Learn more about moneyandinvestments with this collection

How to network effectively

How to read body language

How to find common ground with others

Budgeting = creating a plan to spend your money

Budgeting is simply balancing your expenses with your income.

It's a plan for the coordination of resources and expenditures. When you budget your money, there’s a desired outcome. And being able to track your spending should ultimately move you in the right direction towards meeting your financial goals.

2.19K

11.9K reads

MORE IDEAS ON THIS

Benefits of automated savings

- you don’t have to go through the trouble of making an additional transfer

- it won’t be as tempting to spend money that’s sitting in a savings account that you don’t make regular transactions out of.

1.91K

7.34K reads

Online Scheduling and Online Bill Payment

Scheduling your payments (online or through your financial institution’s bill pay feature) decreases the likelihood of blowing your budget.

Despite the fact that funds will be sitting into your account until the date they are due to be withdrawn, you’ll know the money is off limits...

1.87K

5.39K reads

Allocating expenses

The most common buckets are:

- Expenses, or your needs: housing, food, transportation, clothing, insurance, childcare, etc.

- Debt - monthly debt obligations: personal loan, student loan, auto loan, and credit card payments etc.

- Savings, including fund...

2.4K

7.06K reads

The 50:30:20 budgeting method

Under this method, 50 percent goes to expenses, 30 percent goes to wants, and 20 percent goes to a combination of debt and savings.

A person with a healthy amount of disposable income but loads of debt could probably benefit more from the 50:30:20 method.

2.52K

8.64K reads

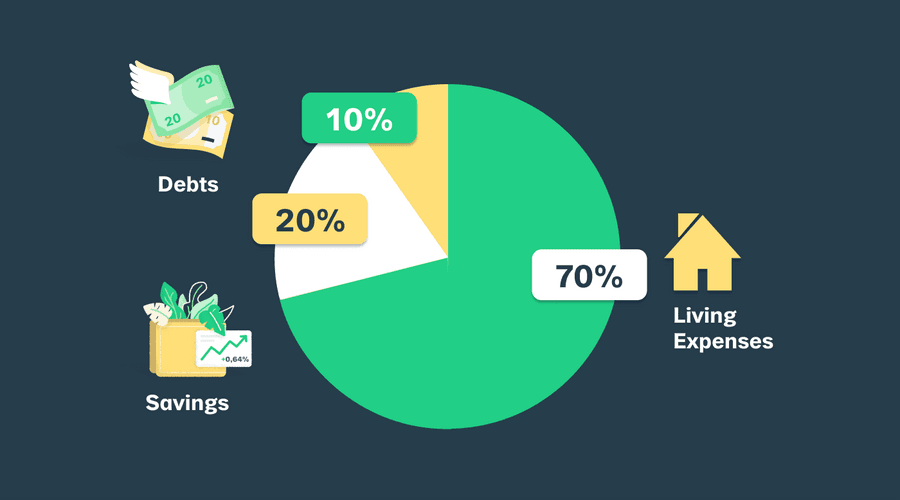

The 70:20:10 budgeting method

This method suggests that you allocate 70 percent of your income to expenses, 20 percent to savings, and the remaining 10 percent to debt.

70:20:10 may work for someone with a healthy emergency fund and minimal debt.

2.61K

10.4K reads

How to create a budget

- Gather Some Financial Information: gather a detailed list of your income and expenses.

- Select a Budgeting Method: figure out how you’ll budget your money to meet your most pressing financial goals.

- Create Your Budget: tally...

2.47K

7.51K reads

CURATED FROM

IDEAS CURATED BY

Related collections

Other curated ideas on this topic:

How to create a budget

- Gather Some Financial Information: gather a detailed list of your income and expenses.

- Select a Budgeting Method: figure out how you’ll budget your money to meet your most pressing financial goals.

- Create Your Budget: tally...

Budgeting for a Life You Can’t Afford

This becomes a problem when you’re spending for a life you can’t afford. It puts pressure on your budget and encourages you to live in a paycheck to paycheck cycle.

Assess your financial situation, cut back on your expenses, prioritize your money goals, and then come up with a new sp...

A Monthly Budget For Your Money

No matter how little or how much money you earn, creating a monthly budget is one of the most important aspects of managing your finances. What gets measured gets managed.

Having a budget doesn't stop you from spending money the way you want it to, but works like a partne...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates