Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

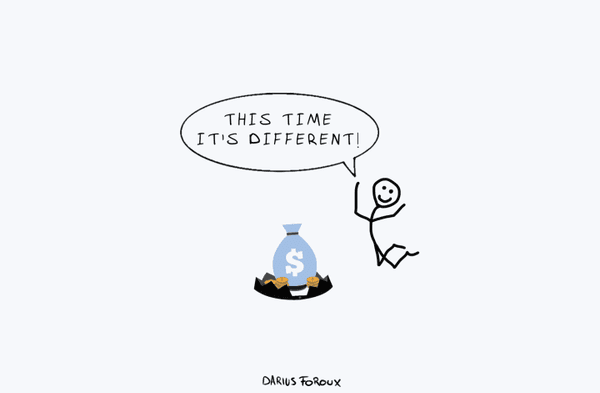

Expectations during the formation of bubbles

When investors deal with an exceptional event, they often say, ”This time, it’s different.” It is more likely to happen during the formation of bubbles.

For example, in 2021, investors and commentators said we were in a bubble for growth stocks and SPACs. While some said it was similar to the Dotcom crash of 2000, other investors said we're certainly not in a bubble. We were, and it started to crash from mid-2021.

7

33 reads

Stock market bubbles

Didier Sornette, a former professor of Entrepreneurial Risks at the Swiss Federal Institute of Technology, published a book, Why Stock Markets Crash, and found that half to two-thirds of all bubbles crashed.

Stock market events repeat themselves. When fiscal policy is easy, and credit comes cheap, asset prices rise. The trend inevitably reverses at some point.

6

17 reads

The “Hot hand” fallacy: When you can’t lose

The “hot hand” fallacy is a cognitive bias that assumes a person who experiences a successful outcome has a greater chance of success if they continue.

When you invest during a bull market, you may feel like a winner on every investment or trade. But hot streaks never last. It is unsustainable if you want to build long-term wealth.

6

19 reads

The “Over-extrapolation” fallacy: The future is not the same

Extrapolation is estimating the values of a variable based on known data. Scientists can look at the existing birthrate and use that data to extrapolate the future population. However, it's not a reliable method when dealing with finance and the economy.

For example:

- If today is bad, you assume the future will worsen.

- If today is good, you assume the future will be even better.

Nothing lasts forever, not the bad or the good times.

6

19 reads

The aware investor avoids losing all their money

Long-term investing is about ensuring you can keep investing. It's not about the right stocks, taking risks, buying low or selling high.

Smart investors stay in the game regardless of the conditions. They recognize patterns in the market and their own thinking, which is an important characteristic of sound investing.

6

23 reads

IDEAS CURATED BY

Catherine Martin's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create and sell NFTs

The future of NFTs

The benefits and drawbacks of NFTs

Related collections

Similar ideas

6 ideas

Value Investing: The Philosophy That Gets you Investing like Warren Buffett

informationprime.wordpress.com

4 ideas

How to Invest in Uncertain Times

investopedia.com

4 ideas

Investing in One Lesson

Mark Skousen

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates