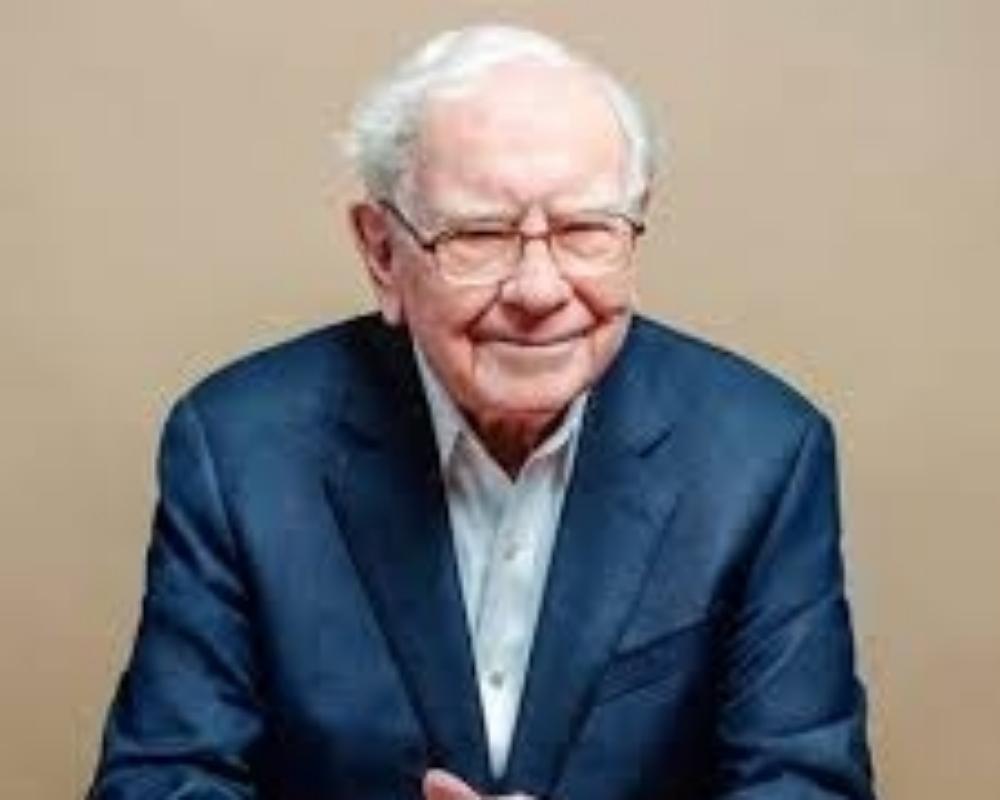

Value Investing: The Philosophy That Gets you Investing like Warren Buffett

Curated from: informationprime.wordpress.com

7

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Understanding The Value Investing Philosophy

The value investing philosophy was pioneered by Benjamin Graham and has been popularly put to great use by Warren Buffett (who needs no introduction). The core ideas behind this philosophy can be summarised as follows:

- Price does not always equal value

- The price you pay for something is only relevant in relation to its value

- The essence of value investing is to purchase shares of a company at a price that is substantially lower than the company’s underlying value.

12

115 reads

Margin of Safety

Margin of safety represents the difference between a company’s stock price and the company’s value.

When the stock price of the company falls sufficiently below the intrinsic value, it creates a buying opportunity. Value investors expect that over time, as others recognize the true value of the company, its share price will climb toward its intrinsic value. As this happens, the margin of safety shrinks. When the share price equals or exceeds the company’s intrinsic value, the margin of safety has disappeared and the shares should be sold.

12

77 reads

Comparisons With Growth Investing

Growth investing and value investing have more in common than apart, the major difference lies in the emphasis on “margin of safety”.

12

99 reads

Value Investing Vs Speculating

Benjamin graham defines an investment operation as “one which, upon thorough analysis, promises safety of principal and an adequate return.”

Based on this definition, there are three components to investing:

- Thorough analysis,

- Safety of principal

- Adequate return.

Any operations not meeting these requirements according to Graham should be considered speculative.

14

88 reads

Criticisms of Value Investing

On paper, the logic of value investing may appear obvious: buy stocks at a bargain price and sell them after the price has gone up. However investment decisions are not that straightforward, an investor is subject to an ever-changing environment where logic can be overshadowed by emotion.

It takes a great deal of conviction to stick to value-investment disciplines, especially when a company’s stock price declines after you purchase its shares.

This is why value investor’s trade long-term (3-5 years).

Value investing principles are therefore mostly unappealing unless the investor has large bucks.

12

72 reads

IDEAS CURATED BY

Writer, artist, Accountant and a forever learner. Learning, loving, Hoping.

CURATOR'S NOTE

This ideas explain the basic elements of value investing philosophy.

“

James Oluwatobi's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

The importance of innovation

The power of perseverance

How to think big and take risks

Related collections

Similar ideas

11 ideas

Warren Buffett: How He Does It

investopedia.com

10 ideas

Investing for Beginners

thebalance.com

2 ideas

Investment Tips for Beginners

google.co.in

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates