Explore the World's Best Ideas

Join today and uncover 100+ curated journeys from 50+ topics. Unlock access to our mobile app with extensive features.

Illusion That The Financial Industry Places YOUR Interests First

"In the casino the house always wins. In horse racing, the track always wins. In the Powerball, the state always wins. In the game of investing, the financial croupiers always win, and investors as a group lose. After the deduction of the costs of investing, beating the stock market is a loser's game."

-John C. Bogle

619

6.75K reads

Investing Strategy

In order to not being a victim of the finance industry an individual must have a strategy.

"The best way to implement this strategy is indeed simple. Buy a find that holds this all-market portfolio, and hold it forever. Such a fund is called an index fund. The index fund is simply a basket (portfolio) that holds many, many eggs (stocks) designed to mimic the overall performance of the U.S. stock market (or any financial market or market sector."

-John C. Bogle

636

5.06K reads

Actively Managed Funds

When a fund is actively managed, it employs a professional portfolio manager, or team of managers, to decide which underlying investments to choose for its portfolio. In fact, one reason you might choose a specific fund is to benefit from the expertise of its professional managers. (Firna Definition)

It is very rare that an actively managed fund can beat average market returns in the long term. The reason for this is Fees. These fees include manager fees, brokerage commissions/transaction fees, and other hidden costs.

579

3.85K reads

Actively Managed Fund Fees

Where do actively managed fund fees come from? The answer is the consumer. The unfortunate truth is that active managers get paid no matter what results they provide (positive or negative). This has proven over time to not work in the consumers best interests.

In order for the active manager to provide value they have to beat the market on top of their fees.

565

3.02K reads

Passively Managed Funds

Passive funds seek to replicate the performance of their benchmarks instead of outperforming them. For instance, the manager of an index fund that tracks the performance of the S&P 500 typically buys a portfolio that includes all of the stocks in that index in the same proportions as they are represented in the index. If the S&P 500 were to drop a company from the list, the fund would sell it, and if the S&P 500 were to add acompany, the fund would buy it. (Firna)

569

2.59K reads

Index Funds

Because index funds don't need to retain active professional managers, and because their holdings aren't as frequently traded, they normally have lower operating costs than actively managed funds. However, the fees vary from index fund to index fund, which means the return on these funds varies as well. (Firna)

565

2.53K reads

Index Funds Continued

Some index funds, which go by names such as enhanced index funds, are hybrids. Their managers pick and choose among the investments tracked by the benchmark index in order to provide a superior return. In bad years, this hybrid approach may produce positive returns, or returns that are slightly better than the overall index. Of course, it's always possible that this type of hybrid fund will not do as well as the overall index. In addition, the fees for these enhanced funds may be higher than the average for index funds. (Firna)

562

1.97K reads

Downside of High Costs In Investing

There are significant downsides to the high costs in investing. An actively managed fund will probably result in significantly less profit/income for the investor as compared to a low cost index fund that passively mimics the performance of an index. Examples of indexes are S&P 500 index, the Russell 2000 Index, or the Wilshire 5000 total market index.

567

1.96K reads

Index Funds Further Explained

An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses, and low portfolio turnover. These funds follow their benchmark index regardless of the state of the markets. (investopedia.com)

564

1.76K reads

Lower Costs Translate into More Money for You

Searching out the lowest cost index fund directly translates into more money for the investor. Therefore not all index funds are equal. Due diligence and research is necessary to maximize returns.

567

1.79K reads

Be Skeptical of New Investing Trends

Ideally investing should be about long term results. Get rich schemes are more like gambling. The payoffs in gambling might be great but the more likely results are loses. Remember the casino always wins. Slow and steady wins the race.

571

1.65K reads

The Financial System

“On balance, the financial system subtracts value from society”

― John C. Bogle

555

1.79K reads

Past Performance Guarantees Nothing

“Buying funds based purely on their past performance is one of the stupidest things an investor can do.”

― John C. Bogle

584

1.79K reads

Hedge Funds

“Some estimates suggest that the failure rate is around 20 percent, meaning that each year, one of every five hedge funds goes up in smoke.”

― John C. Bogle

562

1.74K reads

Costs Savings Strategy

“The best way to implement this strategy is indeed simple: Buy a fund that holds this all-market portfolio, and hold it forever. Such a fund is called an index fund. The index fund is simply a basket (portfolio) that holds many, many eggs (stocks) designed to mimic the overall performance of the U.S. stock market (or any financial market or market sector).”

― John C. Bogle

572

1.48K reads

Stay the Course - Hold Tight

“When you have identified your long-term objectives, defined your tolerance for risk, and carefully selected an index fund or a small number of actively managed funds that meet your goals, stay the course. Hold tight. Complicating the investment process merely clutters the mind, too often bringing emotion into a financial plan that cries out for rationality. I am absolutely persuaded that investors’ emotions, such as greed and fear, exuberance and hope—if translated into rash actions—can be every bit as destructive to investment performance as inferior market returns.”

― John C. Bogle

566

1.3K reads

Investors Choosing Mutual Funds

“Mutual fund investors, too, have inflated ideas of their own omniscience. They pick funds based on the recent performance superiority of fund managers, or even their long-term superiority, and hire advisers to help them do the same thing. But, the advisers do it with even less success. Oblivious of the toll taken by costs, fund investors willingly pay heavy sales loads and incur excessive fund fees and expenses, and are unknowingly subjected to the substantial but hidden transaction costs incurred by funds as a result of their hyperactive portfolio turnover."

― John C. Bogle

555

1.18K reads

Investors Choosing Fund Managers

"Fund investors are confident that they can easily select superior fund managers. They are wrong.”

― John C. Bogle

554

1.32K reads

Navigating Financial Markets

“When navigating the financial markets, the long-term investor must keep in mind the four basic dimensions of long-term return — reward, risk, cost and time — and must apply them to every asset class. Never forget that these four dimensions are remarkably interdependent.”

― John C. Bogle

585

1.15K reads

Owning Corporate America

“I’m speaking here about the classic index fund, one that is broadly diversified, holding all (or almost all) of its share of the $15 trillion capitalization of the U.S. stock market, operating with minimal expenses and without advisory fees, with tiny portfolio turnover, and with high tax efficiency. The index fund simply owns corporate America, buying an interest in each stock in the stock market in proportion to its market capitalization and then holding it forever.”

― John C. Bogle

559

1.04K reads

Keep It Simple

“The grim irony of investing, then, is that we investors as a group not only don't get what we pay for, we get precisely what we don't pay for. So if we pay for nothing, we get everything.”

― John C. Bogle

“When there are multiple solutions to a problem, choose the simplest one.”

― John C. Bogle

574

1.07K reads

Expenses and Emotions Work Against You

“On balance, the financial system subtracts value from society”

― John C. Bogle

“The two greatest enemies of the equity fund investor are expenses and emotions.”

― John C. Bogle

“Owning the stock market over the long term is a winner's game, but attempting to beat the market is a loser's game.”

― John C. Bogle

564

1.08K reads

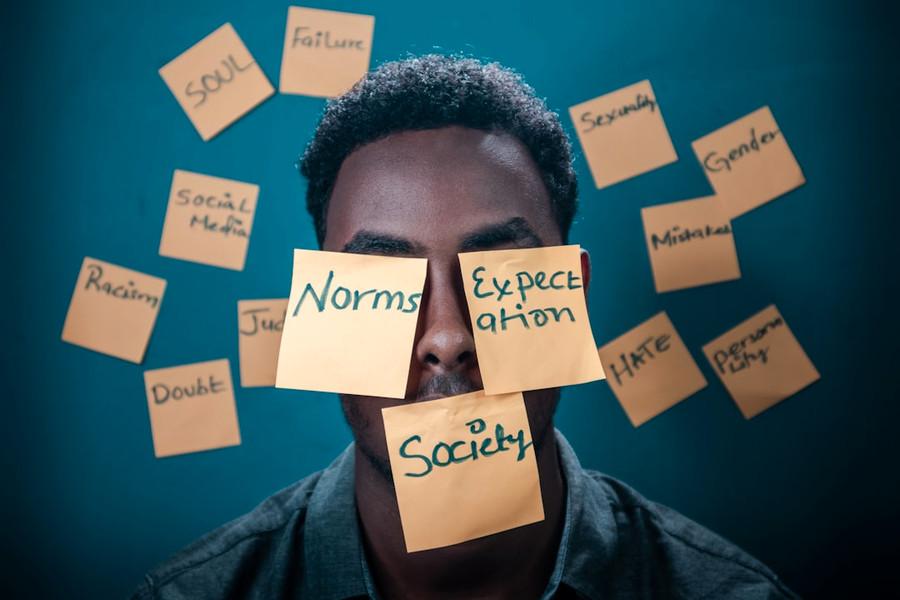

Complexity Works Against You

“Financial markets are far too complex to isolate any single variable with ease, as if conducting a scientific experiment. The record is utterly bereft of evidence that definitive predictions of short-term fluctuations in stock prices can be made with consistent accuracy. The prices of common stocks are evanescent and illusory.”

― John C. Bogle

553

985 reads

Winning Formula

“The winning formula for success in investing is owning the entire stock market through an index fund, and then doing nothing. Just stay the course.”

― John C. Bogle

576

1.06K reads

Buy The Haystack

“The simple fact is that selecting a mutual fund that will outpace the stock market over the long term is, using Cervantes’ wonderful observation, like ‘looking for a needle in the haystack.’ So I offer you Bogle’s corollary: ‘Don’t look for the needle in the haystack. Just buy the haystack!”

― John C. Bogle

564

988 reads

Magic or Compounding

“Investors need to understand not only the magic of compounding long-term returns, but the tyranny of compounding costs; costs that ultimately overwhelm that magic.”

― John C. Bogle

557

1.02K reads

Easy Does It

“It will also tell you how easy it is to do just that: simply buy the entire stock market. Then, once you have bought your stocks, get out of the casino and stay out. Just hold the market portfolio forever. And that’s what the index fund does. This investment philosophy is not only simple and elegant. The arithmetic on which it is based is irrefutable. But it is not easy to follow its discipline.”

― John C. Bogle

559

901 reads

Sensible Investing

“Experience conclusively shows that index-fund buyers are likely to obtain results exceeding those of the typical fund manager, whose large advisory fees and substantial portfolio turnover tend to reduce investment yields. Many people will find the guarantee of playing the stock-market game at par every round a very attractive one. The index fund is a sensible, serviceable method for obtaining the market’s rate of return with absolutely no effort and minimal expense.”

― John C. Bogle

559

846 reads

Tax Efficiency

“Another huge toll has been taken by taxes. Passively managed index funds are tax-efficient, given the low turnover implicit in the structure of the Standard & Poor’s 500 Index (and, to an even greater extent, the all-market Wilshire 5000 Index).”

― John C. Bogle

554

881 reads

Investing In Gold

“Gold is largely a rank speculation, for its price is based solely on market expectations. Gold provides no internal rate of return. Unlike stocks and bonds, gold provides none of the intrinsic value that is created for stocks by earnings growth and dividend yields, and for bonds by interest payments. So in the two centuries plus shown in the chart, the initial $10,000 investment in gold grew to barely $26,000 in real terms. In fact, since the peak reached during its earlier boom in 1980, the price of gold has lost nearly 40 percent of its real value.”

― John C. Bogle

566

879 reads

Reality Verses Perception

“The message is clear: in the long run, stock returns depend almost entirely on the reality of the investment returns earned by our corporations. The perception of investors, reflected by the speculative returns, counts for little. It is economics that controls long-term equity returns; emotions, so dominant in the short-term, dissolve.”

― John C. Bogle

550

850 reads

Enemies of Equity

“While illusion (the momentary prices we pay for stocks) often loses touch with reality (the intrinsic values of our corporations), it is reality that rules in the long run.”

― John C. Bogle

550

861 reads

A Good Plan Triumphs

“The greatest enemy of a good plan is the dream of a perfect plan. Stick to the good plan.”

― John C. Bogle

“Simplicity beats complexity”

― John C Bogle, The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns

“The relentless rules of humble arithmetic.”

― John C Bogle

560

791 reads

Investing Wisdom

“Your index fund should not be your manager’s cash cow. It should be your own cash cow.”

― John C Bogle

“It takes wisdom to know what we don’t know”

― John C. Bogle

556

887 reads

Benjamin Graham's Standards

“It is fair to say that, by Graham’s demanding standards, the overwhelming majority of today’s mutual funds, largely because of their high costs and speculative behavior, have failed to live up to their promise. As a result, a new type of fund—the index fund—is now gradually moving toward ascendancy. Why? Both because of what it does—providing the broadest possible diversification—and because of what it doesn’t do—neither assessing high costs nor engaging in high turnover.”

― John C. Bogle

559

775 reads

Profit Making Reality

“We cannot expect management companies to operate in the public interest. We must recognize the reality that they are in the business of investing other people’s money in order to maximize their own profits, even though those profits come at the expense of their fund shareholders.”

― John C. Bogle,

554

727 reads

Investing For a Lifetime

“In the short run, the stock market is a voting machine; in the long run it is a weighing machine. —Benjamin Graham, Security Analysis (1934)”

― John C. Bogle

“The Index Fund is designed to be held for a lifetime.”

― John C. Bogle

555

764 reads

Passive Investing Statistical Advantage

“Hear David Swensen, widely respected chief investment officer of the Yale University Endowment Fund. “A minuscule 4 percent of funds produce market-beating after-tax results with a scant 0.6 percent (annual) margin of gain. The 96 percent of funds that fail to meet or beat the Vanguard 500 Index Fund lose by a wealth-destroying margin of 4.8 percent per annum.”

― John C. Bogle

555

800 reads

IDEAS CURATED BY

CURATOR'S NOTE

Index investing and protecting yourself. Passive Investing verses Actively Managed Investing.

“

Tom Joad's ideas are part of this journey:

Learn more about books with this collection

Conflict resolution

Motivating and inspiring others

Delegation

Related collections

Discover Key Ideas from Books on Similar Topics

7 ideas

Moving to Outcomes

Robert Glazer, Matt Wool

3 ideas

Last Man Standing

collaborativefund.com

Read & Learn

20x Faster

without

deepstash

with

deepstash

with

deepstash

Personalized microlearning

—

100+ Learning Journeys

—

Access to 200,000+ ideas

—

Access to the mobile app

—

Unlimited idea saving

—

—

Unlimited history

—

—

Unlimited listening to ideas

—

—

Downloading & offline access

—

—

Supercharge your mind with one idea per day

Enter your email and spend 1 minute every day to learn something new.

I agree to receive email updates