Portfolio career

Multiple income streams can add up to be equal or more than a full-time salary.

Your career does not have to be a linear journey to be successful, nor do you have to be confined to just one type of work.

504

2.33K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Conflict resolution

Motivating and inspiring others

Delegation

Related collections

Similar ideas to Portfolio career

The career portfolio

Whereas a career path tends to be a singular pursuit (climb the ladder in one direction and focus on what is straight ahead), a career portfolio is a never-ending source of discovery and fulfillment. It represents your vast and diverse professional journey, including the various ...

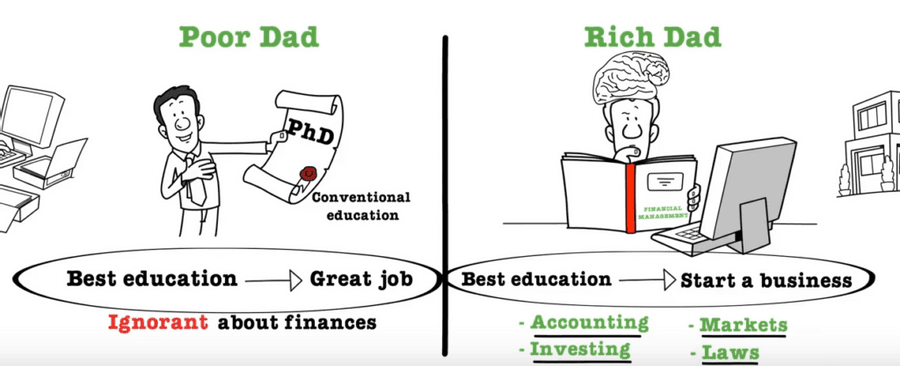

“Poor dad” vs "Rich Dad" Mentality

The “Poor dad”, a stereotype for the regular salary man, believes that one should work for money as an employee at a stable job. This mentality can trap a person into working a job they don’t love, but is willing to stick with because they have to pay the bills.

The "Rich...

Think of your career like your portfolio

- Many of us assume job security, but any job someone gives you can be taken away. You may also wake up and decide the job you have isn’t what you wanted at all, which is another way things change.

- To thrive in a world of flux, think about your career more like...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates