Learn more about marketingandsales with this collection

The value of hard work and persistence

How to stay focused on long-term goals

How to learn from failures and setbacks

Weak Founding Team:

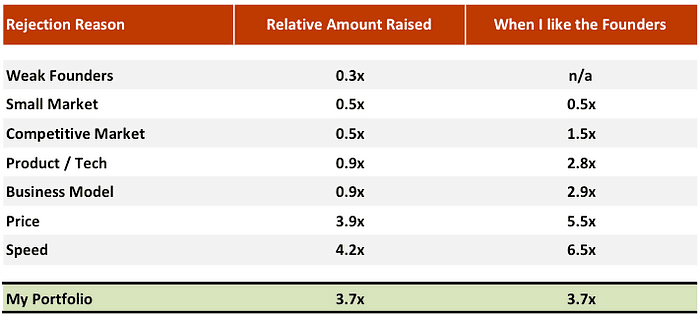

Weak founders have only raised 30% of the average and a 12th of the capital that my portfolio has. On the right-hand side of the chart, you can see each rejection reason but just selecting the companies where I marked in our system as liking the founders a lot. They on average raised 2–3X the average of the respective groupings.

2

0 reads

MORE IDEAS ON THIS

My analysis

I have personally seen 2,684 companies that are b2b, seed stage and based in Europe. Of those, I’ve met in person or had a call with almost 600. Unlike the larger number, these 600 are companies where I’d at least spent time speaking with the founders and understanding the company, so I felt it w...

2

0 reads

The Analysis

I paired the dataset of c. 600 companies and why I said no to them with publically available data on the total amount each company raised since we passed and divided by the number of months since then. This allowed me to roughly compare the many companies on a level playing field, regard...

2

0 reads

Small market and Competitive market:

My main two learning’s here are that a) we should not be investing in small markets, even with a great team and b) we should usually avoid investing in companies with highly competitive markets unless we think the team is incredible.

2

0 reads

Price and Speed

Frontline has always tried our best to price investments at what we feel are fair prices reflecting where the team, product, and the market are. We have not lost investment to a VC that was pricing a deal at a similar level as us, but we have lost deals to other VCs who were pricing it materially...

2

0 reads

Product/Tech and Business Model

Firstly, that at the seed stage, product and business model are not good reasons for rejecting a company. C.50% of the investments we make at frontline are Pre-Product and C. 75% are Pre-Revenue. Potentially it is not that relevant at this stage of a company’s development to have...

2

0 reads

CURATED FROM

IDEAS CURATED BY

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates