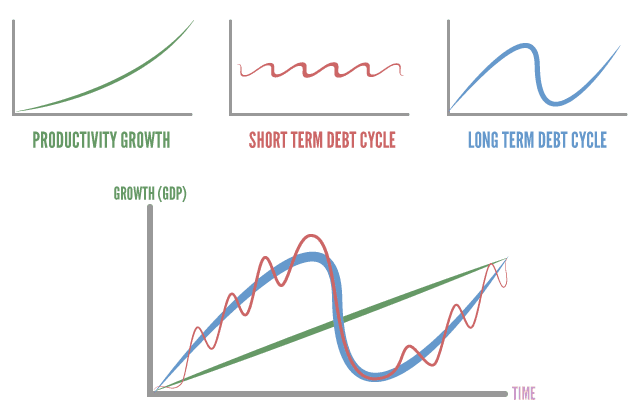

3 base components of the market

- Productivity Growth: Equivalent to technology getting better, faster and us constantly learning from our mistakes. We will always be able to do more with less time and resources than we were able to in the past.

- The Short-Term Debt Cycle is defined by a growth period and then a recession period. These cycles last about 5 – 8 years and peaks when loans become more expensive.

- Long-Term Debt Cycle is similar to the short-term debt cycle and takes typically 50 years to play out. It peaks when the economy is saturated with debt and it literally can not take on any more.

969

2.64K reads

The idea is part of this collection:

Learn more about moneyandinvestments with this collection

Identifying and eliminating unnecessary expenses

How to negotiate better deals

Understanding the importance of saving

Related collections

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates