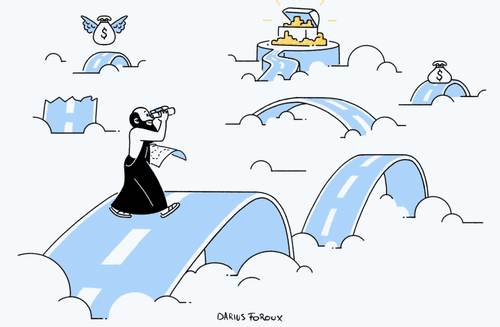

The Stoic Path to Wealth: An ancient investing strategy for the modern world

Curated from: dariusforoux.com

54

1

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Wealth In The Modern World

Investing is about 9 percent theory, 1 percent execution and 90 percent emotion management.

Not everyone becomes a multimillionaire, at least not in the short run. The good news is that there are a lot of financial opportunities in the world, and it is possible to build wealth using public markets as a long term investment. Investment requires managing our emotions, and not to be bogged down by the ups and downs of the volatile markets.

148

1.44K reads

Stoicism And Investing

Stoicism is a life-survival strategy, a way to protect one’s sanity while facing the ups and downs of life. It helps us focus on what we can control and to let go of the stuff we cannot control.

While not many are aware of this, stoicism embraces money and wealth, and advises a person to make money with honesty, dignity and trustworthiness.

130

1.15K reads

Stoic Path To Wealth: Earn Money

No matter how little you earn using income-generating skills like writing, speaking, coding or managing, you can get started with investing by simply earning more than your expenses.

One needs to focus on the income-generation part and create value out of nothing, using one’s skills.

141

1.3K reads

Stoic Path To Wealth: Lose Money

We all have loss aversion, preferring to avoid losses even with the opportunity cost of gaining profits. Losing money, in fact, is a necessary rite of passage that most are not okay with.

The best investors are the ones losing money, but who are smart enough to never lose more than 10 percent of their investment by applying diversification and other investment philosophies.

125

922 reads

Stoic Path To Wealth: Grow Money

Stoic investors make smart, balanced bets. Most of us invest in secure funds with low returns. Investors looking at bigger returns opt for index funds. If you are okay with losing money, that does not mean that you should.

The 90/10 investing thumb rule states that we should put 90 percent of our money into stock investments in index funds with moderate to high returns. The rest of the investment money should be used to speculate on the short-term risks like currencies, Bitcoin etc, that offer a high upside.

143

1.01K reads

IDEAS CURATED BY

Paisley 's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

How to close the deal

How to handle objections

How to present your value to your employer

Related collections

Similar ideas

19 ideas

The Simple Path to Wealth Summary

fourminutebooks.com

5 ideas

The Five Pillars Of Wealth Building

dariusforoux.com

4 ideas

Earn, Save, Invest: 3 Rich Habits for Life - Darius Foroux

dariusforoux.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates