Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

1. Take the rough with the smooth

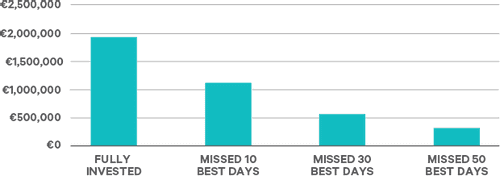

Timing the market is notoriously difficult, even for the most experienced investor. People often focus on trying to dodge the bad days but fail to realise that missing even a few of the best days can be equally damaging. The largest gains tend to occur during periods of extreme volatility and often follow large sell-offs. During these episodes inexperienced investors panic sell or just sit on the side lines. The key lesson is that to be a successful investor it's often better to take the rough with the smooth rather than trying to play the market in search of a quick profit.

10

36 reads

2. Drown out the noise

Many investment houses and brokerage firms profit when investors buy or sell shares. This leads to a lot of noise in the market and it is often difficult to detangle good information from bad. It is challenging to distinguish good financial ‘experts’ from bad, as they are often more concerned with self-promotion rather than providing good investment advice. As George Soros said, “if investing is entertaining, if you're having fun, you're probably not making any money. Good investing is boring.”

10

24 reads

3. Time in the market, not timing the market

The longer you invest for, the better your chance of success. For example, from 1990 - 2016, the average investor will have had a turbulent journey - the dotcom bubble & financial crisis were 2 of the worst bear markets recorded. Yet over that period the return in a back-test of our moderate growth multi-asset portfolio would have averaged 7.4% per annum. That may not sound that great but €1 million invested in 1990 at that rate of return, would now be worth almost €7 million. The lesson is that the power of compounding tends to be the single biggest contributor to an investor’s success.

11

18 reads

4. Geopolitics (often) matters less than we think

It is easy to focus on what can go wrong in the world and extrapolate these geopolitical events into investment returns. Yet geopolitical shocks (outside of world wars) tend to exhibit little or no relationship to returns. Last year was a case in point. Brexit and Donald Trump’s election as the US President threatened to send financial markets into a tailspin, but it never happened. In fact, markets rallied strongly in the second half of 2016.

10

15 reads

5. Build a robust portfolio

Diversification is probably the most commonly quoted piece of investment advice. Yet unfortunately, time and time again people tend to over concentrate their investments in a specific stock or asset. The idea behind diversification is that it spreads out risk and therefore helps mitigate all kinds of developments, especially negative shocks. The reality is that no asset, stock, region, sector or currency will outperform all the time. Multi-asset funds, which divide their investments between different assets, such as stocks, bonds, cash, & property aim to reduce permanent loss of capital.

10

14 reads

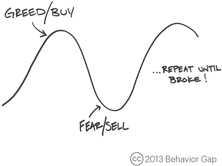

7. Invest counter cyclically

Instead of following the herd, investors should take their lead from the economic and business cycle. One of the few constants in investing is that all economies are cyclical – that is they expand and then contract. By focusing on the cycle, investors can determine the prospect for different assets and markets at the different stages, and importantly can avoid taking on excessive risk when the economy is showing signs of overheating just before a recession. Buying high and selling low is not a sensible investment strategy. Investing counter cyclically is.

10

15 reads

8. Price is what you pay, value is what you get

Overpaying for investments is a common mistake. The most recent examples of this phenomenon were the housing bubble in the run up to the financial crisis. Private investors often do not have access to the same range of data as institutional investors so they often get caught out on price. This is true across all assets including the income yield for property investments, equity valuation metrics like price-to-earnings, or bond yields. Warren Buffett says “price is what you pay, value is what you get”. Consider the intrinsic value of an investment before putting your hard earned capital at risk

11

11 reads

9. Don't let your emotions cloud your judgement

Emotion is dangerous when investing. Unfortunately, it is too easy to become emotionally attached to investments when they are increasing in value. We feel comfortable when we are invested & often actively look to add to winning positions. When the market is doing well it may seem that an individual stock will never go down & that we should hold more and more of it. The most successful investors take profits & rebalance their portfolio. Our experience shows that failing to take profits can result in ‘risk drift’ in portfolios.

11

9 reads

6. Don't follow the herd

“Irrational exuberance" was a phrase championed by former Federal Reserve Chairman Alan Greenspan to explain investor’s behaviour in the mid-to-late 1990s. Although it took a number of years for the bubble to burst, the phrase epitomises the tendency of investors to get most bullish just before a collapse. Quite often it’s wise not to follow the crowd, particularly if the fundamentals do not add up. Remember, when the herd is running towards the cliff, the one running in the opposite direction seems crazy.

11

10 reads

10.Don't chase performance

A common failing of investors is investing in the rear view mirror, chasing performance by buying more of an asset, sector or stock that has performed the best in the most recent time period. A large body of evidence tells us that this leads to underperformance in the long term. Assets that attract the largest amount of inflows subsequently underperform. Investors must accept that no strategy, investment or approach will outperform in every market environment.

11

14 reads

IDEAS CURATED BY

Ifeoluwa Adesemowo's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to close the deal

How to handle objections

How to present your value to your employer

Related collections

Similar ideas

6 ideas

5 Tips for Diversifying Your Portfolio

investopedia.com

4 ideas

Financial Freedom - Part 3 Investments

iit-techambit.in

4 ideas

How to Invest in Uncertain Times

investopedia.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates