Reducing your essentials

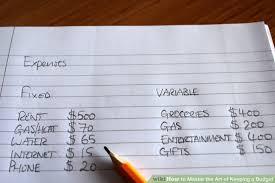

Play around with your monthly budget to see where you can reduce your monthly spending:

- You could contact your internet company to get a discount.

- You can clip coupons and use rebate apps to spend less on your monthly groceries.

- You could set aside less for medical expenses if you have an emergency fund.

1.3K

5.85K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to prioritize tasks effectively

How to manage your time efficiently

How to reduce stress and anxiety

Related collections

Similar ideas to Reducing your essentials

Define what your emergency fund is

Your first step is to figure out what counts as a true emergency.

Not all emergencies can be predicted, but many can. Car repairs, medical expenses, higher-than-normal bills. Even having a list of things that you can and cannot spend an emergency fund on can help you stay on track a...

Keeping The Budget

Compare the total monthly family income with total monthly expenditures. If you have excess money after paying your bills you can save or invest it, otherwise, you have to reduce expenses, increase revenue, or do both.

Analyze your monthly expenses, and set priorities in spending. After ...

Budgeting Like a Pro

- Consider an All-Cash Diet, as limiting yourself to physical currency combats overspending.

- Set aside 1 minute a day to check on your financial transactions, to identify problems, track goal progress and set your spending tone.

- Allocate at least 20% of your in...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates