The Cashflow Quadrant - Why The Rich Get Richer

Curated from: investorjunkie.com

Ideas, facts & insights covering these topics:

2 ideas

·4.4K reads

36

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

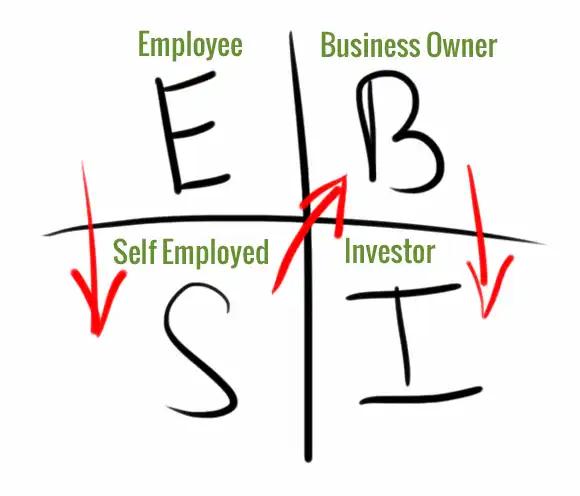

The Cashsflow Quadrant

The Cashflow Quadrant is a concept from Robert Kiyosaki's "Rich Dad Poor Dad" which represents the different methods by which income is generated:

- Employee (E) – Otherwise known as a job

- Self-Employed (S) – Small business owners or self employed (Doctors, and lawyers)

- Business Owner (B) – Big businesses (500 and more employees). Businesses that are selling products and predefined services.

- Investor (I) – People like Warren Buffett

346

2.34K reads

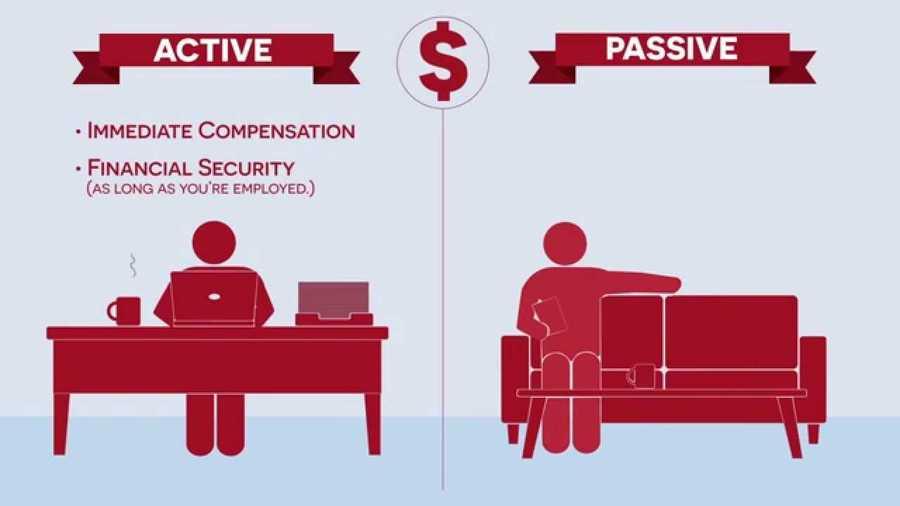

Active vs Passive Income

There are 2 types of income:

Active Income: You are trading time for money. In order to make money you must perform something. Every day you start from zero.

Passive Income: You do not have to be present to generate income. Things like real estate, stocks, bonds are sources of passive income. You are literally making money while sleeping.

325

2.05K reads

IDEAS CURATED BY

Elizabeth V.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Identifying the skills needed for the future

Developing a growth mindset

Creating a culture of continuous learning

Related collections

Similar ideas

3 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates