Option

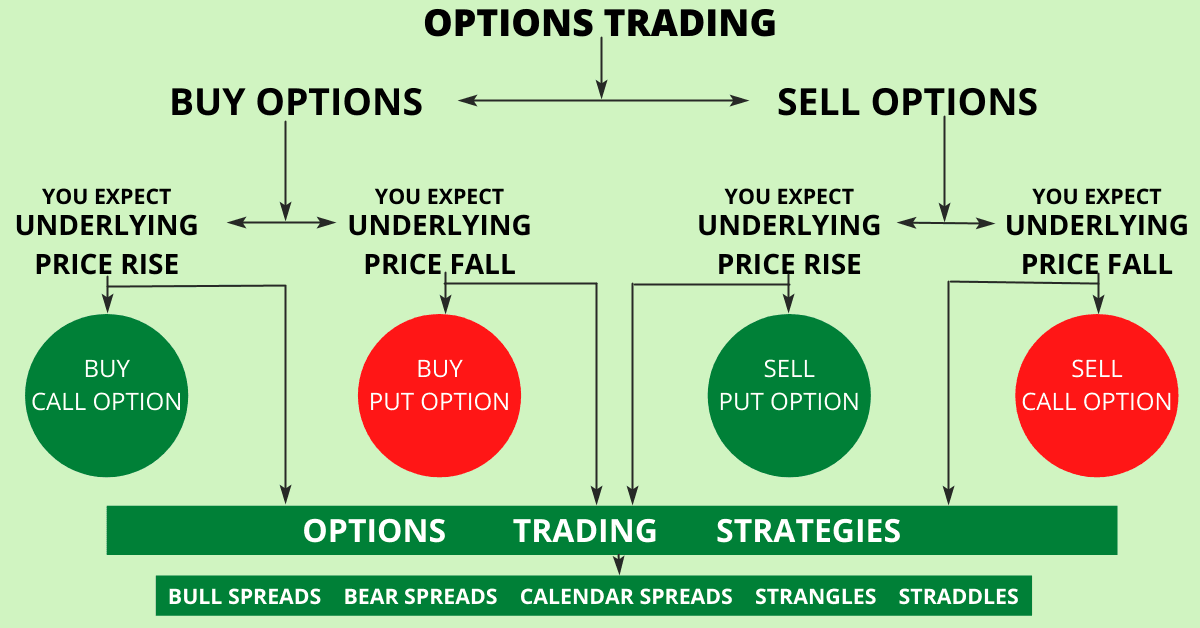

A contract giving the buyer the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price.

349

156 reads

CURATED FROM

IDEAS CURATED BY

The idea is part of this collection:

Learn more about crypto with this collection

The impact of opportunity cost on personal and professional life

Evaluating the benefits and drawbacks of different choices

Understanding the concept of opportunity cost

Related collections

Similar ideas to Option

Forms of trading

Options are divided into "call" and "put" options. With a call option, the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called

Option

An Option is the ability to take a predefined action for a fixed period of time in exchange for a fee. Options are all around us: movie or concert tickets, coupons, retainers, and licensing rights. In exchange for a fee, the purchaser has the right to take some specific action—at...

Covered Call

A covered call strategy involves buying 100 shares of the underlying asset and selling a call option against those shares. When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates