Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

What early retirement means

Early retirement is not defined as when you stop working forever, but as having the freedom and flexibility that saving up enough money can give you if you want to leave a job.

The idea that when you retire, you are done working is an old school idea. Working is actually good for you. People that altogether quit working start losing their mental faculties and may die sooner.

667

4.33K reads

How to retire early

A good early retirement strategy is built on maximizing three aspects: Income, expenses, and savings.

To build your early retirement strategy, you need to determine your retire early or financial independence (FI) number. It is the amount of money you need for work to become optional. Be aware that the number will (and should) change as you change, and your desired lifestyle evolves.

667

3.63K reads

The money you need for early retirement

Based on a series of papers known as the Trinity Studies, you need to save 25-30 times your expected annual expenses to have enough money to last you for the rest of your life.

This multiple is based on the percentage of your investment growth that you would be able to withdraw per year. A safe early retirement withdrawal percentage is between 3%-4%.

714

3.53K reads

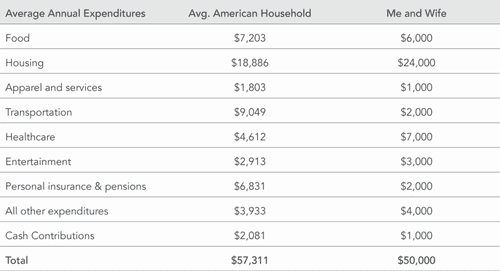

Cut back on your expenses

Cut back on your three biggest expenses.

- Housing: The easiest way to do this is by house hacking, where you rent or buy a 2 or 3 bedroom apartment and rent out the extra rooms to offset or make money on your rent or mortgage.

- Transportation: Don't buy a car if you don't need one. Or buy a used car.

- Food: Make food at home. Buy in bulk. Eat less meat.

686

3.05K reads

Increase and diversify your income streams

Go out and try to make more money. Start by optimizing your full-time job and starting a side hustle.

- Optimize your 9 to 5: Negotiate a raise and work remotely, so you have more control over your time and more time to make money on the side. Ensure you are maximizing all of your employee benefits.

- Start a side hustle: Profitable side hustling is about the money/time tradeoff. It is a lot easier to make money doing something you love.

679

2.51K reads

Set daily, weekly, monthly, and annual savings goals

Most of the retirement calculators come out with a number you will need to "retire" based on your inputs and current progression. The numbers are so large that they seem impossible to reach and consequently discourage saving.

However, a daily goal is much easier to consider. If you need to get to $1,250,000 over a 30 year period, you can wrap your mind around saving $50 a day with an expected 5% annual compounding rate.

676

2.37K reads

Create a simple investing strategy

A good early retirement investing strategy should be simple, focused on stocks, bonds, and real estate, and be executed consistently.

- Ensure to have both a short- and long term investing strategy.

- Only invest in what you understand.

- Stick with asset classes that have performed well historically.

- Ensure your money is working as hard as it can for you by investing in a tax-efficient way.

668

2.29K reads

Fast track your early retirement

Deposit as much money as possible into your investment accounts every day, even if it is only $5. If you get a bonus, invest it. If you make extra money on a side hustle, invest it.

Try to deposit $5/day and then increase it $1/week. You will probably not miss the extra dollar.

676

2.54K reads

The most important numbers to track

The two most important numbers to track your early retirement strategy are:

- Your savings rate: This is the percentage of your income that you're saving either before or after taxes in all of your accounts

- Your net-worth: This is the most important metric to track. Net-worth = your assets - your liabilities.

677

2.39K reads

IDEAS CURATED BY

"Making money is art and working is art and good business is the best art." ~ Andy Warhol

Alexis T.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to create a strong portfolio

How to network and market yourself as a designer

How to manage time and prioritize tasks

Related collections

Similar ideas

4 ideas

Retirement Planning and importance of Retirement Plans

wisdomtimes.com

3 ideas

Financial Independence, Retire Early (FIRE) Definition

investopedia.com

3 ideas

What It Takes to Actually Retire by 30

thecut.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates