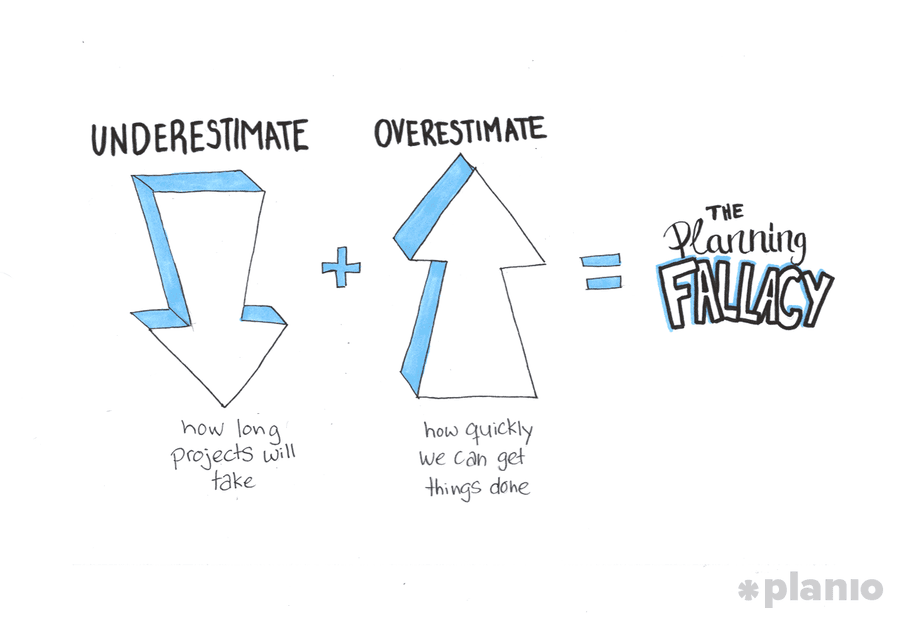

The Planning Fallacy

It states that we are overly optimistic about what we can hypothetically get done in a given day. So we overschedule and create further time debt.

972

2.97K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about timemanagement with this collection

How to set clear objectives

How to follow up after a meeting

How to manage time effectively

Related collections

Similar ideas to The Planning Fallacy

The planning fallacy

The term 'planning fallacy' was coined in 1977 and deals with how most of us are terrible at estimating how long a project will take. We are overly optimistic but terrible at predicting the future. If the project has a budget, we may underestimate that expense to...

Counteract the Planning Fallacy

When you start to schedule your tasks, you may be too optimistic about how much you can get done. You may take on too much work or get stressed when tasks take longer than you expected.

To counteract the Planning Fallacy:

- Work in a buffer into you...

The Planning Fallacy And Social Pressure

The workplace is a competitive zone, and enthusiastic workers take an unfair lead even though their plans are unrealistic and overly optimistic.

You don’t need to succumb to the pressure, once you understand how the planning fallacy works. The outcome will provide clarity to all.

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates