Retirement Planning and importance of Retirement Plans

Curated from: wisdomtimes.com

Ideas, facts & insights covering these topics:

4 ideas

·2.55K reads

10

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Early Mistakes, Late Start & Future Hurdles.

Savings and investments should be part of a monthly budget even when young or just starting a career.

You cannot save enough if you are waiting until your late 30's before thinking about savings and investments. Then credit cards and loans will drag the savings with added responsibilities like marriage, children, care of parents, etc.

142

662 reads

Myth vs. Reality in Retirement Planning

- I’m not that old: It’s not about NOW but saving for your old days when you can no longer work full time.

- I’ll wait for a lump sum is just an excuse to postpone planning or procrastinate.

- Assumed Family/External Support: It’s better to be prepared for eventualities and have contingency funds in hand.

- Financial Requirements Decrease: Medical costs increase with age. Inflation and other factors might also come into play.

- I will not live that long or I won’t retire: People tend to live longer, but they will suffer from medical ailments.

120

515 reads

Retirement Goals

To have a secure and financially independent retired life during your golden years with regular post retirement income, a corpus of savings/investments and a safe shelter or home.

104

642 reads

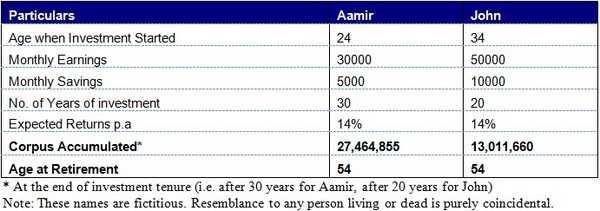

Use Power of Compounding ...

To achieve your retirement goals and objectives – you need to have the right amount of corpus to take care of your regular needs post retirement.

110

732 reads

IDEAS CURATED BY

Elizabeth V.'s ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to practice effectively

The importance of consistency

How to immerse yourself in the language

Related collections

Similar ideas

9 ideas

How to Retire Early | The $50 a Day Early Retirement Strategy

millennialmoney.com

4 ideas

Retirement Planning: Why Plan For Retirement?

investopedia.com

5 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates