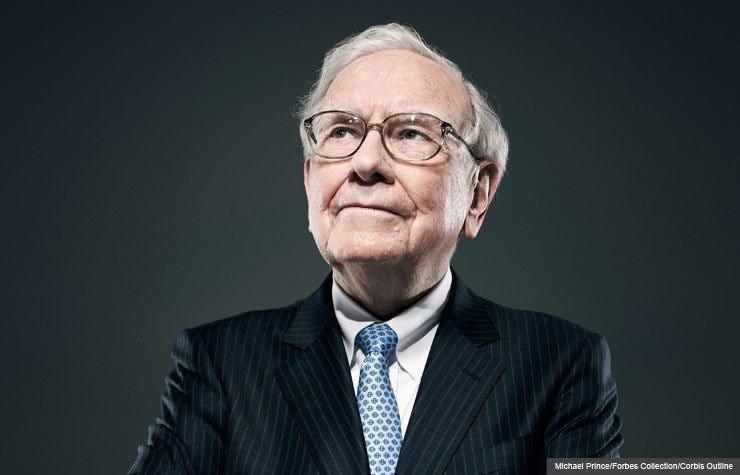

Warren Buffett: How He Does It

Curated from: investopedia.com

Ideas, facts & insights covering these topics:

11 ideas

·35.2K reads

369

3

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Warren Buffet's Way

Buffett follows the Benjamin Graham school of value investing, which are :

- Look for securities whose prices are unjustifiably low based on their intrinsic worth.

- Look at companies as a whole - company performance, company debt, and profit margins, whether companies are public, how reliant they are on commodities, and how cheap they are.

958

9.4K reads

Warren Buffet's Investing Philosophy

- Buffett takes this value investing approach to another level.

- Many value investors do not support the efficient market hypothesis (EMH) . This theory suggests that stocks always trade at their fair value, which makes it harder for investors to either buy stocks that are undervalued or sell them at inflated prices.

- Investors like Buffett trust that the market will eventually favor quality stocks that were undervalued for a certain time.

895

5.12K reads

Warren Buffett‘s Methodology

- Warren Buffett finds low-priced value by asking himself some questions when he evaluates the relationship between a stock's level of excellence and its price.

- Keep in mind these are not the only things he analyzes, but rather, a brief summary of what he looks for in his investment approach.

872

4.51K reads

1. Company Performance

- Sometimes return on equity (ROE) is referred to as stockholder's return on investment.

- It reveals the rate at which shareholders earn income on their shares.

- Buffett always looks at ROE to see whether a company has consistently performed well compared to other companies in the same industry.

- ROE is calculated as follows: ROE = Net Income ÷ Shareholder's Equity

- Looking at the ROE in just the last year isn't enough. The investor should view the ROE from the past five to 10 years to analyze historical performance.

925

3.1K reads

2. Company Debt

- The debt-to-equity ratio (D/E) is another key characteristic Buffett considers carefully.

- Buffett prefers to see a small amount of debt so that earnings growth is being generated from shareholders' equity as opposed to borrowed money.

- The D/E ratio is calculated as follows: Debt-to-Equity Ratio = Total Liabilities ÷ Shareholders' Equity

- This ratio shows the proportion of equity and debt the company uses to finance its assets, and the higher the ratio, the more debt—rather than equity—is financing the company.

902

2.39K reads

3. Profit Margins

- A company's profitability depends not only on having a good profit margin, but also on consistently increasing it.

- This margin is calculated by dividing net income by net sales.

- For a good indication of historical profit margins, investors should look back at least five years.

- A high-profit margin indicates the company is executing its business well, but increasing margins mean management has been extremely efficient and successful at controlling expenses.

890

2.04K reads

4. Is the Company Public?

- Buffett typically considers only companies that have been around for at least 10 years.

- As a result, most of the technology companies that have had their initial public offering (IPOs) in the past decade wouldn't get on Buffett's radar.

- He's said he doesn't understand the mechanics behind many of today's technology companies, and only invests in a business that he fully understands.

- Value investing requires identifying companies that have stood the test of time, but are currently undervalued.

- Never underestimate the value of historical performance. This demonstrates the company's ability.

877

1.85K reads

5. Commodity Reliance

- You might initially think of this question as a radical approach to narrowing down a company. Buffett, however, sees this question as an important one.

- He tends to shy away (but not always) from companies whose products are indistinguishable from those of competitors, and those that rely solely on a commodity such as oil and gas .

- If the company does not offer anything different from another firm within the same industry, Buffett sees little that sets the company apart.

- Any characteristic that is hard to replicate is what Buffett calls a company's economic moat, or competitive advantage.

880

1.68K reads

6. Is it Cheap?

- This is the kicker. Finding companies that meet the other five criteria is one thing, but determining whether they are undervalued is the most difficult part of value investing. And it's Buffett's most important skill.

- To check this, an investor must determine a company's intrinsic value by analyzing a number of business fundamentals including earnings, revenues, and assets.

- And a company's intrinsic value is usually higher (and more complicated) than its liquidation value, which is what a company would be worth if it were broken up and sold today.

871

1.52K reads

6. Is it Cheap? (cont.)

- Once Warren Buffett determines the intrinsic value of the company as a whole, he compares it to its current market capitalization - the current total worth or price.

- Sounds easy, doesn't it? Well, Buffett's success, however, depends on his unmatched skill in accurately determining this intrinsic value.

- While we can outline some of his criteria, we have no way of knowing exactly how he gained such precise mastery of calculating value.

864

1.53K reads

The Bottom Line

- As you've probably noticed, Buffett's investing style is like the shopping style of a bargain hunter.

- It reflects a practical, down-to-earth attitude.

- Buffett maintains this attitude in other areas of his life: He doesn't live in a huge house, he doesn't collect cars, and he doesn't take a limousine to work.

- The value-investing style is not without its critics, but whether you support Buffett or not, the proof is in the pudding.

869

2.06K reads

IDEAS CURATED BY

Lawyer turned Artist Visionary Curator & Gallerist. Empowering self-love and joy through art & words. www.innerjoyart.com 💝 Instagram : dymphna.art

Dymphna Lanjuran's ideas are part of this journey:

Learn more about strategy with this collection

How to analyze churn data and make data-driven decisions

The importance of customer feedback

How to improve customer experience

Related collections

Similar ideas

10 ideas

6 ideas

Value Investing: The Philosophy That Gets you Investing like Warren Buffett

informationprime.wordpress.com

5 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates