5 Simple Steps to Creating a Budget That Actually Works

Curated from: crediful.com

Ideas, facts & insights covering these topics:

7 ideas

·60.2K reads

177

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Budgeting = creating a plan to spend your money

Budgeting is simply balancing your expenses with your income.

It's a plan for the coordination of resources and expenditures. When you budget your money, there’s a desired outcome. And being able to track your spending should ultimately move you in the right direction towards meeting your financial goals.

2.2K

12.2K reads

How to create a budget

- Gather Some Financial Information: gather a detailed list of your income and expenses.

- Select a Budgeting Method: figure out how you’ll budget your money to meet your most pressing financial goals.

- Create Your Budget: tally up all your expenses and income to see where you stand and allocate expenses.

- Execute Your Plan: you can use a notebook, pen and paper, a spreadsheet or an online software.

- Reward Yourself: you can work a small percentage into your budget to treat yourself each month.

2.49K

7.8K reads

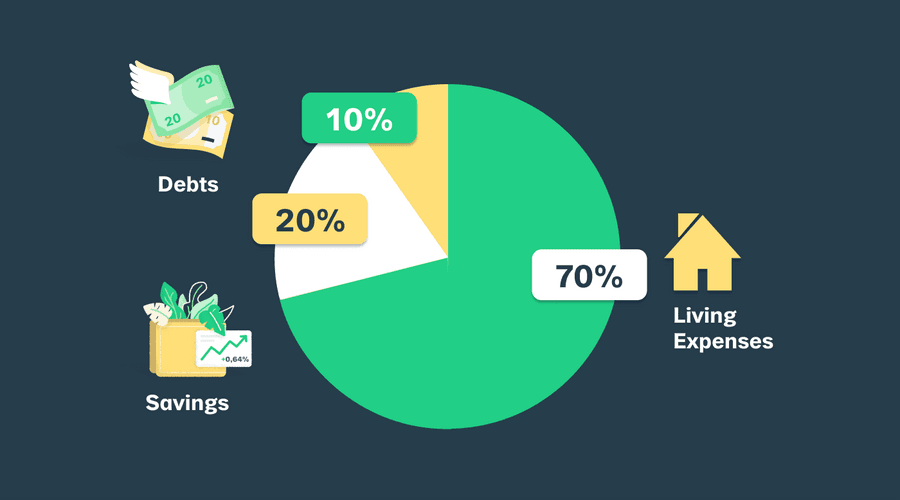

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

2.62K

10.7K reads

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

2.53K

8.91K reads

Allocating expenses

The most common buckets are:

- Expenses, or your needs: housing, food, transportation, clothing, insurance, childcare, etc.

- Debt - monthly debt obligations: personal loan, student loan, auto loan, and credit card payments etc.

- Savings, including funds for your emergency fund.

- Consider automating your retirement contributions to ensure you stick to the plan.

- Wants: don't deprive yourself.

2.41K

7.32K reads

Online Scheduling and Online Bill Payment

Scheduling your payments (online or through your financial institution’s bill pay feature) decreases the likelihood of blowing your budget.

Despite the fact that funds will be sitting into your account until the date they are due to be withdrawn, you’ll know the money is off limits for casual spending.

1.88K

5.63K reads

Benefits of automated savings

- you don’t have to go through the trouble of making an additional transfer

- it won’t be as tempting to spend money that’s sitting in a savings account that you don’t make regular transactions out of.

1.92K

7.61K reads

IDEAS CURATED BY

Summer S.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to network effectively

How to read body language

How to find common ground with others

Related collections

Similar ideas

5 ideas

Your Complete Guide to Creating a Monthly Budget in 2020

listenmoneymatters.com

4 ideas

What Is the 50/20/30 Budget Rule?

investopedia.com

5 ideas

Conscious Spending Plan: Budget by Looking Into the Future

iwillteachyoutoberich.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates