How to Drastically Cut Expenses

Curated from: lifehacks.io

Ideas, facts & insights covering these topics:

5 ideas

·1.38K reads

5

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

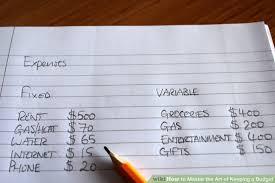

Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

Analyze your monthly expenses, and set priorities in spending. After you separate money for the inescapable expenses, reduce variable costs to easily achieve monthly savings.

70

363 reads

Make The Whole Family Save

When it comes to household budgets and saving, it is important that all family members contribute to cost reduction.

Distributing savings equally prevents others from feeling injured as the only ones who are deprived of what they care about.

56

214 reads

Be Careful With Credit Cards

Do not carry a credit card with you when you go for a walk. Their ease of use can compel us to pay with it, which puts us at risk of paying high interest.

53

219 reads

Plan The Procurement

Track and compare prices in stores and plan a higher monthly food supply.

Leave only daily purchases of bread, milk and basic necessities for everyday small purchases in smaller shops. Major retail chains often offer lower prices or have discount prices, which you can use to purchase monthly.

58

263 reads

Treat Yourself Wisely

Spending money towards priorities doesn’t mean sacrificing all nonessentials. Find something that the whole family can enjoy and is not too expensive and set it as a monthly reward for the effort.

58

321 reads

IDEAS CURATED BY

Lola F.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to delegate tasks efficiently

How to use technology to your advantage

How to optimize your work environment

Related collections

Similar ideas

5 ideas

Your Complete Guide to Creating a Monthly Budget in 2020

listenmoneymatters.com

15 ideas

40 Ways to Save Money on Monthly Expenses - The Simple Dollar

thesimpledollar.com

2 ideas

Your 6-Step Guide to Making a Personal Budget

thebalance.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates