How to Move Money in the 21st Century

Curated from: a16z.com

Ideas, facts & insights covering these topics:

4 ideas

·721 reads

10

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Companies need better software to manage day-to-day finance

The tools that exist today for tracking and managing financial operations are outdated. Furthermore, payment complexity is increasing as businesses become global.

Large companies try to keep up by creating homegrown solutions with many engineers and operations specialists. For example, companies like Airbnb and Uber have 200+ employees tracking their real-time financial health.

Then there are the breakdowns in these payment operations, such as when Citibank accidentally wired $900M to a hedge fund.

27

350 reads

Payins and payouts are mostly manual

- Payouts send money outside of the business, such as bank wires and ACH, paying vendor invoices, creating transaction logs, etc.

- Payins bring money into the business by accepting various payment methods, optimising payment routes and authorisation rates, identifying fraud and failure, allowing for rewards, gift cards, payment splitting, etc.

The payment acceptance methods - credit cards, e-wallets, crypto, gift cards, bank transfers - differ by company and geography and can take months to implement. For payouts, a bank transfer involves a series of manual approvals.

27

136 reads

The opportunity to build

Financial Operations (FinOps) could be an emerging software category with a huge opportunity to rethink the way businesses manage their money. As a result, it is expected that a number of companies will build solutions.

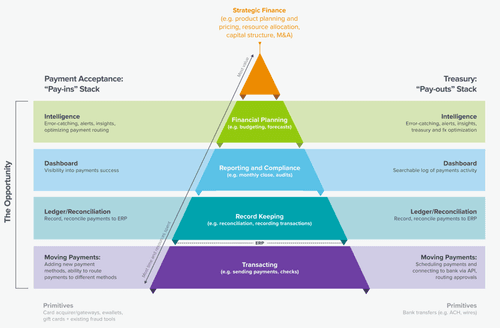

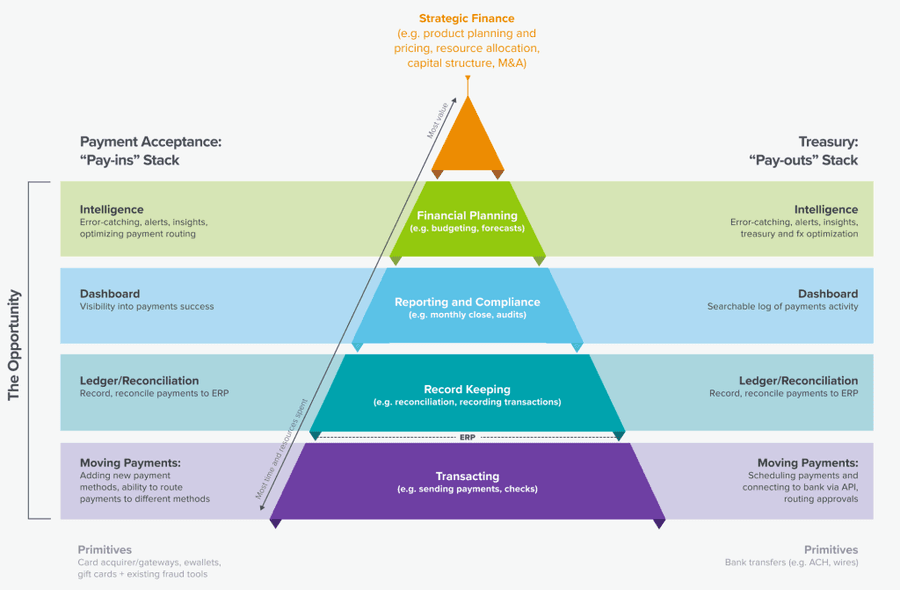

Both payins and payouts can organise workflows into layers on top of the existing primitive workflows. These layers are:

- Moving payments

- Ledger/reconciliation to record payment entries and connect to the ERP.

- Dashboard - the ability to see and search transactions

- Intelligence - the ability to set alerts and catch errors.

28

122 reads

Building principles

Building in this category requires building trust and reducing friction in the onboarding. The product needs to be highly reliable and likely needs to be added on top of existing products at first. Setup cannot be overly complex, as this is what the buyer wants to avoid.

To get to market, early design partners and product marketing are critical. Leadership across the company should find it easy to understand and get insights into the real-time financial health of the company.

27

113 reads

IDEAS CURATED BY

CURATOR'S NOTE

As companies continue to expand globally and new payment methods are created, there is an increasing need for a new generation of “financial operations” (FinOps) to help businesses manage their money.

“

Elizabeth V.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to use storytelling to influence and persuade

How to create a compelling narrative

How to structure your story for maximum impact

Related collections

Similar ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates