Everything You Need to Know About Finance and Investing in Under an Hour | William Ackman

Curated from: Big Think

Ideas, facts & insights covering these topics:

8 ideas

·3.07K reads

31

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Brief Summary

The video covers the basic concepts and principles of finance and investing, such as income statement, balance sheet, cash flow statement, assets, liabilities, equity, return on investment, risk and reward, compounding interest, inflation, valuation, diversification, leverage, hedge funds, etc.

38

636 reads

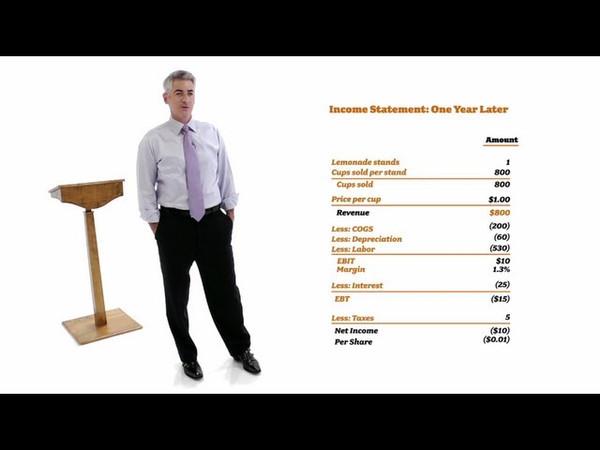

Income Statement, Balance Sheet, and Cash Flow Statement

These are the three financial statements that show the performance and health of a business. The income statement shows how much revenue and profit a business makes over a period of time. The balance sheet shows what assets and liabilities a business has at a point in time. The cash flow statement shows how much cash a business generates or spends over a period of time.

39

487 reads

Assets, Liabilities, and Equity

These are the three main components of the balance sheet. Assets are things that have value or generate income for a business. Liabilities are things that cost money or require payment for a business. Equity is the difference between assets and liabilities. It represents the ownership interest or residual value of a business.

Example of these concepts is buying a house. We need to know how to calculate the assets (house), liabilities (mortgage), equity (down payment), etc. of buying a house.

37

399 reads

Return on Investment

This is one of the most important concepts in investing. It measures how much money you make or lose from an investment relative to how much money you invest. It is usually expressed as a percentage or ratio.

Buying stocks is an example of it. To make most profit, we need to know how to calculate the return on investment (ROI) from buying stocks at different prices and selling them at different prices.

39

337 reads

Risk and Reward

This is another important concept in investing. It describes the trade-off between potential gain and potential loss from an investment. Generally speaking, the higher the risk of an investment, the higher the expected reward of an investment, and vice versa.

The video use sample in buying lottery tickets. As buying lottery tickets is a high-risk, high-reward investment, but also a low-probability, low-expectation investment.

37

304 reads

Investing

Investing is putting money into something with the expectation of getting more money back in the future. Investing can be done in various ways, such as buying stocks (shares of ownership in a company), bonds (loans to a government or corporation), or other securities (financial instruments that represent rights or claims). Investing helps us grow our wealth over time and achieve our financial goals.

38

314 reads

Diversification

Diversification is spreading your money across different types of investments that have different levels of risk and return. Diversification helps reduce your overall risk by minimizing your exposure to any single investment that may perform poorly or fail. Diversification also helps increase your potential return by capturing opportunities from different markets or sectors.

38

295 reads

Think Like An Owner

Thinking like an owner means having a long-term perspective and caring about the quality and value of what you invest in. Thinking like an owner means doing your own research, analyzing the fundamentals, and making informed decisions based on facts and logic. Thinking like an owner also means being responsible for your actions and accountable for your results. Thinking like an owner helps you avoid being swayed by emotions, fads, or hype that may lead you astray as an investor.

38

299 reads

IDEAS CURATED BY

CURATOR'S NOTE

In this video, William Ackman, a billionaire investor and founder of Pershing Square Capital Management, explains the basics of finance and investing.

“

Benny Herlambang's ideas are part of this journey:

Learn more about crypto with this collection

How to create a diversified portfolio

How to analyze stocks and bonds

Understanding the basics of investing

Related collections

Similar ideas

1 idea

ETHEREUM IS EXPLODING

Andrei Jikh

2 ideas

Investment Tips for Beginners

google.co.in

1 idea

Become a Millionaire…With 500 Bucks a Month - Darius Foroux

dariusforoux.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates