Valuation For Startups — 9 Methods Explained

Curated from: medium.com

Ideas, facts & insights covering these topics:

10 ideas

·2.35K reads

18

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

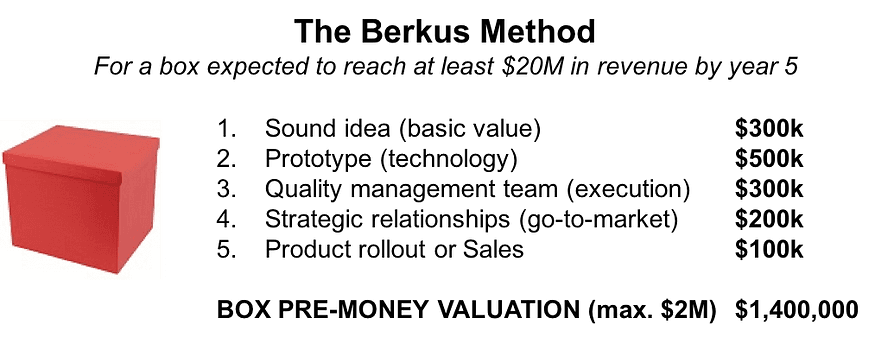

Value your startup with the Berkus Method

The Berkus Method is a simple and convenient rule of thumb to estimate the value of your box. It was designed by Dave Berkus, a renowned author and business angel investor. It is meant for pre-revenue startups.

The starting point is: do you believe that the box can reach $20M in revenue by the fifth year of business? If the answer is yes, then you can assess your box against the 5 key criteria for building boxes.

52

530 reads

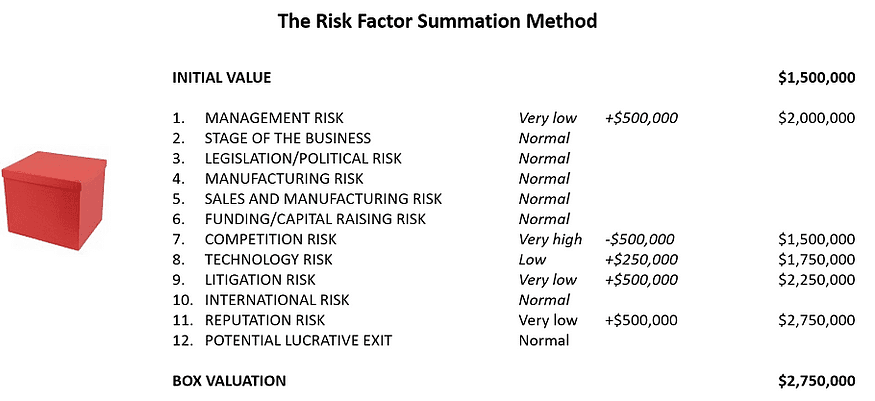

Value your startup with the Risk Factor Summation Method

The Risk Factor Summation Method or RFS Method is a slightly more evolved version of the Berkus Method. First, you determine an initial value for your box. Then you adjust said value for 12 risk factors inherent to box-building.

The initial value is determined as the average value for a similar box in your area, and risk factors are modeled as multiples of $250k, ranging from $500k for a very low risk, to -$500k for a very high risk.

It is meant for pre-revenue startups.

49

352 reads

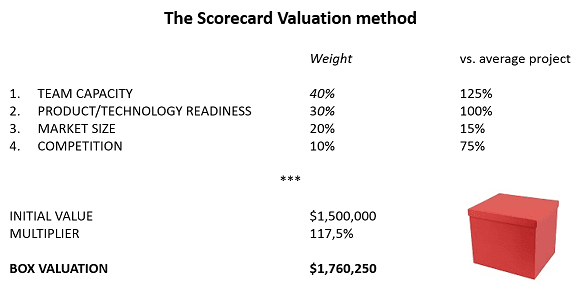

Value your startup with the Scorecard Valuation Method

The Scorecard Valuation Method is a more elaborate approach to the box valuation problem. It starts the same way as the RFS method i.e. you determine a base valuation for your box, then you adjust the value for a certain set of criteria.

Nothing new, except that those criteria are themselves weighed up based on their impact on the overall success of the project.

It is meant for pre-revenue startups.

48

264 reads

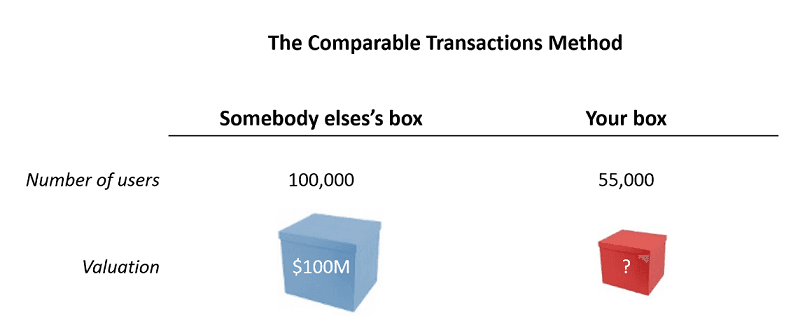

Value your startup with the Comparable Transactions Method

The Comparable Transactions Method is really just a rule of three.

Depending on the type of box you are building, you want to find an indicator that will be a good proxy for the value of your box. This indicator can be specific to your industry: Monthly Recurring Revenue (Saas), HR headcount (Interim), Number of outlets (Retail), Patent filed (Medtech/Biotech), Weekly Active Users or WAU (Messengers). Most of the time, you can just take lines from the P&L: sales, gross margin, EBITDA, etc.

It is meant for pre- and post-revenue startups.

50

215 reads

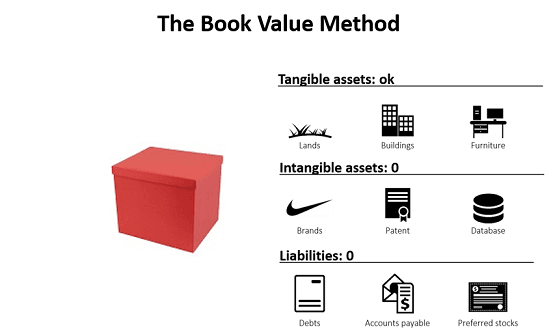

Value your startups with the Book Value Method

The book value refers to the net worth of the company i.e. the tangible assets of the box i.e. the “hard parts” of the box.

The Book Value Method is particularly irrelevant for startups as it is focused on the “tangible” value of the company, while most startups focus on intangible assets: RD (for a biotech startup), user base and software development (for a Web startup), etc.

48

196 reads

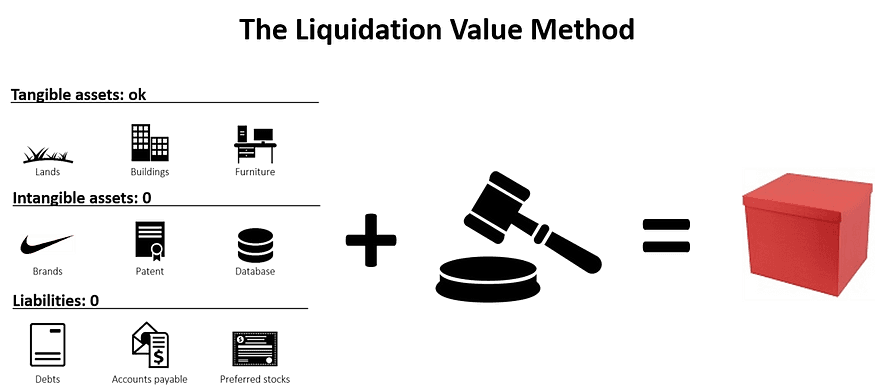

Value your startup with the Liquidation Value Method

Rarely good from a seller perspective, the liquidation value is, as implied by its name, the valuation you apply to a company when it is going out of business.

Practically, the liquidation value is the sum of the scrap value of all the tangible assets of the company.

48

176 reads

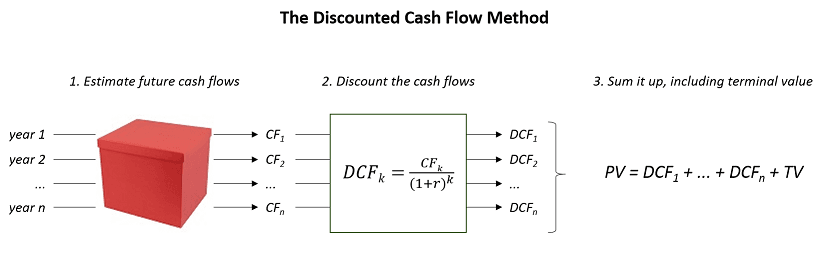

Value your startup with the Discounted Cash Flow method

If your box works well, it brings in a certain amount of cash every year. Consequently, you could say that the current value of the box is the sum of all the future cash flows over the next years. And that is exactly the reasoning behind the DCF method.

48

158 reads

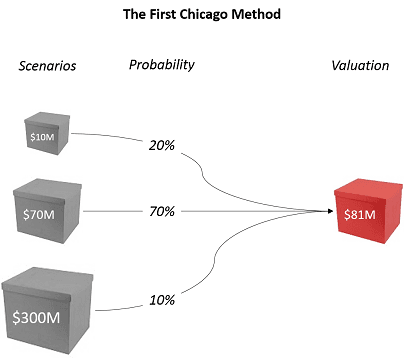

Value your startup with the First Chicago Method

The First Chicago Method answers to a specific situation: what if your box has a small chance of becoming huge? How to assess this potential?

The First Chicago Method (named after the late First Chicago Bank — if you ask) deals with this issue by making three valuations: a worst-case scenario (tiny box), a normal case scenario (normal box), a best-case scenario (big box).

The First Chicago Method is meant for post-revenue startups.

50

148 reads

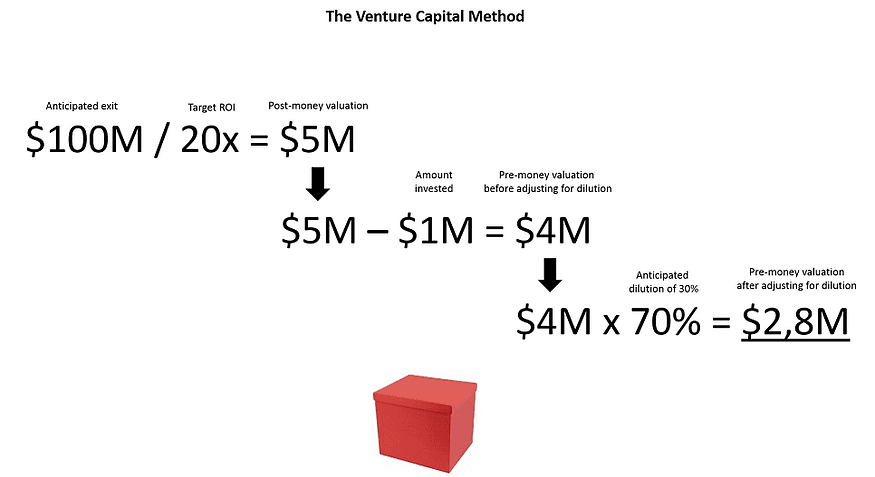

Value your startup with the Venture Capital Method

As its name indicate, the Venture Capital Method stands from the viewpoint of the investor.

An investor is always looking for a specific return on investment, let’s say 20x. Besides, according to industry standards, the investor thinks that your box could be sold for $100M in 8 years. Based on those two elements, the investor can easily determine the maximum price he or she is willing to pay for investing in your box, after adjusting for dilution.

49

142 reads

And the best valuation method is…

The best valuation method is the one described by Pierre Entremont. He says you should start by defining your needs and then negotiate dilution.

The optimal amount raised is the maximal amount which, in a given period, allows the last dollar raised to be more useful to the company than harmful to the entrepreneur.

52

174 reads

IDEAS CURATED BY

Kimberly Trevino's ideas are part of this journey:

Learn more about productivity with this collection

How to choose the right music for different tasks

The benefits of listening to music while working

How music affects productivity

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates