The 4% Rule

Lesson 3: The 4% Rule states that, we can retire when our annual spending is equal to 4% of our total savings. To retire, we should have at least 25 times of our annual spendings as our total saving….

99

729 reads

CURATED FROM

IDEAS CURATED BY

Similar ideas to The 4% Rule

The four percent rule

The four percent rule states that you could withdraw four percent of your principal balance every year and live on this indefinitely. That means you need to save 25 times your annual expenses to become financially independent.

The four percent rule is not perfect. There is no risk-free inv...

How much you should save every month

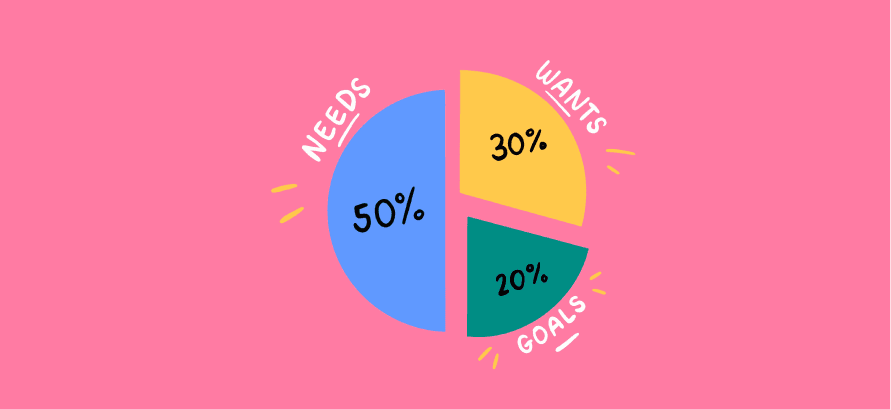

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your inco...

The 50-20-30 rule

It is a budget rule to help people reach their financial goals. It states that:

- You should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to ev...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates