Disrupting the time-money relationship

Investing and passive income disrupt the time-money relationship.

To make money without having to trade any of your time frees up your time to ultimately do things that are more important to you.

298

1.19K reads

CURATED FROM

Time Is NOT Money | We Need To Change Our Thinking | Time > Money

millennialmoney.com

5 ideas

·5.98K reads

IDEAS CURATED BY

"Many people are in the dark when it comes to money, and I'm going to turn on the lights. " ~ Suze Orman

The idea is part of this collection:

Learn more about personaldevelopment with this collection

How to overcome fear of rejection

How to embrace vulnerability

Why vulnerability is important for personal growth

Related collections

Similar ideas to Disrupting the time-money relationship

When we believe that time is money

Our work culture promotes the ideas that time is money.

And we end up managing our money poorly so we end up wasting our time. We also trade more of our time to make more money, but if we would use that time to do things that make us happier, we would live happier lives.

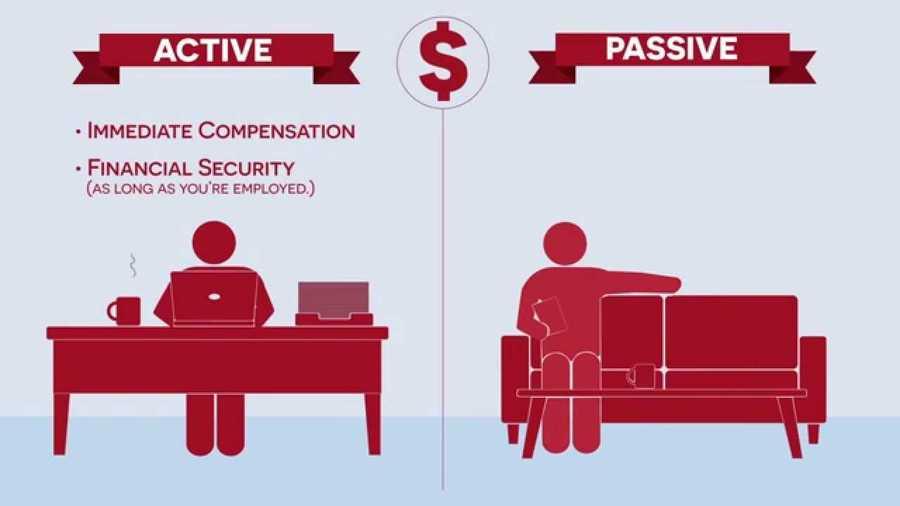

Active vs Passive Income

There are 2 types of income:

Active Income: You are trading time for money. In order to make money you must perform something. Every day you start from zero.

Passive Income: You do not have to be present to generate income. Things like real estate...

The quest for passive income

The idea of a diversified portfolio is to have different kinds of active and passive income.

Passive income is investing time and money up front to help earn money continually even while you sleep. It can take many forms, including digital downloads, e-books, selling stock imagery, lic...

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates