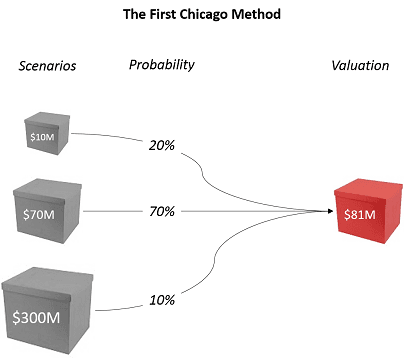

Value your startup with the First Chicago Method

The First Chicago Method answers to a specific situation: what if your box has a small chance of becoming huge? How to assess this potential?

The First Chicago Method (named after the late First Chicago Bank — if you ask) deals with this issue by making three valuations: a worst-case scenario (tiny box), a normal case scenario (normal box), a best-case scenario (big box).

The First Chicago Method is meant for post-revenue startups.

50

148 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to choose the right music for different tasks

The benefits of listening to music while working

How music affects productivity

Related collections

Similar ideas to Value your startup with the First Chicago Method

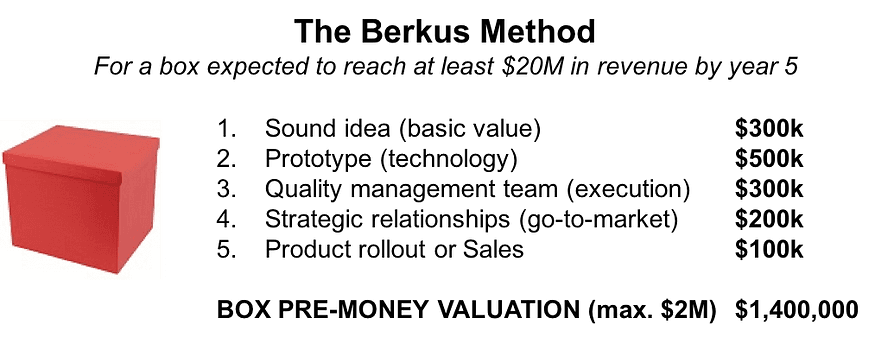

Value your startup with the Berkus Method

The Berkus Method is a simple and convenient rule of thumb to estimate the value of your box. It was designed by Dave Berkus, a renowned author and business angel investor. It is meant for pre-revenue startups.

The starting point is: do you believe that the box can reach $20M in reven...

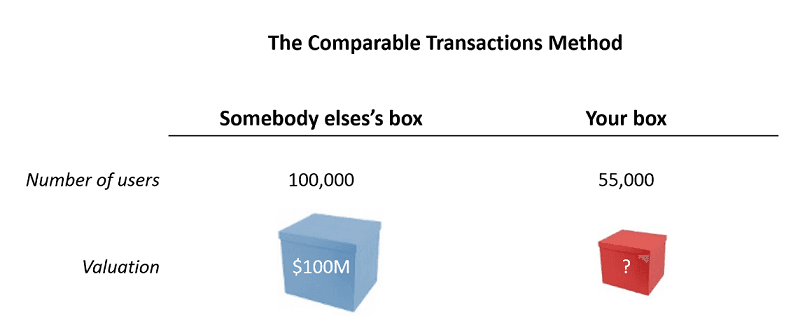

Value your startup with the Comparable Transactions Method

The Comparable Transactions Method is really just a rule of three.

Depending on the type of box you are building, you want to find an indicator that will be a good proxy for the value of your box. This indicator can be specific to your industry: Monthly Recurring Revenue (Saas), HR head...

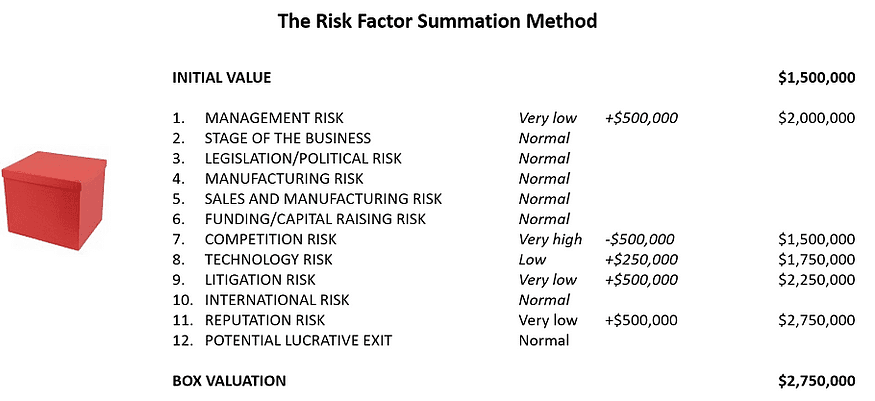

Value your startup with the Risk Factor Summation Method

The Risk Factor Summation Method or RFS Method is a slightly more evolved version of the Berkus Method. First, you determine an initial value for your box. Then you adjust said value for 12 risk factors inherent to box-building.

The initial value is determined as the average value for a sim...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates