Many life transitions happen in your 30's

From moving up in your career to buying a home. Making smart moves with your money during your 30's can help you achieve future financial success.

333

3.54K reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to communicate effectively with difficult people

How to handle conflict

How to stay calm under pressure

Related collections

Similar ideas to Many life transitions happen in your 30's

Anyone Can Become Rich

This is the main premise of the best selling book by Ramit Sethi. He structures his ideas into 4 buckets:

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals

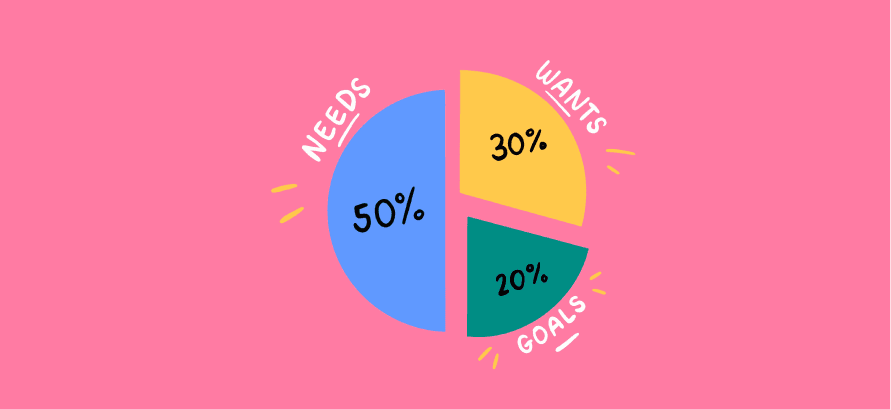

The 50-20-30 rule

It is a budget rule to help people reach their financial goals. It states that:

- You should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do.

- The remaining half should be split up between 20% savings and debt repayment and 30% to ev...

Key Takeaways

- Money is not just a tool for buying things, it also shapes our emotions & attitudes in ways that can be both positive and negative.

- The way we think about money is often irrational & influenced by emotions, which can lead to poor financial decisions.

- The role of luck in finan...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates