Learn more about business with this collection

How to create a successful onboarding process

Why onboarding is crucial for customer retention

How to measure the success of onboarding

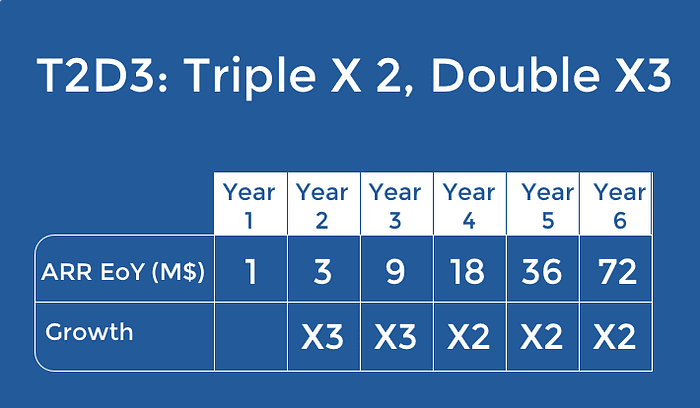

1- Revenue growth: the T2D3 framework

Some companies find their PM fit faster than others. The T2D3 framework shows what it takes to grow your revenue from $1M — $2M to around $100M Arr in 6–7 years. The vast majority of Saas startups will never reach this level of growth and that’s completely fine. If you talk to “traditional” Saas Vcs, they’ll probably ask themselves: “does this company have the potential to T2D3?””

3

6 reads

MORE IDEAS ON THIS

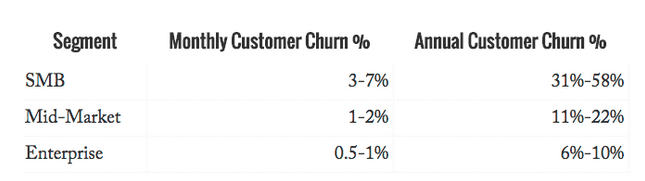

4- Churn Benchmark

Churn is one of the most coveted and analyzed SaaS metrics on the internet so I won’t go into details here but just share this table by Tomasz Tunguz:

You can probably be even more demanding for the Enterprise segment and expect a 0–0.5% monthly customer churn (and you generally measure En...

3

2 reads

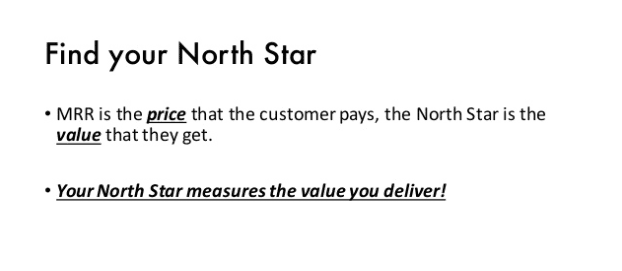

North Star

What's a Good or Bad North Star?

• Bad: Mostly measuring price paid as opposed to value delivered • MRR, paid seats

• Good: Measures value delivered in bulk • MAU, DAU, messages sent

• Better: Unquestionably indicates Product-Market fit has been reached with the customer • Nu...

3

3 reads

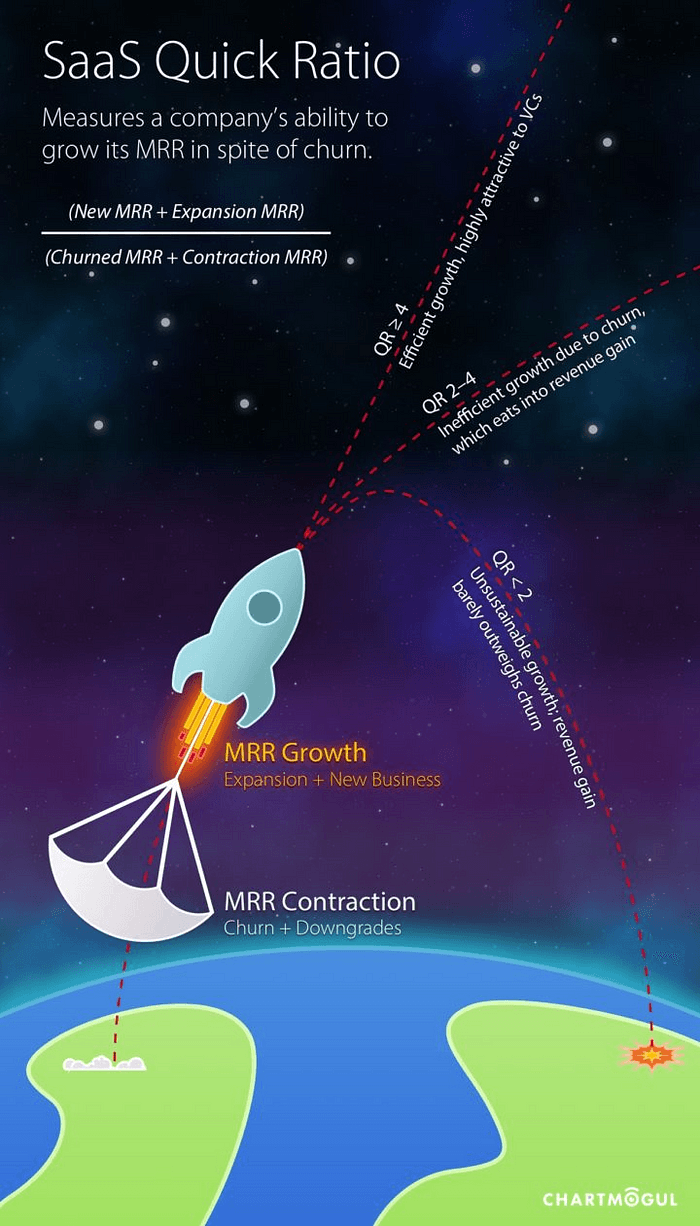

2- Revenue Growth efficiency: SaaS Quick Ratio

High Churn and lack of account expansion can kill even the fastest growing companies.

This is where the SaaS Quick Ratio comes in handy.

SaaS Quick Ratio = (New MRR + Expansion MRR) / (Churned MRR + Contraction MRR)

A Saas quick ratio superior to 4 will excite Vcs, between 2 an...

3

5 reads

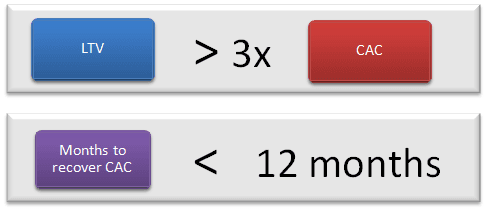

3- The LTV / CAC ratio

Ltv stands for lifetime value and Cac stands for the customer acquisition cost. VCs expect that a customer generates at least 3 times what it cost you to acquire him (it’s a minimum).

This ratio mixes many aspects from sales and marketing efficiency to your ability to keep users (linked to ...

3

2 reads

5- The 40% Rule

The 40% rule is that your growth rate + your profit should add up to 40%. So, if you are growing at 20%, you should be generating a profit of 20%. If you are growing at 40%, you should be generating a 0% profit. If you are growing at 50%, you can lose 10%. If you are doing better than the 40% rul...

3

3 reads

CURATED FROM

IDEAS CURATED BY

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates