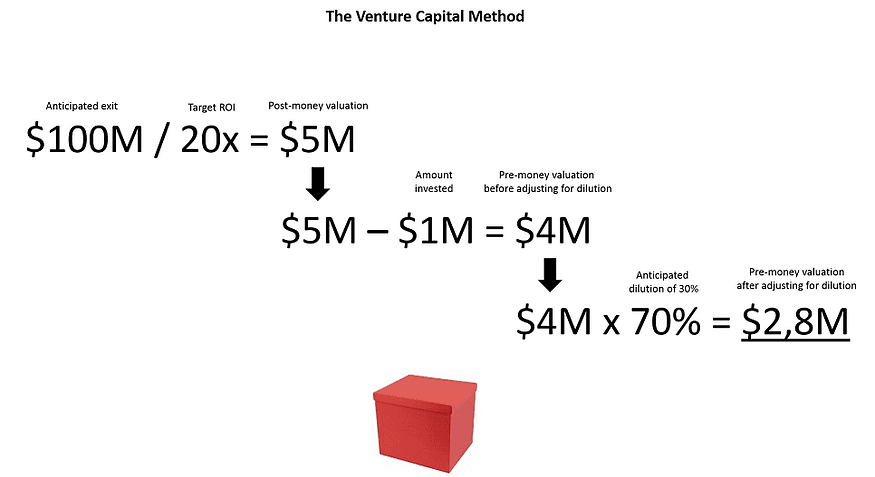

Value your startup with the Venture Capital Method

As its name indicate, the Venture Capital Method stands from the viewpoint of the investor.

An investor is always looking for a specific return on investment, let’s say 20x. Besides, according to industry standards, the investor thinks that your box could be sold for $100M in 8 years. Based on those two elements, the investor can easily determine the maximum price he or she is willing to pay for investing in your box, after adjusting for dilution.

49

142 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about productivity with this collection

How to choose the right music for different tasks

The benefits of listening to music while working

How music affects productivity

Related collections

Similar ideas to Value your startup with the Venture Capital Method

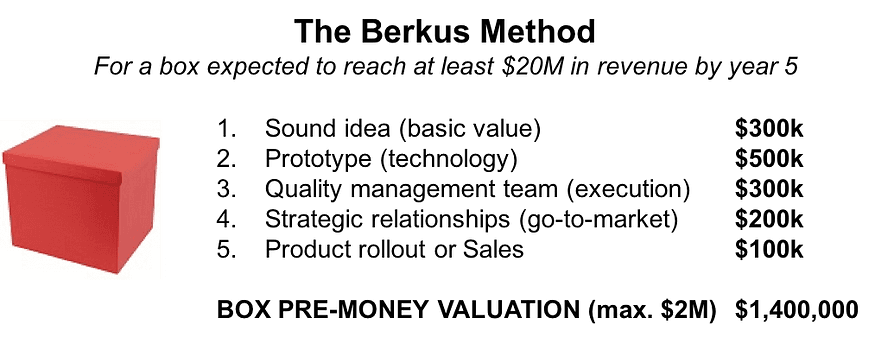

Value your startup with the Berkus Method

The Berkus Method is a simple and convenient rule of thumb to estimate the value of your box. It was designed by Dave Berkus, a renowned author and business angel investor. It is meant for pre-revenue startups.

The starting point is: do you believe that the box can reach $20M in reven...

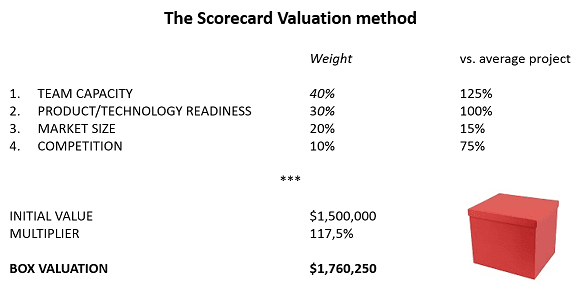

Value your startup with the Scorecard Valuation Method

The Scorecard Valuation Method is a more elaborate approach to the box valuation problem. It starts the same way as the RFS method i.e. you determine a base valuation for your box, then you adjust the value for a certain set of criteria.

Nothing new, except that those criteria are themselv...

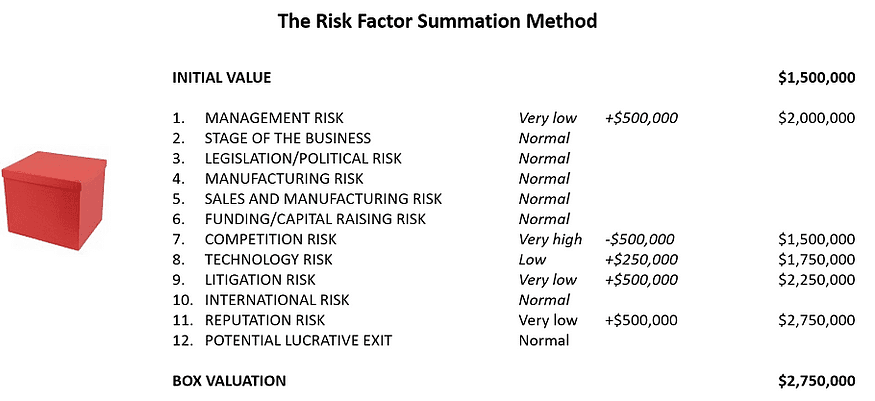

Value your startup with the Risk Factor Summation Method

The Risk Factor Summation Method or RFS Method is a slightly more evolved version of the Berkus Method. First, you determine an initial value for your box. Then you adjust said value for 12 risk factors inherent to box-building.

The initial value is determined as the average value for a sim...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates