Buying a snack at the gas station

We don’t keep track of all the little snack purchases made on the go.

Get in the habit of bringing plenty of liquids and a snack or two with you whenever you go do errands.

1.31K

6.64K reads

CURATED FROM

IDEAS CURATED BY

Total food specialist. Friendly webaholic. Coffee fan. Proud analyst. Tv expert. Explorer. Travel nerd. Incurable beer advocate.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to create customer-centric strategies

The importance of empathy in customer success

The impact of customer success on business growth

Related collections

Similar ideas to Buying a snack at the gas station

Taking a Step at a Time

A big mistake that we make is that we try to go for the big shot and end up failing, and therefore, our confidence falls greatly. It's human psychology to fall apart when we lose and to be optimistic when we get things right. Hence, we have to take the shorter appraoch to get things right.

...

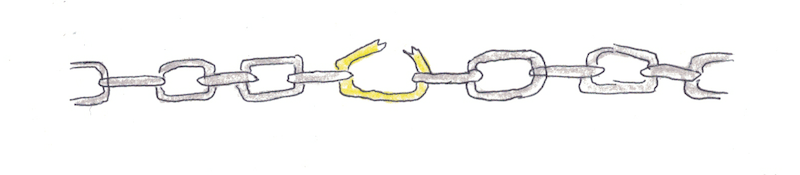

Don’t Break the Chain

Keep track of how many days in a row you’ve successfully followed your habit. As your chain gets longer and longer, you become increasingly committed to the habit.

Pros:

- Maintains habits over a longer timeframe than a 30-day trial.

- Better for thing...

15. Doing Routines Instead of Habits

Habits are routines that you do with little or no conscious thought, also meaning little energy investments.

Time management tips:

- Build the habit loop. Choose a trigger, execute the routine and do something enjoyable afterward. Let’s say at 10 a...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates