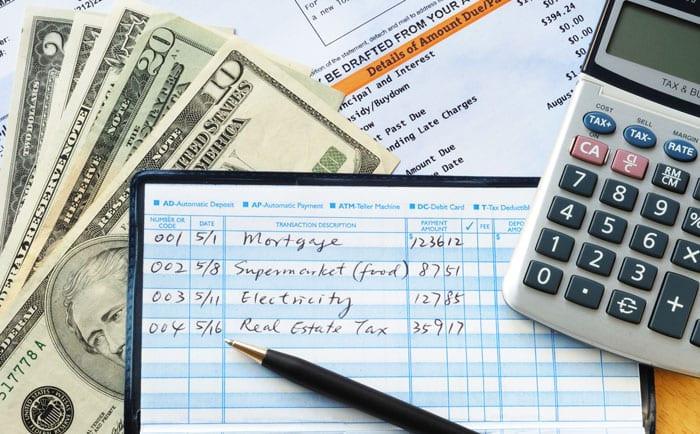

Regular monthly bills

The bulk of your budget is made up of necessities like rent, phone and internet bills, insurance, etc. If you can lower your monthly expenses, you can save a lot for unplanned events.

- Find a cheaper place to live.

- Get a cheaper phone plan

- Find a better insurance company

- Grocery show once a week, so you don't waste food.

531

4.33K reads

CURATED FROM

IDEAS CURATED BY

"In fact, the confidence of the people is worth more than money." ~ Carter G. Woodson

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Identifying and eliminating unnecessary expenses

How to negotiate better deals

Understanding the importance of saving

Related collections

Similar ideas to Regular monthly bills

Learn to Budget

Create a plan for your money so you know where it's going every month.

A popular and effective way to budget is with the 50/30/20 rule, where 50% of your income goes towards necessities (bills, food, housing, etc.), 20% of your income goes towards savings a...

Save Money

- Lower your cell phone bill by downgrading your plan if you don’t need all you are paying for.

- Don’t outsource household services when possible.

- Stop tithing, at least temporarily. Most religious groups are supportive of this if you need time to get...

Budgeting your money is the cornerstone of a sound financial plan, and seeing all the numbers in black and white can offer valuable perspective on where your mone...

WES MOSS

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates