Automate anything you can

Assuming you have enough to cover the bills and aren't pulling an overdraft fee, start by automating your retirement savings. You know you need an emergency fund, so automate. Do the same with increasing your 401(k) contributions each year, or paying off your credit card debt.

177

594 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to practice effectively

The importance of consistency

How to immerse yourself in the language

Related collections

Similar ideas to Automate anything you can

Allocating expenses

The most common buckets are:

- Expenses, or your needs: housing, food, transportation, clothing, insurance, childcare, etc.

- Debt - monthly debt obligations: personal loan, student loan, auto loan, and credit card payments etc.

- Savings, including fund...

How to Save Right for Retirement

- Start Saving ASAP. Money you put in your retirement fund now will have more time to grow through compound growth.

- Avoid cashing out your retirement account early as it prevents your money from being invested and leads to penalties and tax bills.

- Contribute mo...

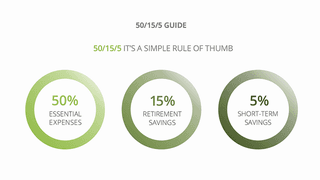

The 50/15/5 rule for multiple financial goals

- 50% of your income goes toward essential expenses: rent, bills, minimum debt payments.

- 15% percent goes to retirement savings. They also suggest you increase this by 1% each year.

- 5% goes toward unexpected monthly expenses or building an emergency...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates