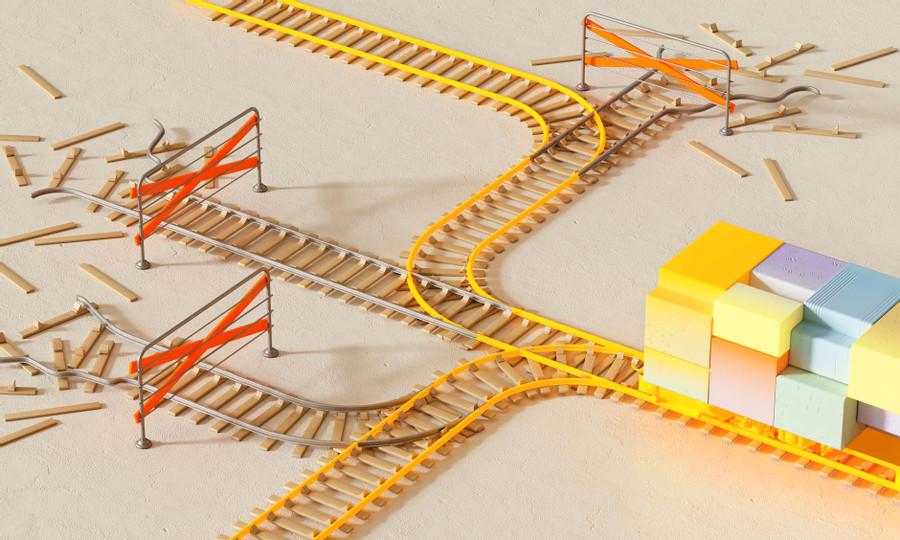

Not all biases are bad

We can become side-tracked if we are too preoccupied with mental errors.

Some biases are underappreciated but can be lifesavers.

69

354 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about problemsolving with this collection

Understanding the importance of constructive criticism

How to receive constructive criticism positively

How to use constructive criticism to improve performance

Related collections

Similar ideas to Not all biases are bad

We’re Biased And Biases Hurt

Biases are mental patterns or shortcuts that influence our perception about something, someone, or a situation. We learn them from our families, friends, teachers, media, and throughout our culture. While we might not be aware of our biases, they can perpetuate oppression...

More Biases

It was quite interesting reading about these cognitive biases, this book has mentioned 13 biases. These are very thought-provoking, I researched and found a book that has given some more details about 100 such Biases with daily life examples, and how to overcome them just...

The problem with heuristics

The problem with using this appears we rely too much on using our existing heuristic patterns without modifying them, because that can create a state of mental stagnation.

Mental operations are affected by mistakes such as cognitive biases, if we are not careful.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates