1. Live Within Your Means

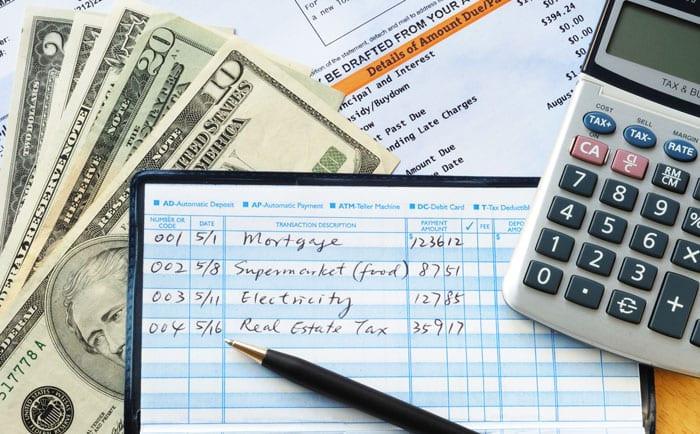

Do you want to improve your budgeting habits? Follow the simple 50/30/20 rule.

Determine your income and expenses using a budgeting spreadsheet or app.

- Allocate 50% of your income for essentials (needs), such as food, housing, and bills.

- Allot 30% for discretionary spending (wants), like personal items and leisure activities.

- Save 20% for your financial goals. Budgeting can still be enjoyable!

Remember: Never spend more than you earn. If something is beyond your means, save until you can afford it.

146

1.18K reads

CURATED FROM

IDEAS CURATED BY

Lawyer turned Artist Visionary Curator & Gallerist. Empowering self-love and joy through art & words. www.innerjoyart.com 💝 Instagram : dymphna.art

Budgeting is a very important aspect in one's life and business too. Personally, I think it will be beneficial if this is taught to children as part of their early childhood education. It can support building financial literacy, discipline, awareness and self-control since young.

“

Similar ideas to 1. Live Within Your Means

1. Budgeting Basics:

Income vs. Expenses: Understand how to balance what you earn and what you spend

Needs vs. Wants: Differentiate between essential expenses and discretionary spending

Savings: Allocate a portion of your income to savings and emergen...

How much you should save every month

The popular 50/30/20 rule states that you should reserve 50 percent of your budget for essentials like rent and food, 30 percent for discretionary spending, and 20 percent for savings.

But it's not that simple. If you're a high earner, you'd be wise to save a larger percentage of your inco...

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings a...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates