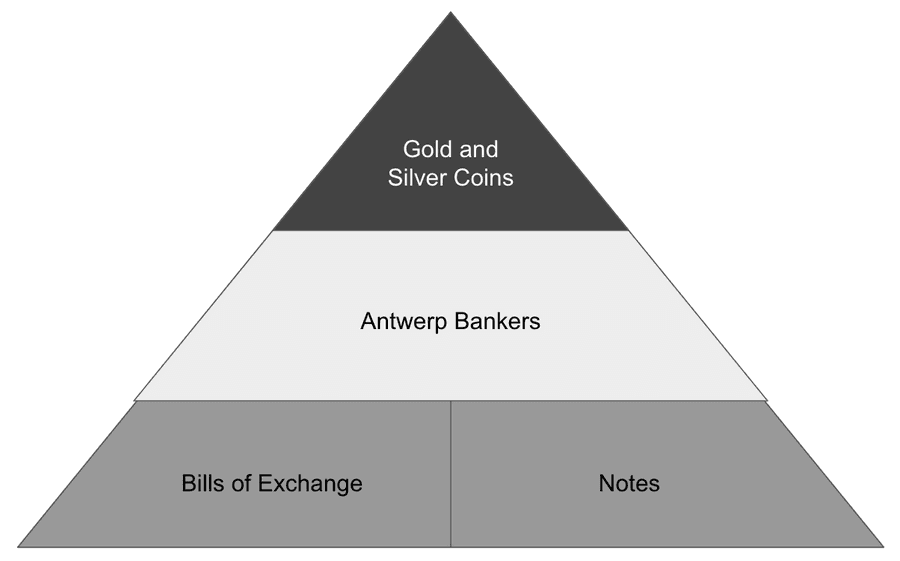

Medici Banking Dynasty

First of all we need to see the difference between first layer & second layer money:

- A gold coin - First Layer Money.

- A piece of paper (bills of exchange) that says: "The Medici banking family will pay one gold coin to the bearer on demand". - Second Layer Money.

The gold coin is a first layer money because it is the basis of the monetary system. If the gold coin wouldn't exist the piece of paper wouldn't neither.

289

2.39K reads

Centralizd Banking

With the emerging layered money the arise of centralized entities was a matter of time.

The first to appear and take control of the monetary system were the Bank of Amsterdam and the Bank of England.

Both entities gave unpredecented power over the peoples' monetary affairs to their governments.

289

2.32K reads

Bank of Amsterdam (BoA)

It was created back in 1609 and thanks to the world's first joint-stock company, the Dutch East India Company (Vereenigde Oostindische Compagnie, or VOC).

The VOC was the first example of equity investors providing capital in exchange for a share of ownership in the form of a paper certificate.

As the shares increased in value, original investors wanted to realize gains by selling them for cash to new investors, and that is how the first stock market was born.

All cashiers were forced to surrender precious metal to the Bank of Amsterdam and were issued BoA deposits in return.

298

1.95K reads

Bank of England (BoE)

The Bank of England was created in 1694 with the purpose to purchase new government bonds in an effort to rebuild the country after a crushing defeat of the English navy.

It was tasked with taking custody of precious metal, issuing deposits, effecting transfers between depositors, and circulating notes as cash.

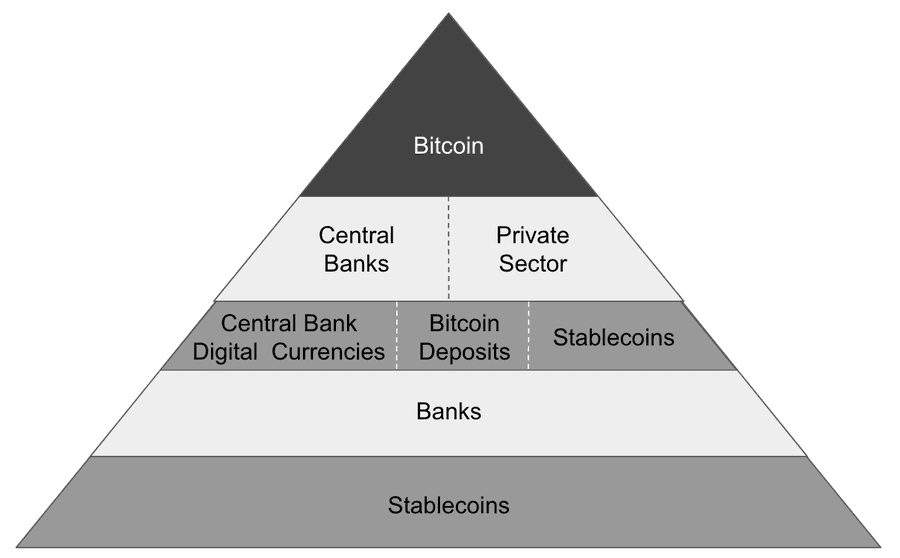

The Bank of England and the Private Sector (private banks/non-government entities) created the third-layer of money.

This third-layer money was issued by Private Sector and its value relied on both BoE Deposits and BoE Notes. Private Sector issued:

- Deposits

- Bills of Exchange

282

1.63K reads

Federal Reserve System

Shortly after an earthquake in 1906 rocked San Francisco, the US immersed into a financial crisis.

Congress passed into law the Federal Reserve System on Decemeber 23, 1913.

The Fed was founded to combat financial crises, and it would do this with a second-layer money called reserves.

Wholesale money (Fed reserves) is money that banks use, and retail money (Fed notes) is money that people use.

288

1.71K reads

Federal Reserve Act

The Federal Reserve Act's stated the following purposes:

- To provide for the establishment of Federal reserve banks.

- To furnish an elastic currency.

- Means of rediscounting commercial paper.

- To establish a more effective supervision of banking in the US.

The Act also decreed that at least 35% of the Fed's assets must be held in gold.

287

1.53K reads

No Gold for the People

Franklin Roosevelt issued Executive Order 6102 on April 5, 1933 which instructed all "gold coin, gold bullion, and certificates to be delivered to the government."

The order was effectively a forced sale of gold in exchange for Fed notes (cash) by all US citizens and eliminate the people's access to first-layer money.

In 1934 the US devaluated the dollar against gold by increasing the gold price from $20.67 to $35 per ounce.

The goal was to attract foreign demand by having the cheapest prices.

289

1.53K reads

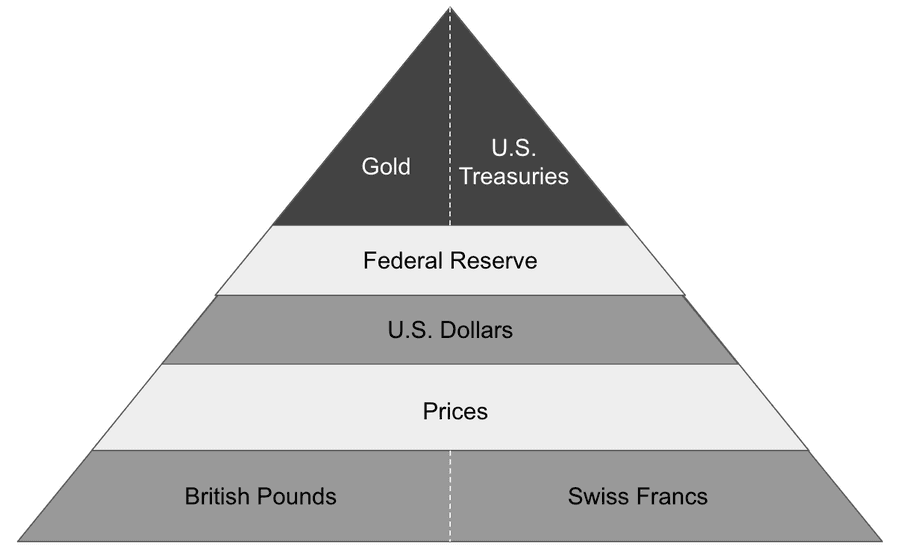

Bretton Woods

In 1944, world leaders gathered at a hotel in Bretton Woods, New Hampshire and formalized that all currencies besides the dollar were forms of third-layer money within the dollar pyramid.

Federal Reserve notes still promised the bearer gold coins on demand at $35 per ounce.

Currencies would have fixed exchange rates with the dollar and wouldn't themselves be redeemeble for gold.

287

1.51K reads

Eliminating Gold Convertibility

In 1971, the United States suspended gold convertability for the dollar; the suspension was supposed to be temporary, but the dollar never returned to any linkage with the commodity.

Two years later, the modern era of free-floating currencies began, officially ending the Bretton Woods agreement.

Gold transitioned to the informal role of neutral money, still held today by governments and central banks around the world as first-layer, counterparty-free money.

280

1.34K reads

"Today, our financial system is broken. It works, but the fractures within make it prone to ruptures. It almost collapsed in 2008 and again in 2020. The Federal Reserve has done its job as lender of last resort in each circumstance and kept the financial system alive, but everybody now understands the Fed is the world's only true source of liquidity, and without its support the system couldn't stand on its own."

NIK BATHIA

289

1.38K reads

A Renaissance of Money

Bitcoin originated back in 2008, forty-six days after the fall of Lehman Brothers. Its whitepaper was sent to a very small online community called the Cryptography Maling List.

The paper was written by Satoshi Nakamoto. The creator remains unknown even now, something that strengthens Bitcoin's neutrality, as no leader exists who wields too much influence, can be coerced or blackmailed, or will try to change Bitcoin's rules.

Satoshi would send his last knwon correspondance in April 2011 and disappeared from the Internet forever.

288

1.35K reads

"A puely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial instituton."

SATOSHI NAKAMOTO

284

1.47K reads

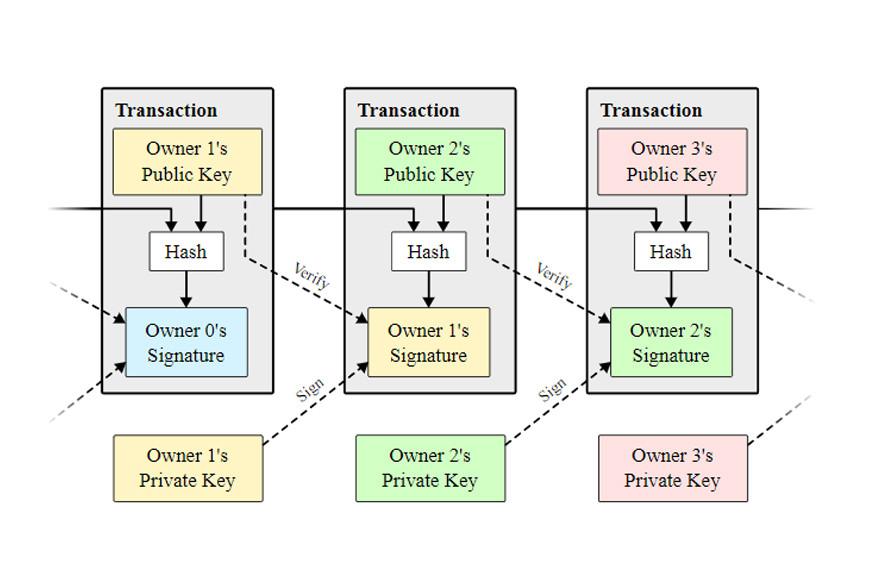

Defining Bitcoin

It is a completely revolutionary form of money which is characterized by being:

- Immutable and Antifragile.

- Secure and Trustless.

- Transparent and Neutral.

Bitcoin officially refers to two things:

- The Bitcoin software protocol.

- The monetary unit within that software.

Bitcoin uses the Secure Hash Algorithm 256 (SHA256) as security mechanism.

292

1.4K reads

Bitcoin Analogies

BTC is digital gold. It's a form of money. People trust BTC because they believe it to be rare and valuable. It has a price in hundreds of different currencies. It doesn't originate from the balance sheet of a financial institution, just like gold doesn't.

BTC is digital land. There are only 57 million square miles of land on Earth. Similarly, there will only be 21 million BTC. This digital land is divisible into the tiniest of parcels.

Bitcoin works similarly to email. Email addresses can be shared with anybody, but only the password holder can access received messages.

287

1.23K reads

"The steady addition of a constant amount of new coins is analogous to gold miners expending resources to add goldto circulation."

SATOSHI NAKAMOTO

277

1.39K reads

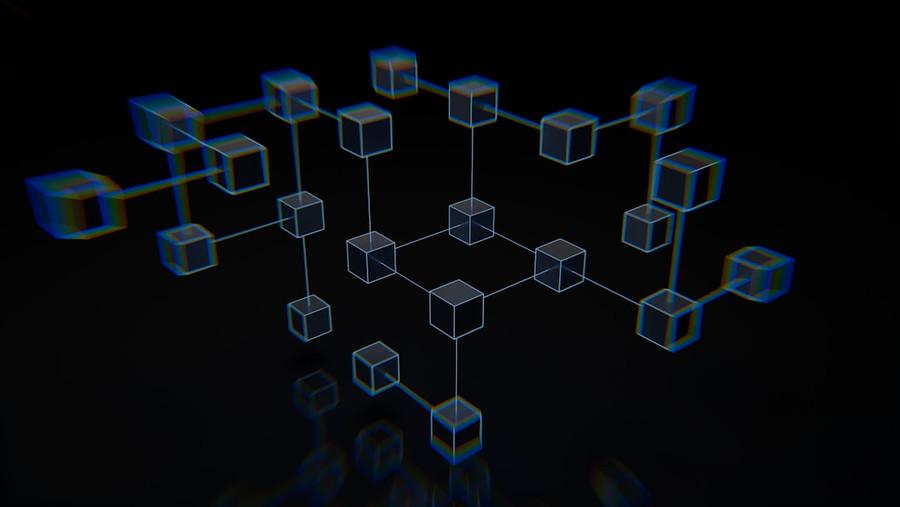

Blockchain and Bitcoin Mining

The Bitcoin blockchain most fundamentally describes a record of transactions simultaneously kept by all peers in the network. Blockchain can be understood as a Distributed & Public Ledger.

Bitcoin mining is the process of verifying new transactions to the Bitcoin digital currency system, as well as the process by which new bitcoin enter into circulation.

For each block successfully mined the winner of the Proof of Work problem of that block gets awarded with 6.25 BTC as an incentive to maintain the blockchain running. This BTC issuance is reduced every 210,000 blocks mined to the half.

285

1.18K reads

"The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronicaly, but they lend it out in waves of credit bubbles with barely a fraction in reserve."

SATOSHI NAKAMOTO

281

1.17K reads

"Actually there is a very good reason for Bitcoin-backed banks to exist, issuing their own digital cash currency, reedemable for bitcoins. Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and inlcuded in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient. Likewise, the time needed for Bitcoin transactions to finalize will be impractical for medium to large value purchases."

HAL FINNEY

277

1.13K reads

"Bitcoin-backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.

I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash."

HAL FINNEY

277

1.04K reads

Central Bank Digital Currencies

The invention of Bitcoin has changed money forever and forced central banks to respond with their own iteration of cryptocurrency.

Worldwide, central banks are preparing to launch central bank digital currencies (CBDCs) as another second-layer monetary instrument originating from their balance sheets on par with reserves and paper currency.

It's uncertain how CBDCs will be constructed, how similar or different their technology will be to Bitcoin's, or the impact they'll have.

281

1.08K reads

IDEAS CURATED BY

Business Administration and Management Student | Blockchain, DEFI & Web3 | Social Worker | "Fix the money & fix the world."

CURATOR'S NOTE

Understand money history and the layers that conform our monetary system, as well as the revolutionary form of money Bitcoin.

“

Max Pamies i del Campo's ideas are part of this journey:

Learn more about crypto with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Discover Key Ideas from Books on Similar Topics

16 ideas

The Bitcoin Standard

Saifedean Ammous

7 ideas

The Thinking Healthcare System

Dominique J Monlezun

5 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates