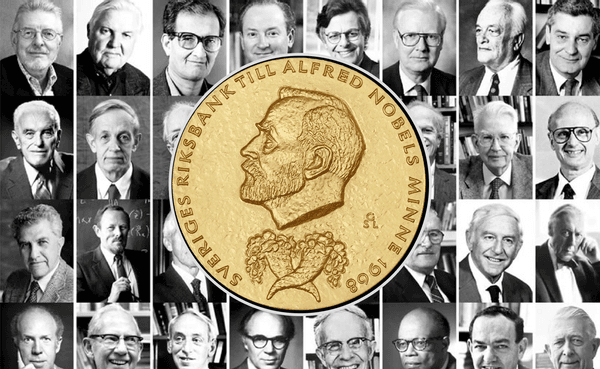

5 Nobel Prize-Winning Economic Theories You Should Know About

Curated from: investopedia.com

Ideas, facts & insights covering these topics:

6 ideas

·22.4K reads

168

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Management of Common Pool Resources

Political science professor Elinor Ostrom showed that common-pool resources, such as water supplies or fish, can be effectively managed collectively without government or private control.

But this is only possible if those using the resource are physically close to it and have a relationship with each other. They will self-police to ensure community rules are followed.

541

5.97K reads

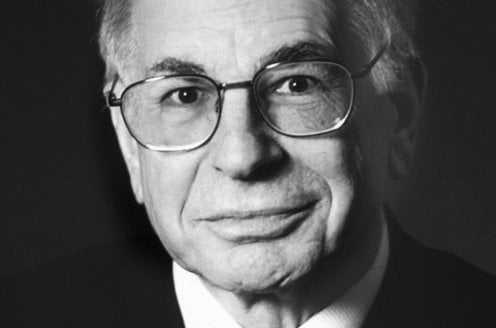

Behavioural Economics

The economic theory of expected utility maximization says that people will act out of rational self-interest. But psychologist Daniel Kahneman showed that it is incorrect.

- Common cognitive biases cause people to use faulty reasoning to make irrational decisions, such as the anchoring effect, the planning fallacy, and the illusion of control.

- People make decisions by using irrational guidelines such as perceived fairness and loss aversion, which are based on feelings, attitudes, and memories.

- People tend to use general rules, such as representativeness, to make judgments in contradiction to the laws of probability.

596

4.54K reads

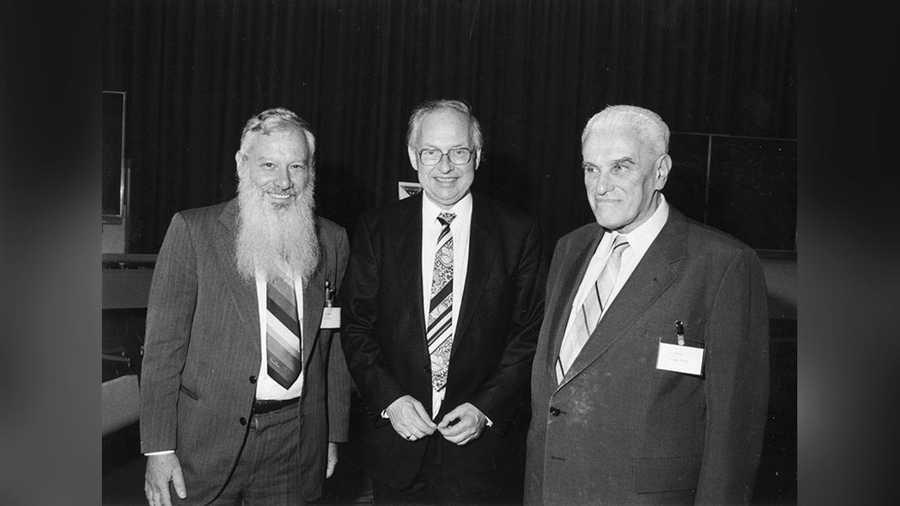

Asymmetric Information

- In 2001, George A. Akerlof, A. Michael Spence, and Joseph E. Stiglitz won the prize "for their analyses of markets with asymmetric information."

- Economic models predicated on perfect information are often misguided. In reality, one party usually has superior knowledge, such as in the car market, where sellers know more than buyers about the quality of their vehicles and can lead to a market of lemons (adverse selection.)

- Better-informed market participants can transmit information to lesser-informed participants. Job applicants can use educational attainment as a signal to prospective employers about their likely productivity; corporations can signal their profitability to investors by issuing dividends.

525

3.22K reads

Game Theory

- In 1994 Nash, Selten and Harsanyi became Economics Nobel Laureates for their contributions to economic game theory.

- Non-cooperative games are those where participants make non-binding agreements. They base their decisions on how they think the other participants will behave, without knowing how they really will behave.

- The Nash Equilibrium is a method for predicting the outcome of non-cooperative games based on equilibrium. These findings have been applied to dynamic strategic interactions, and to scenarios with incomplete information to help develop the field of information economics.

549

3.22K reads

The Public Choice Theory

- James M. Buchanan's work within Public Choice earned him the Nobel Prize in Economic Science in 1986.

- This theory shows that contrary to the conventional wisdom that public-sector actors act in the public's best interests, politicians and bureaucrats tend to act in self-interest, just like private-sector actors.

- Using these insights, we can better understand the incentives that motivate political actors and better predict the results of political decision-making, then design fixed rules that will lead to better outcomes.

552

2.66K reads

The Black-Scholes Theorem

This is a key concept in modern financial theory used for valuing European options and employee stock options.

Investors can use an online options calculator to get results by adding an option's strike price, the underlying stock's price, the option's time to expiration, its volatility, and the market's risk-free interest rate.

Robert Merton and Myron Scholes won the 1997 Nobel Prize in economics for the Black-Scholes theorem.

514

2.77K reads

IDEAS CURATED BY

Elizabeth V.'s ideas are part of this journey:

Learn more about economics with this collection

Ways to improve productivity

Strategies for reducing stress

Tips for managing email overload

Related collections

Similar ideas

3 ideas

Why Has Gold Always Been Valuable?

investopedia.com

6 ideas

Adam Smith: The Father of Economics

investopedia.com

7 ideas

Comparative Advantage Definition

investopedia.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates