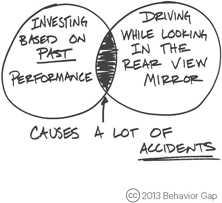

10.Don't chase performance

A common failing of investors is investing in the rear view mirror, chasing performance by buying more of an asset, sector or stock that has performed the best in the most recent time period. A large body of evidence tells us that this leads to underperformance in the long term. Assets that attract the largest amount of inflows subsequently underperform. Investors must accept that no strategy, investment or approach will outperform in every market environment.

11

14 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to close the deal

How to handle objections

How to present your value to your employer

Related collections

Similar ideas to 10.Don't chase performance

Passive Investing

- To ensure the highest margin of safety, choose an investment that gives consistent returns.

- The most conservative investor will avoid short-term market volatility by investing in assets over the

Investing in Stocks

- It means investing in common stock, which is another way to describe business ownership or business equity.

- When you own equity (the value of the shares issued by a company) in a business, you are entitled to a share of the profit or losses generated by that company's operatin...

Stoic Path To Wealth: Grow Money

Stoic investors make smart, balanced bets. Most of us invest in secure funds with low returns. Investors looking at bigger returns opt for index funds. If you are okay with losing money, that does not mean that you should.

The 90/10 investing thumb rule states that we should put 90 percent...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates