Investing for Beginners: The Complete Investing 101 Guide for 2019

Curated from: listenmoneymatters.com

152

Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Investing

... is the trading of your money today for a lot more money in the future. It is a high yield over the long term.

978

6.37K reads

What happens to your money

Banks don’t like to give away their money. That mindset is reflected in the interest rates of checking and savings accounts of 0,5% and 0.9% avg. annual interest respectively.

When you deposit your money in the bank, the bank turns around and invests that money at 7% a year or more. After they collect their profit, they give a tiny shaving of it to you.

889

3.55K reads

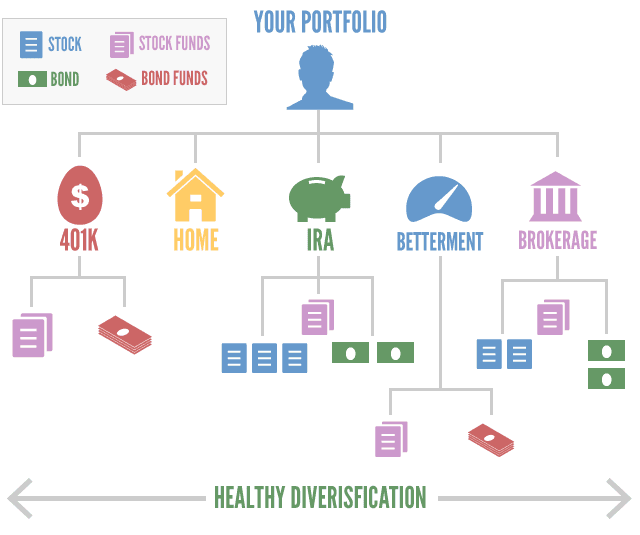

Portfolio and Diversification

- Your portfolio reflects your long-term wealth building investment strategy – not the short term. It includes everything you own. Your retirement accounts, your investment accounts, even your home are types of investments.

- Diversification is a way to describe owning multiple types of investment assets. Diversification is smart because you both protect yourself from failure and position yourself to take advantage of multiple robust methods for building wealth.

976

3.32K reads

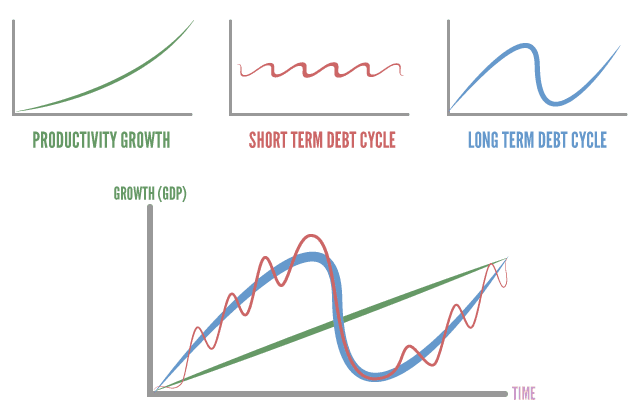

3 base components of the market

- Productivity Growth: Equivalent to technology getting better, faster and us constantly learning from our mistakes. We will always be able to do more with less time and resources than we were able to in the past.

- The Short-Term Debt Cycle is defined by a growth period and then a recession period. These cycles last about 5 – 8 years and peaks when loans become more expensive.

- Long-Term Debt Cycle is similar to the short-term debt cycle and takes typically 50 years to play out. It peaks when the economy is saturated with debt and it literally can not take on any more.

974

2.67K reads

The Average Investor...

- does not try and time the market – buy low and sell high,

- also does not try to beat the market,

- just try and achieve average returns,

- realises that it does not involve a lot of work or stress and locks in a nice healthy return over the long term.

1K

3.18K reads

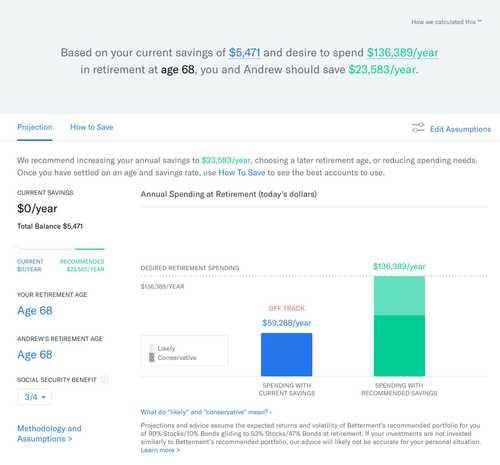

You Don’t Need a Financial Advisor

- A financial advisor’s compensation is rarely if ever tied to your success. The majority of their income is based upon the amount they get you to invest.

- You will pay a fee to your chosen fund plus a fee to the financial advisor.

- You Might Not Get The Best Financial Advisor. Would you even be able to tell the difference between a good financial advisor if you had a chance to talk with 100 of them? Or will you go with the best salesmen?

- It is neither difficult nor time-consuming to invest yourself because you're just going to mirror the market average.

903

2.46K reads

The Average Investor’s Commandments

- Think Long-Term. It’s very rare for a sudden move in price to mean very much Things will balance out so be patient.

- Always keep a few months expenses around in case something happens and invest the rest.

- Buy What You Believe In. If you do not know or understand what you’re buying, don’t buy it. Invest in something that you personally believe in.

- Do Your Own Research.

- Set It and Forget It.

- Consistently Contribute.

- Be Fearful When Others Are Greedy.When everyone is a winner you should be concerned.

- Be Greedy When Others Are Fearful.The best time to buy is when the world is on fire, not just the typical knee-jerk reaction of the media.

- Find and Remove Frivolous Fees. When the stakes are highest, so are the fees. Even a 1% fee can become significant over the long-term.

- Diversify. If it can fail, it will fail. Plan ahead for failure.

1.32K

2.79K reads

IDEAS CURATED BY

Paisley 's ideas are part of this journey:

Learn more about moneyandinvestments with this collection

Identifying and eliminating unnecessary expenses

How to negotiate better deals

Understanding the importance of saving

Related collections

Similar ideas

8 ideas

Investing for beginners

moneysavingexpert.com

2 ideas

Investment Tips for Beginners

google.co.in

12 ideas

A Beginner's Guide to Stock Investing

investopedia.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates