These firms typically invest in companies that have strong growth potential but may require operational improvements, restucturing, or strategic guidance to realize their full potential. Private equity firms often take an active role in the management of their portfolio companies, to maximize returns for their investors

17

136 reads

CURATED FROM

IDEAS CURATED BY

Private equity investments can offer investors access to exciting investment opportunities with the potential for higher returns than traditional investment vehicles.

“

The idea is part of this collection:

Learn more about economics with this collection

Identifying the skills needed for the future

Developing a growth mindset

Creating a culture of continuous learning

Related collections

Similar ideas

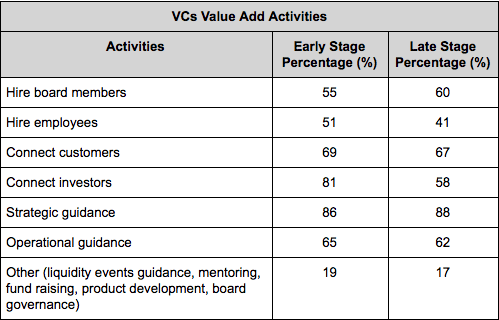

Post-Investment Value Add

VCs are active investors and strive to add value to their companies after they invest.

VCs are critical in the professionalization of startups: they will improve governance through strategic guidance, by structuring the boards of directors and by helping in hiring outside managers and dire...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates