"Bitcoin-backed banks will solve these problems. They can work like banks did before nationalization of currency. Different banks can have different policies, some more aggressive, some more conservative. Some would be fractional reserve while others may be 100% Bitcoin backed. Interest rates may vary. Cash from some banks may trade at a discount to that from others.

I believe this will be the ultimate fate of Bitcoin, to be the "high-powered money" that serves as a reserve currency for banks that issue their own digital cash."

HAL FINNEY

277

1.04K reads

CURATED FROM

IDEAS CURATED BY

Business Administration and Management Student | Blockchain, DEFI & Web3 | Social Worker | "Fix the money & fix the world."

Understand money history and the layers that conform our monetary system, as well as the revolutionary form of money Bitcoin.

“

The idea is part of this collection:

Learn more about crypto with this collection

How to manage risk

How to analyze investment opportunities

The importance of long-term planning

Related collections

Similar ideas to HAL FINNEY

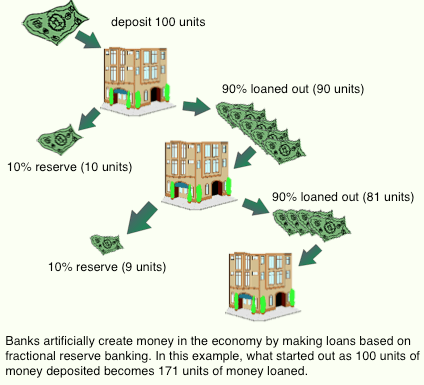

Fractional Reserve & Money Supply

Banks loan money they don't have. Most hold a limited reserve to serve the few who decide to make redraws. When the majority decides to liquidate their bank accounts we have what is called a bank run.

In order to protect the banks, central banks were created to provide a gu...

Why are cryptocurrencies so popular?

Some of the reasons:

- Some see cryptocurrencies such as Bitcoin as the currency of the future and are racing to buy them now, presumably before they become more valuable

- Some like the fact that cryptocurrency removes central banks from managing the money supply ...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates