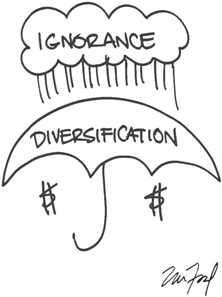

5. Build a robust portfolio

Diversification is probably the most commonly quoted piece of investment advice. Yet unfortunately, time and time again people tend to over concentrate their investments in a specific stock or asset. The idea behind diversification is that it spreads out risk and therefore helps mitigate all kinds of developments, especially negative shocks. The reality is that no asset, stock, region, sector or currency will outperform all the time. Multi-asset funds, which divide their investments between different assets, such as stocks, bonds, cash, & property aim to reduce permanent loss of capital.

10

14 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to close the deal

How to handle objections

How to present your value to your employer

Related collections

Similar ideas to 5. Build a robust portfolio

Build a diverse portfolio

The key to everyday investing is diversification, which means owning different types of investments to spread out the risk. You definitely want to own stock index funds because stocks over time have always offered the best return.

You need investments that can do well when...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates