Money are a Ponzi Scheme

Curated from: Coin Bureau

Ideas, facts & insights covering these topics:

5 ideas

·1.96K reads

22

2

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Fiat money

Fiat money is a government-issued currency that is not backed by a commodity such as gold. Most paper notes started as being backed by a reserve of valuable commodities, usually gold (the "Gold Standard"). Tying a currency to gold limits inflation and money supply.

But politicians hate the gold standard, so since Nixon's presidency, the US dollar was no longer tied to gold and money had value just because the government says so.

49

714 reads

A history of the US fiat currency

1933 - President Franklin D. Roosevelt had gold confiscated and people were forced to accept paper money for their gold. The government needed people to adopt the inflated paper and they used force.

1940s - Bretton Woods Agreement created a collective international currency peg to the U.S. dollar which was in turn pegged to the price of gold.

1971 - President Nixon unilaterally cancelled the direct international convertibility of the US dollars to gold. Making the US government in charge of money supply and world money master.

41

348 reads

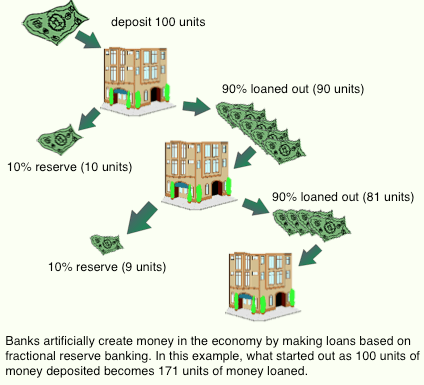

Fractional Reserve & Money Supply

Banks loan money they don't have. Most hold a limited reserve to serve the few who decide to make redraws. When the majority decides to liquidate their bank accounts we have what is called a bank run.

In order to protect the banks, central banks were created to provide a guaranteed reserve for commercial banks. But once the government stepped in to protect the banks the fractional reserve mandates(only a fraction of deposits are backed by actual cash) began to be used to make up the money from thin air. Every dollar that a bank holds can be multiplied by at least 10x.

38

284 reads

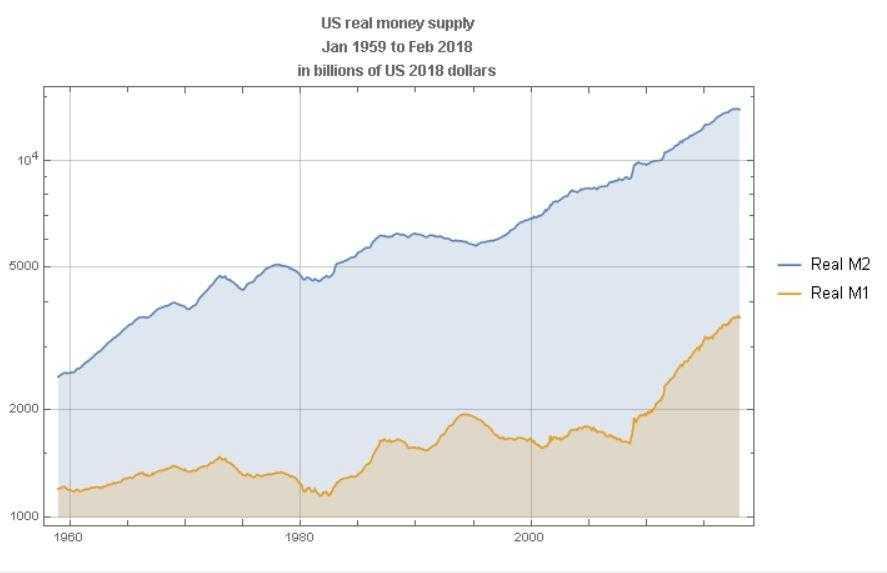

Money Supply & Inflation

We can measure the supply of money that exists in the market with main metrics:

- M1 money supply includes liquid money aka cash.

- M2 (which includes M1) includes loans, deposits & market funds. This is mainly made up money.

As the chart shows the US (and all other countries with central banks) have most of the monetary mass made up. An influx of money causes inflation and this is exactly what during the last decades.

43

279 reads

We print money digitally. As a central bank, we have the ability to create money. And we do that by buying bonds for other government guaranteed securities. And that actually increases the money supply. We also print actual currency and we distribute that through the Federal Reserve banks.

JAY POWELL, CHIEF OF FEDERAL RESERVE

40

337 reads

IDEAS CURATED BY

Life-long learner. Passionate about leadership, entrepreneurship, philosophy, Buddhism & SF. Founder @deepstash.

Vladimir Oane's ideas are part of this journey:

Learn more about politics with this collection

The differences between Web 2.0 and Web 3.0

The future of the internet

Understanding the potential of Web 3.0

Related collections

Similar ideas

1 idea

ETHEREUM IS EXPLODING

Andrei Jikh

3 ideas

Jordan Peterson with Robert Breedlove discussing fiat & bitcoin

Robert Breedlove

11 ideas

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates