Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Rich Dad, Poor Dad

"Rich Dad, Poor Dad" is a best-selling personal finance book, written by Robert T. Kiyosaki and Sharon L. Lechter.

It reads like an allegorical story about Robert Kiyosaki and his two dads : a “poor dad”, a highly educated college professor & the “rich dad”, a wealthy entrepreneur who owns dozens of businesses. Both dads offer conflicting advice on money.

355

5.6K reads

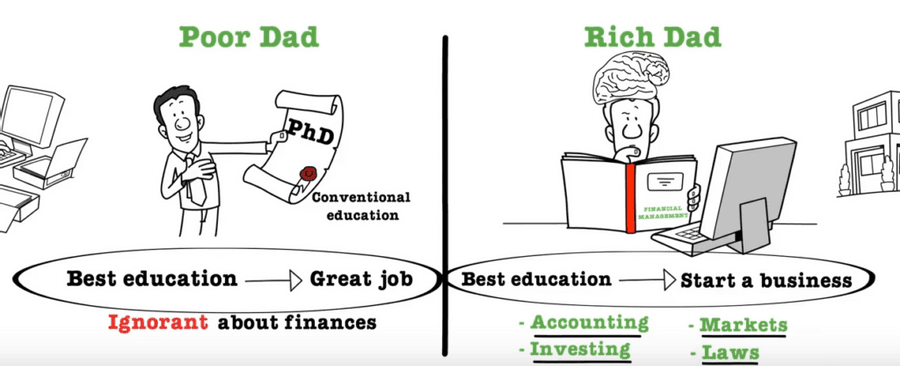

“Poor dad” vs "Rich Dad" Mentality

The “Poor dad”, a stereotype for the regular salary man, believes that one should work for money as an employee at a stable job. This mentality can trap a person into working a job they don’t love, but is willing to stick with because they have to pay the bills.

The "Rich dad", an entrepreneur, thinks wealth comes from experience-based learning (learn on the job, by becoming an entrepreneur) and multiple income streams.

When the “poor dad” encourages working your way up the ladder, “rich dad” laughs and says, “Why not own the ladder?”

431

2.83K reads

Key lessons for becoming a "Rich Dad"

According to Kiyosaki in his book "Poor Dad, Rich Dad", rich people do certain things poor people don't:

- The rich buy assets (things that generate revenue like bonds), not liabilities (things that cost money like rent).

- The rich become financial literate through experience, not by studying hard at fancy schools.

- The rich learn to sell early on.

- The rich manage fear better. They take more risks and don't play it safe.

522

2.73K reads

IDEAS CURATED BY

Lola F.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to develop a healthy relationship with money

How to create a budget

The impact of emotions on financial decisions

Related collections

Similar ideas

3 ideas

2 ideas

The Cashflow Quadrant - Why The Rich Get Richer

investorjunkie.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates