Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

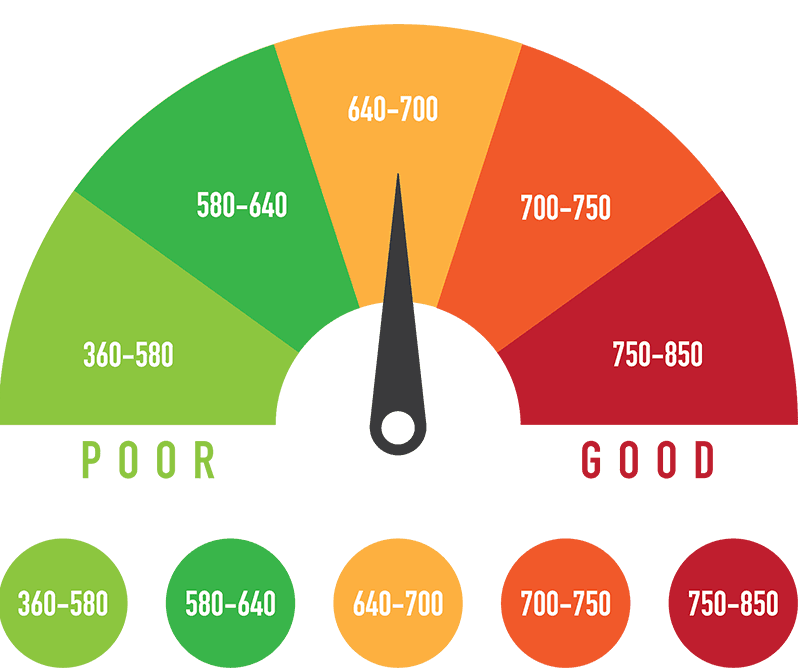

The credit score

It is a three-digit number that lenders use to assess your creditworthiness and your ability to pay your bills on time.

- The score ranges between 300 and 850.

- The higher the score, the more creditworthy you are, and the more likely lenders will lend you money at a lower interest rate.

- The FICO score is the most widely used, but there are also other systems.

- Your history of payments determines your score as well as your credit utilisation.

- Your credit report determines your credit score.

37

207 reads

The history of the credit scores

Bill Fair and Earl Isaac developed credit scores in the 1950s to create a standard system to measure credit. They called it Fair, Isaac, and Company, known as FICO. Another credit score is the Vantage Score.

Both FICO and Vantage Score base their scores on analysing each credit report as collected by the three major credit reporting agencies: Experian, Equifax, and TransUnion. But FICO and VantageScore use different methods for a credit score, taking various data into account.

30

96 reads

The reason for different scores

Mortgage lenders usually use FICO scores to determine one's ability to pay them back. Since the three credit bureau scores are different, some banks look at all of them to get an average, or tri-merge, score.

Two common factors in determining your creditworthiness are timely payments and credit utilization. Other factors like credit history, types of accounts, and recent hard inquiries are used to varying degrees. It means that the score you see may be different to the score a lender use.

30

92 reads

Factors that make up your credit score

- Late or missed payments will drive down your credit score and remain on your record for seven years.

- Credit utilization is the percentage of available credit you're currently using. If you use more than 30% of your available credit, scoring models will consider you unreliable.

- Credit history considers your long-standing credit accounts. A long account history in good standing increases your score.

- Too many recently-opened credit accounts can be seen as risk.

- Having different credit accounts increases your credit score.

33

108 reads

Credit scores are different from credit reports

A credit report documents your credit history, your current status of accounts and payments, and when companies have pulled your report when you've applied for credit. A credit report is the source of your credit score.

It is vital to keep an eye on your reports and notice anything that could cause long-term damage to your credit. You can request a free credit report per bureau every year.

31

93 reads

Credit repair companies

Common factors that could damage your credit score are negative items, such as bankruptcies, foreclosures, late payments, high credit utilization, and credit inquiries from potential lenders.

Some people employ the services of credit repair companies to dispute incorrect or fraudulent credit items on your behalf, but the outcome is not guaranteed.

30

126 reads

IDEAS CURATED BY

Paisley 's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

The impact of opportunity cost on personal and professional life

Evaluating the benefits and drawbacks of different choices

Understanding the concept of opportunity cost

Related collections

Similar ideas

6 ideas

5 easy steps to improve your credit score

money.cnn.com

8 ideas

Lessons about Business credit management

vocal.media

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates