Steps of the zero-sum budget

- Determine how much you make on any given month.

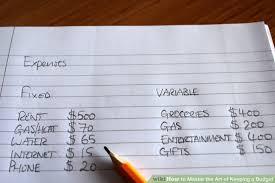

- List your bills: Once you determine how much money you'll make this month, figure out how much money you need to spend next month.

- Compare and contrast: Once you see your monthly income and your monthly bills on paper, a clear picture of how much money is left over emerges.

- Spend all of your money on paper: decide where that money will serve you best.

- Track your spending.

- Make adjustments to get it right.

334

1.35K reads

CURATED FROM

IDEAS CURATED BY

Total food specialist. Friendly webaholic. Coffee fan. Proud analyst. Tv expert. Explorer. Travel nerd. Incurable beer advocate.

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Cultivating self-awareness and self-reflection

Prioritizing and setting boundaries for self-care

Practicing mindfulness and presence

Related collections

Similar ideas to Steps of the zero-sum budget

Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

Analyze your monthly expenses, and set priorities in spending. After ...

The "zero-sum budget"

An emergency savings fund buffer is vital for freelancers. It will help you to keep your head above water when your income fluctuates.

A zero-sum budget means living off last month's income alone. This can be done in the following way:

- Start

The zero-sum budget

Using this method forces you to “spend” every dollar that you make, by allocating all of your earnings into the different categories that your finances require.

It prevents waste and maximizes your income, with the ultimate goal of reaching zero at the end of each month.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates