7.

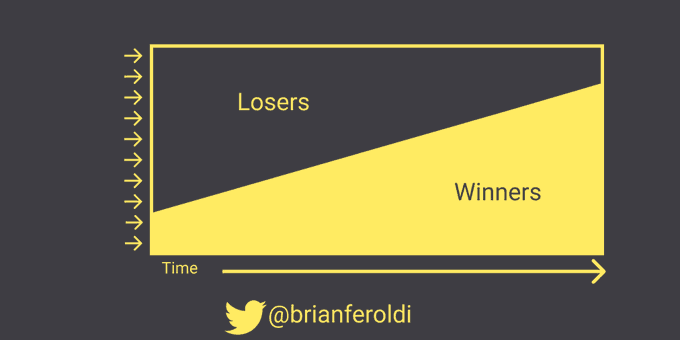

If you rarely sell, your portfolio will concentrate itself

46

350 reads

CURATED FROM

10 critical investing lessons I wish I could teach my younger self

mobile.twitter.com

10 ideas

·4.24K reads

IDEAS CURATED BY

I've been investing for 18+ years I've made TONS of mistakes along the way here are 10 critical investing lessons I wish I could teach my younger self:

“

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

How to apply new knowledge in everyday life

Why continuous learning is important

How to find and evaluate sources of knowledge

Related collections

Similar ideas to 7.

“I might need it some day”

One thing that stops many of us in the process of decluttering is the worry that if we sell, trash, or donate an item (we rarely/ never use), we may need it someday.

Your investment time-frame

Decide for how long you want to invest to best evaluate your portfolio for the future.

A short term investment portfolio will likely be riskier than long term retirement portfolios.

An honest risk-assessment

Think about how much risk you are willing to tolerate:

- If you are looking for quicker returns, you may prefer a more volatile portfolio of individual stocks, ETFs, or high-risk mutual funds.

- However, if you want to build your portfolio for retirement or savings,...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates